Kenya’s Ksh10 Trillion Debt Forces Ruto to Make Radical Changes

The debt ceiling for the government is once again being determined by using the Gross Domestic Product (GDP), as was previously the case.

Notably, Kenya utilized this strategy in the past but gave it up in 2019 in favor of adopting the numerical debt ceiling even as the country’s debt crossed the Ksh10 trillion threshold in June 2023.

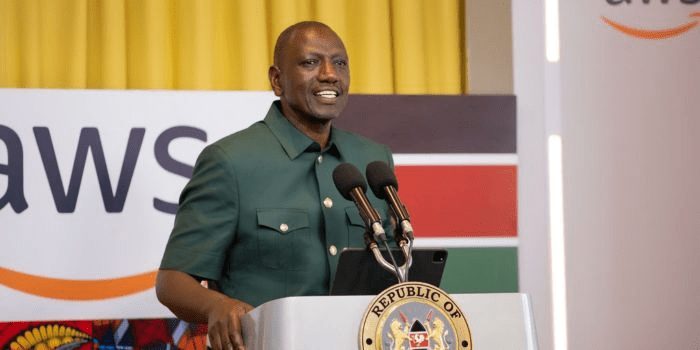

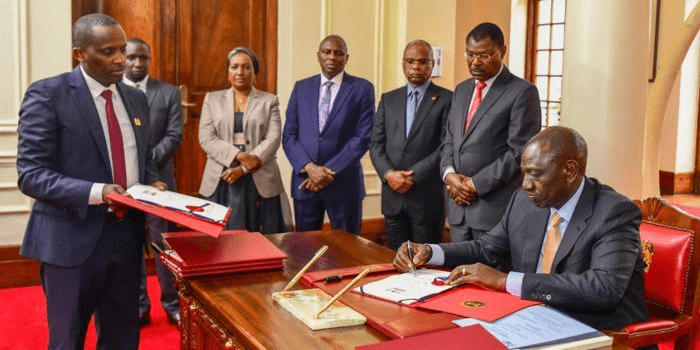

The new debt cap, which will be set at 55 percent of GDP, was established under a new law that was signed by President William Ruto.

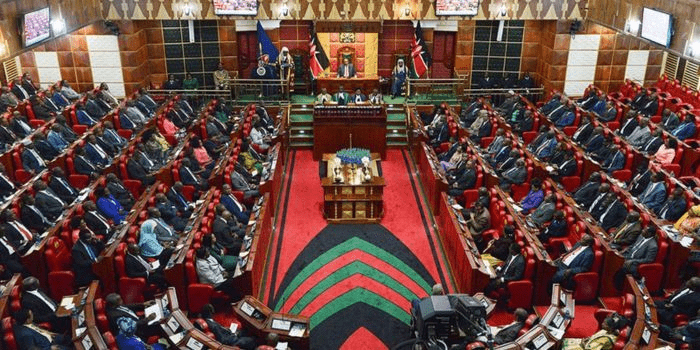

“This mechanism improves debt transparency since public debt is measured relative to the country’s income and ability to pay,” MPs stated while preparing the passed Bill.

According to the most recent estimations, Kenya has already exceeded the 55% threshold because the country’s GDP is expected to reach Ksh17.7 trillion by the end of 2023 as per the projections.

This indicates that by the new law, Kenya’s debt would be set at Ksh9.6 trillion; however, because the numerical debt ceiling calculation was applied, the country has exceeded this by Ksh500 billion.

On the other hand, with the new law in place, the administration anticipates that it will meet the 55 percent target by the year 2027.

The grace period of five years is intended to provide the government of President William Ruto with sufficient time to establish the policies and procedures necessary to rein in the escalating national debt.

ALSO READ:

- Kenya Airways Responds to Claims of Unlicensed Pilot Operating For 8 Years

- Eldoret Policewoman Arrested After Shooting Husband 12 Times

- Red Cross ‘Appalled’ By Human Misery Of Israel-Hamas War

If extreme or exceptional economic conditions arise, the government will be authorized to borrow up to sixty percent of the GDP.

In the new legislation, “extreme and exceptional circumstances” are defined as natural disasters or specific political developments.

The Governor of the Central Bank, Kamau Thugge, gave an interview to NBC News last week and indicated that the debt had breached the Ksh10 trillion level because of the COVID-19 outbreak and the crisis in Ukraine.

The Governor also brought up the fact that an exceptional drought in Kenya led to the country’s agriculture sector contracting, which in turn caused the government to borrow additional money to keep the economy afloat.

Thugge assuaged the concerns of the international community by reassuring them that Ruto’s administration had taken steps to ensure that Kenya would recover from economic shocks both external and internal.

He forecast that the economy of the country will expand by 5 percent, which is more than the average growth rate for economies around the world and also 2 points higher than the forecasts for economies in Sub-Saharan Africa.

Kenya’s Ksh10 Trillion Debt Forces Ruto to Make Radical Changes