Kenyan Manufacturers Urge IMF Aid Amid Ruto’s Tax Hike

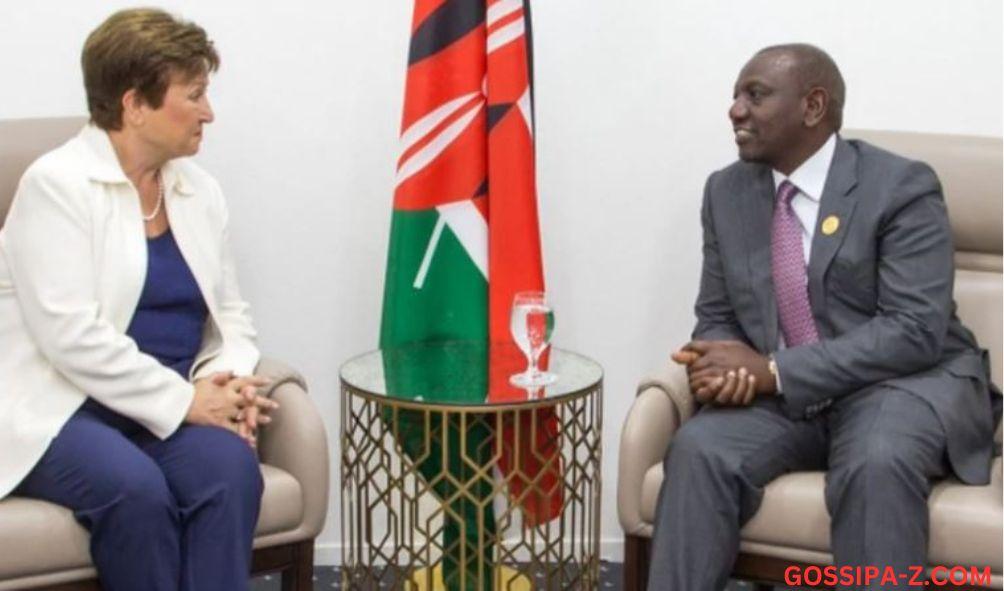

Four significant challenges influencing the operations of the Kenya Association of Manufacturers (KAM), including excessive taxation, were deliberated upon during a meeting with IMF representatives.

Tuesday, the association issued a statement acknowledging that businesses throughout the nation were being impacted by the taxation measures presently implemented by the administration of President William Ruto.

It was acknowledged that the companies’ production costs had increased, although the statement did not divulge specific tax information.

The new taxes and levies, such as the revised National Social Security Fund (NSSF) contributions and the 1.5% Housing Fund, have had a severe impact on KAM members, who are among the largest employers in the country.

Local manufacturing is also being impacted by the dollar and dwindling sterling shortages, according to the team.

The importation of basic materials, as stated by the manufacturers, is dollar-dependent. Due to this, their overall business and output were being adversely affected by the shortage.

The clinkers, which are utilized in the manufacturing of cement, are one example of the basic materials that the Ruto administration has been eager to tax more heavily upon their importation.

“During the meeting, KAM emphasized the impact of the availability of the US dollar and its pricing dynamics on local manufacturers. This is because local industry is heavily dependent on raw materials and intermediate goods for processing and capital goods for investment.

“Additionally, fluctuation in the availability of the US dollar in the market hinders manufacturers’ ability to meet import payment obligations on time, which delays procurement of raw materials for processing, thus interfering with production schedules,” read the statement in part.

ALSO READ:

- President Ruto: ‘My Hands Tied’ as Fuel Costs Soar

- Senators Challenge Ichung’wah: Demand Impeachment Motion for CS Kuria

However, it was observed that there is room for improvement regarding the taxman’s delays in issuing VAT refunds.

Ruto, on March 31, instructed the taxman to remit all validated VAT refunds within a six-month timeframe, despite the manufacturers failing to specify the length of the delays.

Also discussed at the Tuesday meeting was the regulatory burden placed on manufacturers.

“We shall continue to work together with the IMF and like-minded partners to establish a long-lasting solution to the fiscal and regulatory challenges affecting our members,” read the statement in part.

David Ndii, Ruto’s economic advisor, stated that the Kenya Kwanza administration was placing significant emphasis on addressing business taxation in the upcoming fiscal year. This development prompted the business magnates to express their concerns.

Ndii doused the ineffective lobbying efforts of corporations regarding taxation issues, despite his characterization of the existing taxation system as precarious.

“We have a very bad lobbying system coming from even the manufacturers. One person is lobbying for protection on this and another one is lobbying for something with the opposite effect,” Ndii stated during an economic forum on Tuesday.

“We have the tax policy that we found and we will look at it and come up with a coherent set of principles by which we are going to change tax and a much more predictable way of tax.”

Kenyan Manufacturers Urge IMF Aid Amid Ruto’s Tax Hike