Ndindi Nyoro Sells 36pc Stake In Kenya Power

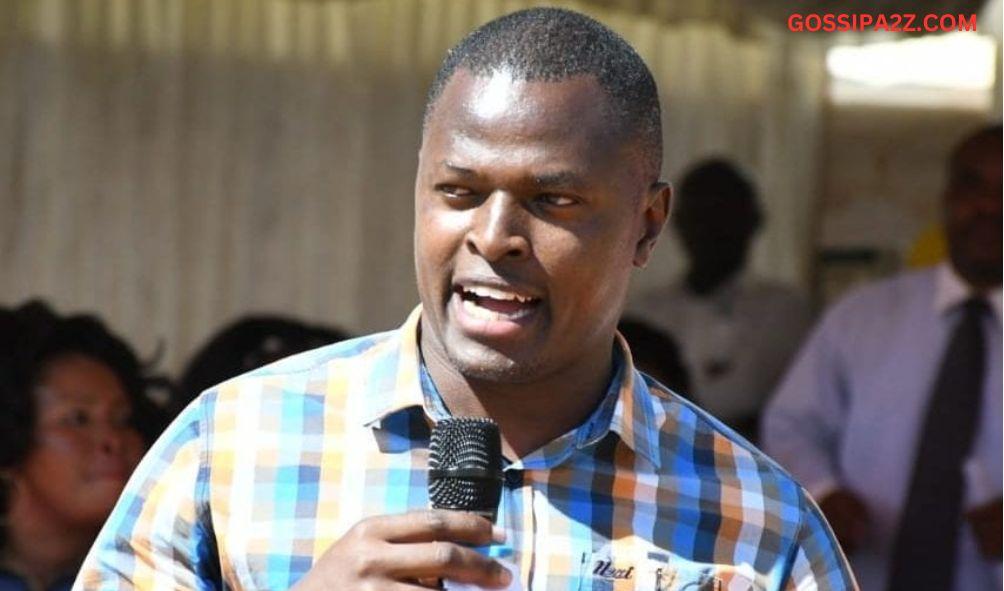

Kiharu Member of Parliament Ndindi Nyoro divested 11.78 million shares, equivalent to 36% of his ownership in Kenya Power, from June to December 2023. According to recent regulatory documents reviewed by the Business Daily, this transaction reduced his stake in the utility to 20.72 million units.

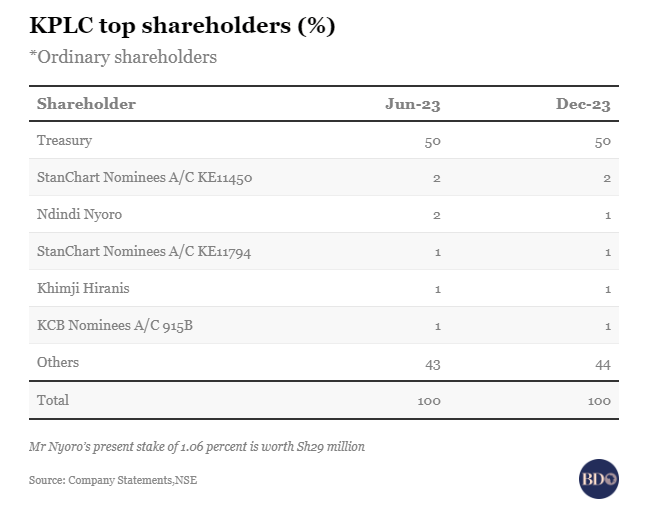

Mr. Nyoro currently holds a 1.06 percent ownership stake in the utility, which, based on Kenya Power’s closing share price of Sh1.40 on Monday, is valued at Sh29 million. The shares relinquished by the MP during the first half of the year amount to Sh16.5 million at the current market price.

As of June 30, 2023, his stock market account, specifically the CDS, showed ownership of 32.5 million shares, and the estimated worth of the stake was Sh51.35 million, based on the current price of Sh1.58 per share.

The legislator had increased his ownership in the energy company by acquiring an additional 5.2 million shares in the 12 months preceding June 2023, establishing himself as the primary individual stockholder during that period.

He currently holds the second position, trailing behind Naran Khimji Hirani and Virji Khimji Hirani. The two of them collectively possess 23.85 million shares in Kenya Power, representing a 1.22 percent ownership stake.

In 2022, Mr. Nyoro, the head of the Budget and Appropriations Committee in the National Assembly, revealed that he initiated his venture into the stock market during his first year at Kenyatta University.

Together, shareholders from Kenya and the East African Community (EAC) possess a combined total of 605.9 million shares in Kenya Power, valued at Sh848.3 million. This represents a 31.05 percent ownership stake in the company.

ALSO READ:

- Kenya Owes Chebukati a Hero’s Farewell for ‘Saving’ Democracy – MP Declares

- HELLFIRE HORROR: Worshippers in Bomet Torch Granny Alive in ‘Satanic Purge’ Ritual(Video)

- Haitian Police Caught in Explosive Feud with Kenyan Peacekeepers? Officials Scramble to Deny Rift

- Raila Odinga’s 2027 Options After Shocking AUC Defeat

- Congo Frees Opposition Leader and Former President’s Ally Jean-Marc Kabund

Institutional investors affiliated with the East African Community (EAC), including the Kenyan government, collectively possess 1.26 billion shares, equivalent to 64.36 percent of the total, valued at Sh1.76 billion. The remaining 89.58 million shares, constituting 4.6 percent, are owned by foreign investors.

Analysts consider Kenya Power’s stock to be undervalued among those listed on the Nairobi Securities Exchange (NSE), with a low price-to-book (P/B) ratio of 0.78. This makes it appealing to long-term investors who are prepared to endure the extended bearish trend in the market. The company’s share price has declined by 12.9 percent since June 2023, resulting in a market capitalization of Sh2.73 billion.

The company’s most recent financial report for the year ending June 2023 indicates that its net assets amount to Sh56.8 billion. Despite being significantly undervalued, investors have been unable to capitalize on potential catalysts, such as cash distributions from asset sales. This issue is similar to the challenges faced by other state-owned firms like KenGen.

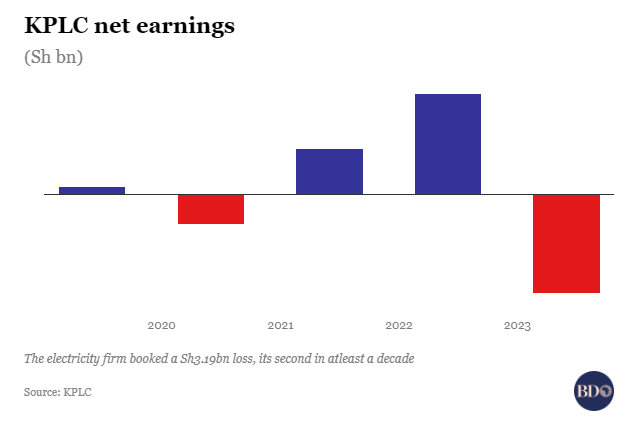

The utility disclosed a net loss of Sh3.19 billion for the fiscal year ending in June 2023, attributing it to increased financing costs on its foreign currency liabilities caused by the depreciation of the shilling.

The corporation stated that it might have disclosed a net profit of Sh3.26 billion for the period. However, the 89 percent surge in financing costs to Sh24 billion from the previous Sh12.9 billion hurt its overall financial performance, despite a 12 percent increase in operating profit to Sh19.2 billion.

Kenya Power stands as one of the prominent users of foreign currency in the nation, necessitating a monthly sum ranging from $45 million to $50 million, as well as €18 million to €20 million, to fulfill its commitments, primarily with independent power producers.

Ndindi Nyoro Sells 36pc Stake In Kenya Power