Kenyans to Pay More on Loans as CBK Increases Base Lending Rate

On Tuesday, the Central Bank of Kenya (CBK) increased the base lending rate from 12.50 percent to 13 percent. This policy decision paved the way for commercial banks to raise interest rates on loans provided to the Kenyan public.

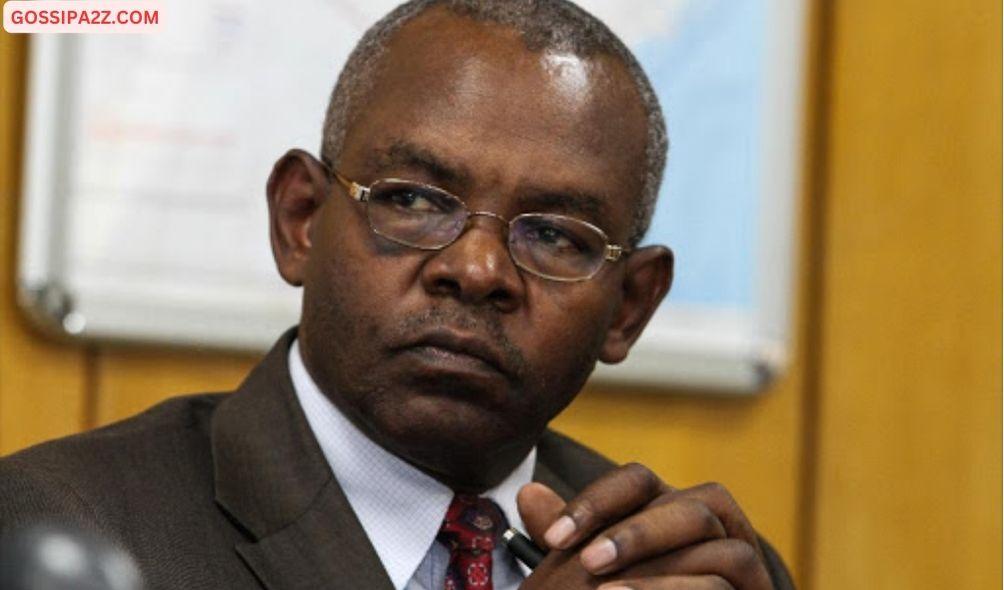

In a communication issued following the most recent meeting of the Monetary Policy Committee (MPC), CBK Governor Kamau Thugge emphasized that the decision to implement the policy was aimed at curbing the escalating inflation rates.

“The proposed action will ensure that inflationary expectations remain anchored while setting inflation on a firm downward path towards the 5.0 percent mid-point of the target range, as well as addressing residual pressures on the exchange rate,” CBK noted in a statement.

The Monetary Policy Committee (MPC) observed a rise in the general inflation rate to 6.9% in January 2024, up from 6.6% in December 2023, and it persisted near the upper limit of the government’s target range.

In January 2024, food inflation rose to 7.9%, up from 7.7% in December 2023. This increase is primarily due to elevated prices of certain non-vegetable items, which can be attributed in part to decreased supply influenced by seasonal factors.

In January 2024, fuel inflation increased to 14.3%, up from 13.7% in December 2023, primarily driven by elevated electricity tariffs.

ALSO READ:

- “Two Groups, One Agenda”: Gachagua Accuses Raila of Secret Political Deals

- Exclusive: Ida Odinga’s 75th Birthday Party in Karen (Photos)

- FKF President Discloses Exact Amount Paid to Harambee Stars Players

- Gachagua’s Ally Senator John Methu Admits Ruto Might Win 2027 Elections

- Maraga Explains Why He Hasn’t Campaigned in Kisii Despite 2027 Bid

“The risks to inflation remain elevated in the near term, reflecting the impact of the second-round effects of the rise in fuel inflation, and pass-through effects of exchange rate depreciation,” CBK stated.

However, Thugge revealed that the foreign exchange reserves of CBK, amounting to USD 7,101 million (equivalent to 3.8 months of import cover), still offer sufficient protection against potential short-term disturbances in the foreign exchange market.

As per CBK, the resilience in the number of loan applications and approvals indicates a consistent demand, especially for meeting working capital needs.

“The banking sector remains stable and resilient, with strong liquidity and capital adequacy ratios. The ratio of gross non-performing loans (NPLs) to gross loans stood at 14.8 percent in December 2023 compared to 15.3 percent in October 2023,” read part of a statement by CBK.

“Growth in commercial bank lending to the private sector stood at 13.9 percent in December 2023 compared to 13.2 percent in November.”

Kenyans to Pay More on Loans as CBK Increases Base Lending Rate