Ruto Unveils New Strategy For Loans After World Bank and IMF Funding

Kenya’s National Treasury has formulated comprehensive strategies for securing external financing in the days following the approval of Ksh1.9 trillion in loans by the World Bank and the International Monetary Fund (IMF).

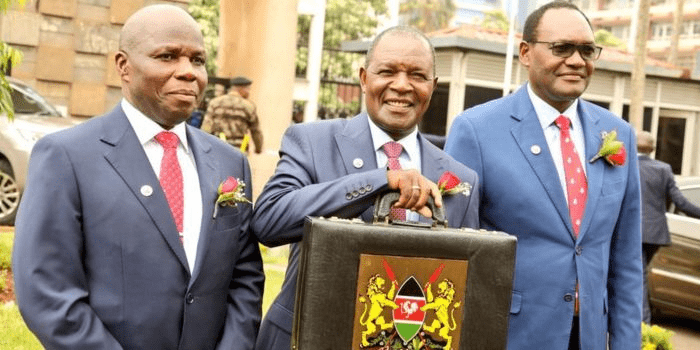

CS Njuguna Ndung’u revealed in a statement that the nation would have a preference for obtaining loans from multilateral agencies as opposed to commercial institutions.

Njuguna further stated that the country found concessional loans from institutions like the World Bank and IMF to be more economically viable due to the favorable terms and conditions associated with the credits extended.

Concessional loans are typically extended with a reduced interest rate when compared to commercial bank loans.

Additionally, a prolonged grace period is extended for borrowers to repay the credit.

“In light of the uncertainty surrounding access to global bond markets, the government strategy has shifted to focus on seeking out concessional funding from the multilateral lenders like IMF and the World Bank and bilateral development partners, in addition to stepping up efforts to improve macroeconomic environment and carrying out the necessary structural reforms.

“Kenya will continue its efforts to access commercial financing when favorable market conditions permit,” read the statement in part.

Conversely, the CS stated that the government would persist in executing alternative approaches, including bolstered revenue collection, to guarantee punctual debt repayments.

A revision of the budget to reduce wasteful spending was also emphasized as one of the new fiscal measures.

ALSO READ:

- “Two Groups, One Agenda”: Gachagua Accuses Raila of Secret Political Deals

- Exclusive: Ida Odinga’s 75th Birthday Party in Karen (Photos)

- FKF President Discloses Exact Amount Paid to Harambee Stars Players

- Gachagua’s Ally Senator John Methu Admits Ruto Might Win 2027 Elections

- Maraga Explains Why He Hasn’t Campaigned in Kisii Despite 2027 Bid

“As such, the fiscal deficit is projected to decline from 5.6 percent of GDP in FY 2022/23 to 4.7 percent of GDP in FY 2023/24 and further to below 4 percent of GDP in FY 2024/25.

“Despite the liquidity challenges Kenya is facing, the macroeconomic environment remains stable, with real GDP expanding by 5.4 percent in the first half of 2023, primarily due to a robust recovery in the agriculture and services sectors,” read the statement in part.

The Treasury unveiled its strategies after the World Bank’s declaration that it would gradually disburse Ksh1.8 trillion ($12 billion) in credit to Kenyans over a period of three years.

The IMF, on the other hand, declared that the nation would receive a loan in the amount of Ksh142.8 billion.

Ruto asserts that credit facilities will be utilized to augment the nation’s currency reserves and mitigate the risks associated with inflation and debt.

The nation’s debt portfolio, which comprised the Eurobond scheduled for maturity the following year, amounted to Ksh10.58 trillion as of September 2023. Beginning in December, Kenya will pay Ksh500 billion to service the Eurobond.

Ruto Unveils New Strategy For Loans After World Bank and IMF Funding