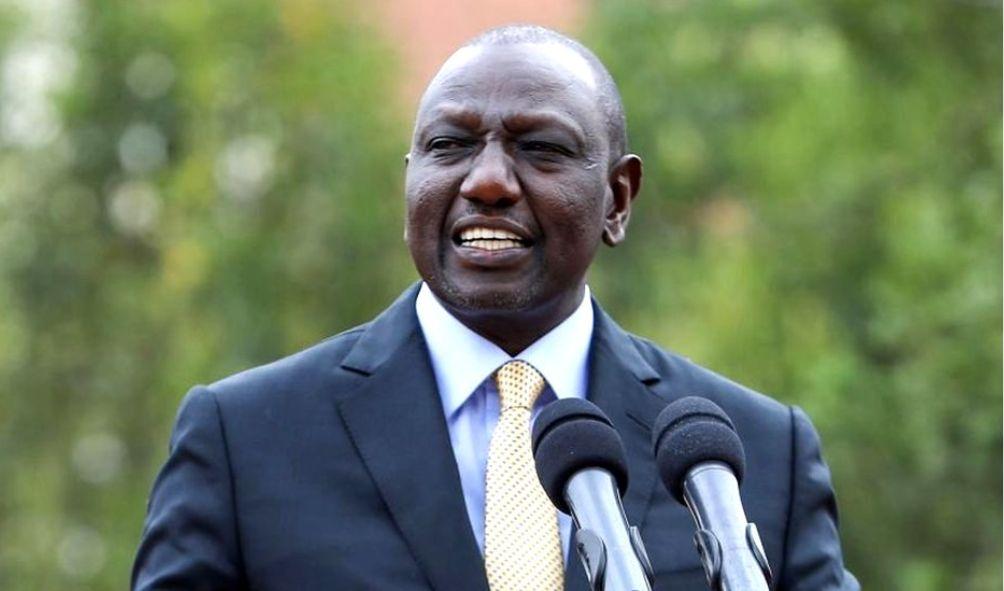

Unleashing the Street Tax Revolution: Ruto’s Sh1.2bn Boost to Deploy KRA Agents in Markets

The National Assembly’s Budget and Appropriations Committee (BAC) has proposed adding Sh1.2 billion to the Kenya Revenue Authority’s (KRA) recurrent budget to hire tax assistants as President William Ruto tightens the noose on tax evaders.

As the government implemented new measures targeting Kenyans in the informal and agriculture sectors, the committee recommended adjusting the general administration planning and services budget of the National Treasury to accommodate the funding for the hiring of agents. In a report to the entire House, the BAC recommended: “Increase Sh1.2 billion (recurring) for KRA to employ tax assistants.”

The Treasury indicated in the Budget Policy Statement (BPS) for 2023 that the untapped Micro, Small, and Medium Enterprises (MSMEs) sector tax base has the potential to generate Sh2.8 trillion in revenue.

A recently published National Tax Policy (NTP), which will guide Kenya’s taxation framework for at least three years, aims for a unified collection of taxes, levies, and fees and the sharing of information between the national and county governments. This would result in the identification of more tax evaders and the closing of existing collection loopholes.

Treasury proposed in the policy guidelines for hard-to-tax sectors to target agriculture and informal sectors aggressively to increase tax revenues.

ALSO READ: Ndindi Nyoro Grilled Over Ruto’s Conflicting Statements

“To achieve this goal, the government will investigate ways to increase the taxation of informal sectors, such as by increasing its presence in major cities, as well as the mechanism for collecting taxes from the informal sector, such as the appointment of tax collection agents,” states the Policy.

Educational initiatives It also proposes implementing taxation education programs for farmers and informal sector groups and requiring farmers and informal sector players to register with their respective subsector associations and co-operative societies.

This is in addition to a strong push to ensure that county and national governments share information that will assist in recruiting more potential taxpayers, as the government seeks to increase tax collections.

Tax, levy, and fee collection could soon be centralized, as opposed to the current situation where county and national governments operate different channels of the collection; the Policy requires a gradual shift from the current framework.

“Progressively adopt a unified system for the collection of taxes, fees, and levies by the national and county governments,” states the NTP.

This proposal would affect numerous areas in which counties currently collect taxes, fees, and levies, including parking fees and business licenses like single business permits and cess.

It would also bring about changes in the Own Source Revenue (OSR) of the counties, where the majority of devolved units have been grossly underperforming and have poor capacity in their revenue collection, yielding little from their rich resources.

ALSO READ: Unveiling the Truth: President Ruto Urged to Apologize for Deceiving Kenyans with False Manifesto

The Commission on Revenue Allocation published a report last year indicating that while Kenya’s 47 county governments had the potential to collect Sh216 billion annually, they were only collecting Sh31 billion, an underperformance of more than 80%.

The government is under pressure to collect at least Sh535 billion in taxes in the remaining two months of the 2022/23 fiscal year, as the KRA collected only Sh1.57 trillion in taxes through April’s end.

This will be a difficult task for the tax collector, as the Sh535 billion it must collect to reach the Sh2.1 trillion budgeted target is 70 percent higher than the average collection over the preceding 1 month period.

Unleashing the Street Tax Revolution: Ruto’s Sh1.2bn Boost to Deploy KRA Agents in Markets

HEY READER. PLEASE SUPPORT THIS SITE BY CLICKING ADS. DON’T FORGET TO HIT THE NOTIFICATION BELL FOR MORE UPDATES AROUND THE GLOBE.