Kenyan Exceptionalism: Who’s Spared from Housing Levy?

Some Kenyans may not need to pay the housing levy under the suggestions outlined in the Draft Affordable Housing Regulations 2024.

This represents a departure from a previous suggestion where each person would face a 1.5 percent reduction in income aimed at funding the Affordable Housing Programme.

The latest proposals suggest that a portion of Kenyan expatriates will not have to pay the Housing Levy, along with various forms of income benefits for unemployed Kenyans.

“A person or category of persons may be exempted from the payment of the Levy where that person is exempted from the imposition of taxes under an international agreement or a host country agreement to which Kenya is a part,” the Draft reads in part.

Furthermore, certain types of income might be excluded from the Levy if they stem from pensions or gratuities disbursed to individuals upon the conclusion of a contract.

ALSO READ:

- “Two Groups, One Agenda”: Gachagua Accuses Raila of Secret Political Deals

- Exclusive: Ida Odinga’s 75th Birthday Party in Karen (Photos)

- FKF President Discloses Exact Amount Paid to Harambee Stars Players

- Gachagua’s Ally Senator John Methu Admits Ruto Might Win 2027 Elections

- Maraga Explains Why He Hasn’t Campaigned in Kisii Despite 2027 Bid

Kenyans who are compensated through medical expense reimbursements will likewise be exempt from the 1.5 percent income deduction.

This will also include individuals receiving compensation for travel and lodging costs related to work-related tasks.

The Draft has also specified that insurance payouts will not be considered as qualifying income for deductions under the Housing Levy.

Parliament has also been granted the authority to enact legislation that could exempt additional individuals from the levy as deemed necessary.

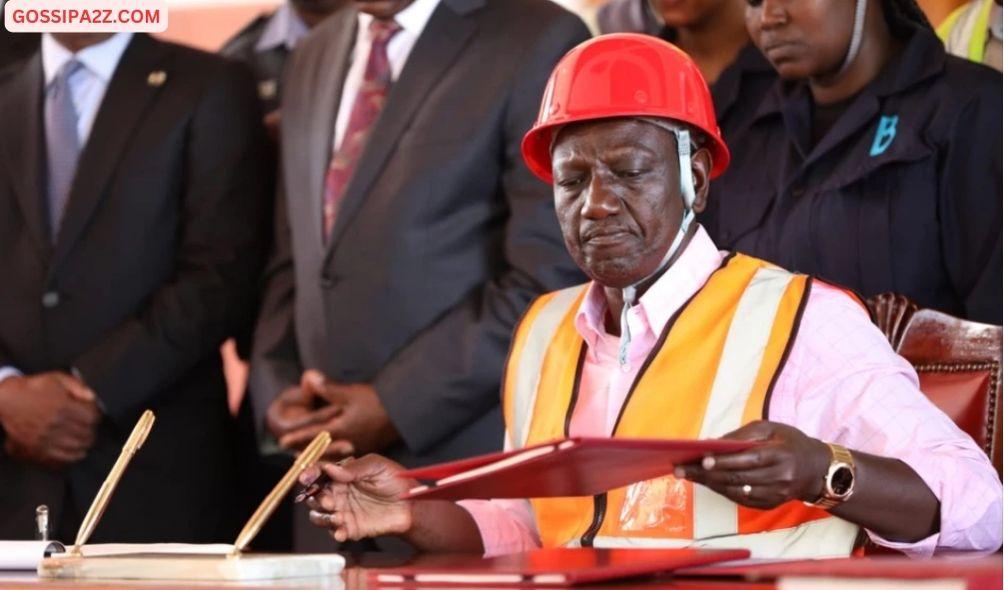

Deductions for the Affordable Housing Levy commenced in March following President William Ruto’s approval of the Affordable Housing Bill, turning it into law.

The program spearheaded by President William Ruto aims to build 250,000 housing units annually.

The initiative aims to address the nation’s housing shortage while also generating employment prospects for Kenyan citizens.

Kenyan Exceptionalism: Who’s Spared from Housing Levy?