Banks Resist Proposal to Raise Cash Reporting Limit to Sh2.1m

Commercial Banks have opposed a government proposal to increase the reporting threshold for large cash transactions by 50 percent to $15,000 (Sh2.1 million) because the decision will facilitate money laundering and the financing of terrorism in Kenya.

The Financial Reporting Centre (FRC) will no longer require bank customers to disclose the source, intended use, and beneficiaries of transactions below $15,000 (Sh2.1 million) after the cabinet of President William Ruto approved amendments to the law.

The Kenya Bankers Association (KBA) stated before a parliamentary commission conducting public participation on the amendment that increasing the threshold from the current $10,000 (Sh1.41 million) will place Kenya at a geopolitical disadvantage given its location in the Horn of Africa.

“Retain the cash limits at $10,000 or equivalent in other currencies as opposed to the $15,000 or equivalent in other currencies,” David Nyamato, chairperson of the KBA compliance committee and head of governance, regulatory affairs & stakeholder relations at NCBA Bank Kenya, advised members of parliament.

Mr. Nyamoto, who presented the KBA position on the Bill, stated, “Due to the increase in exchange rate volatility and out-of-control inflation, the $10,000 threshold should be maintained and applied using a risk-based approach.”

The Cabinet approved the Anti-Money Laundering and Combating the Financing of Terrorism (Amendment) Bill, 2023, last month.

ALSO READ: Ruto Steps In: Del Monte Land Dispute Addressed

The Finance and National Planning Committee of the National Assembly is conducting public hearings on the Bill.

The law currently requires banks to request an explanation of the source and use of funds for transactions exceeding $10,000 and to report any suspicious transactions to the FRC.

Kenya is a signatory to the Anti-Money Laundering and Combating Terrorism Frameworks of the United Nations Security Council and a member of the Financial Action Task Force (FATF), which monitors countries to combat money laundering and terrorism financing.

Mr. Nyamato, who was accompanied by the KBA’s chief financial officer, Kennedy Mutisya, urged the members of parliament to establish specific guidelines for the procedure.

Mr. Nyamato stated, “Kenya’s position as the largest economy in the region and its function as a transit hub for the Eastern Africa region also pose a significant risk in terms of illicit trade.”

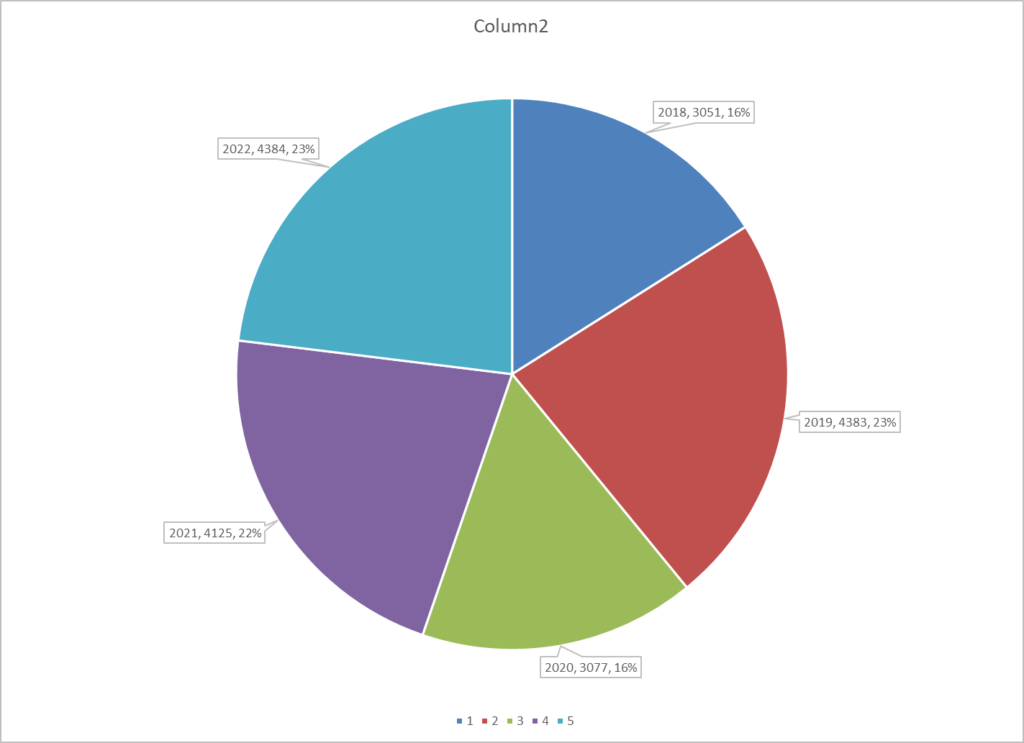

Economic crimes

Source: KNBS

Due to its proximity to Somalia, a stronghold of Al-Shabaab, Kenya also functions as a significant hub for tourism-related activities. A universal increase in the threshold heightens the danger of terrorist financing.”

The KBA noted that the European Union (EU) halted the implementation of a sizable transaction limit in Euros across member states in 2021.

The association informed the session led by the vice-chairman of the committee, Benjamin Lang’at, that US federal law mandates institutions to report cash or coin transactions exceeding $10,000 to the Financial Enforcement Network.

In Malaysia, Mr. Nyamato stated that cash transactions were reduced from $50,000 to $25,000 in Malaysian Ringgit as of January.

ALSO READ: 9 Governors, Including Waititu, Obado, and Sonko, Face Ongoing Court Cases – EACC

“The current cash reporting threshold in China is $4,451.” The KBA stated that the cash reporting threshold in South Africa was revised to 50,000 Rand ($2,600).

Mr. Nyamato stated that Tanzania’s current reporting threshold is $10,000, whereas Uganda’s transaction limit is greater than 20 million Ugandan shillings ($5,500).

“Financial reporting systems are a worldwide concern. It pertains to the entirety of the financial sector, and we as a nation must adhere to global requirements and standards, Mr. Nyamato told the committee.

We are presently experiencing a volatile exchange rate. We request that you keep the threshold at $10,000 because CBK regulations require us to report any transaction exceeding Sh1 million.”

If the proposed legislation is enacted, the FRC will be able to specify the circumstances under which it may request the revocation of a reporting institution’s license.

In October 2021, the then-president of Kenya, Uhuru Kenyatta, directed financial institutions to increase the reporting limit. However, the Central Bank of Kenya advised against the suggestion out of concern that it would expose Kenya to economic sanctions.

Banks Resist Proposal to Raise Cash Reporting Limit to Sh2.1m