Ksh300 Billion Eurobond Payment Threatening to Taint Ruto’s 2024

During his New Year address from State House in Nakuru, President William Ruto recognized that Kenyans had faced significant challenges throughout the year 2023.

Addressing the public on Sunday, the President reassured voters that the most challenging phase had passed and the nation was moving forward toward 2024 with a feeling of hopefulness.

Although the President attempted to calm the nation, the looming burden of a Ksh300 billion Eurobond repayment scheduled for June 2024 posed a threat, indicating that 2024 could be another challenging year for Kenyans regarding economic advancement and living expenses.

In the year 2023, Kenya obtained loans exceeding Ksh300 billion (equivalent to USD 2 billion) from the international market and amassed more than Ksh1 trillion through tax collections.

A significant portion of the funds gathered was used to address a burdensome Ksh11 trillion debt, leaving fewer resources allocated towards advancing the development goals.

Ruto stated that his government had implemented sufficient strategies to prevent Kenya from falling into a recession due to debt repayment.

“In 2023, we triumphed over the threat of hunger and economic stagnation. Kenya is now secure about foreign debts,” he stated.

Although the President has promised that Kenya won’t disregard its global commitments, it’s the internal affairs that will face repercussions due to the repayment of the Eurobond.

Government employees are expected to face postponed salary payments, while local government leaders are preparing for delays in receiving devolved funds.

On December 6, Treasury Cabinet Secretary Njuguna Ndung’u, during his appearance before the National Assembly Finance Committee, admitted that the government was encountering an economic predicament.

ALSO READ:

- Kenya Owes Chebukati a Hero’s Farewell for ‘Saving’ Democracy – MP Declares

- HELLFIRE HORROR: Worshippers in Bomet Torch Granny Alive in ‘Satanic Purge’ Ritual(Video)

- Haitian Police Caught in Explosive Feud with Kenyan Peacekeepers? Officials Scramble to Deny Rift

- Raila Odinga’s 2027 Options After Shocking AUC Defeat

- Congo Frees Opposition Leader and Former President’s Ally Jean-Marc Kabund

He described the Treasury’s difficulty in covering salaries, a problem expected to escalate when the Eurobond matures in June 2024.

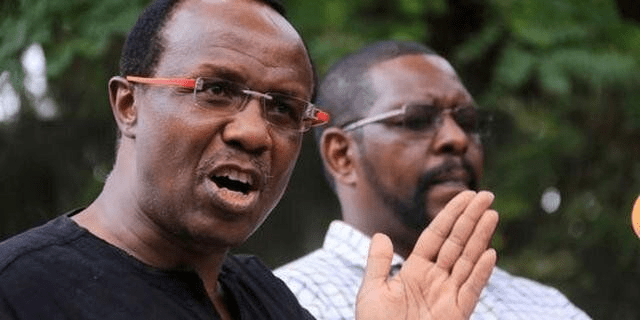

On December 27, Digital Strategist Dennis Itumbi disclosed that President William Ruto was prioritizing the matter of repaying debts and ensuring economic stability as the focus for 2024.

He clarified that Ruto was convening multiple gatherings at the State House to prevent the situation from causing financial ruin to the country.

“The debate and discussion around the many options available and the decisions taken in the interest of the country continue to pay off,” he revealed.

David Ndii, serving as the President’s Council of Economic Advisors Chairperson, heads the team offering guidance to the President.

If the team effectively manages Kenya’s repayment in June 2024, the President will have the opportunity to implement the majority of his development initiatives in the following years.

In 2025, the nation is anticipated to make payments for debt servicing that amount to under Ksh15 billion.

Ksh300 Billion Eurobond Payment Threatening to Taint Ruto’s 2024