Kenya’s Financial Tightrope: Fitch’s Caution on Ksh300B Eurobond Payment

The Kenyan Shilling reached an all-time low on Tuesday, following a warning from credit rating agency Fitch that the country was vulnerable to a negative listing.

Wednesday marked the record low of 152.80 per dollar for the local currency, representing a decline of approximately one percent. Fitch stated that contingent on Kenya’s foreign reserves, it was contemplating downgrading the country’s credit rating.

Kenya’s credit rating would be reduced, according to the credit rating agency, if a significant portion of its foreign reserves were to be utilized to offset the Ksh300 billion Eurobond that is scheduled to mature in June 2024.

“Deploying reserves to redeem the Eurobond would reduce import cover, which could still contribute to a downgrade of Kenya’s rating depending on the extent of the drawdown and outlook for other sources of external financing,” Fitch warned.

Fitch suggested that to prevent the negative classification, the National Treasury investigated alternative methods of augmenting its foreign reserves.

“We believe some of the government’s planned additional external financing will also materialize,” Fitch stated.

The government intends to increase foreign reserves in part by syndicating bank loans and issuing additional Eurobonds.

ALSO READ:

- Senator Cherargei Urges Ruto to Deal with Murkomen: Claims He’s More Controversial Than Kuria

- Airbnb Joins Fight Against Tax Cheats, Shares Kenyan Transactions with KRA

The alert was issued by Fitch concurrently with the International Monetary Fund’s (IMF) approval of a Ksh98 billion expansion of Kenya’s lending program.

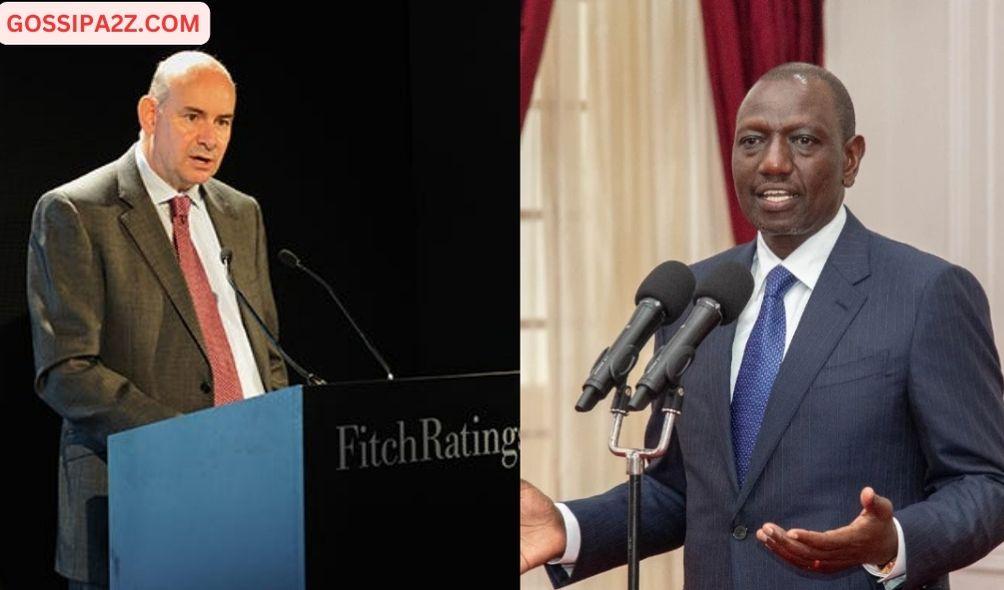

International rating agencies have been accused by President William Ruto in the past of coercing the nation into paying exorbitant interest rates.

Ruto critiqued Moody’s Investors Service in August after the rating agency issued a comparable admonishment to Fitch.

Ruto subsequently stated that the agency acted with ulterior motives, anticipating Kenya’s default to generate higher interest rates for the advantage of investors.

The Kenyan government was considering the now-irredeemable option of repurchasing fifty percent of the Eurobond one year before its maturity date.

“We need to see the details and the terms of the buyback before we can assess whether it constitutes a distressed exchange, and therefore a default under Moody’s definition,” the agency warned.

Kenya’s Financial Tightrope: Fitch’s Caution on Ksh300B Eurobond Payment