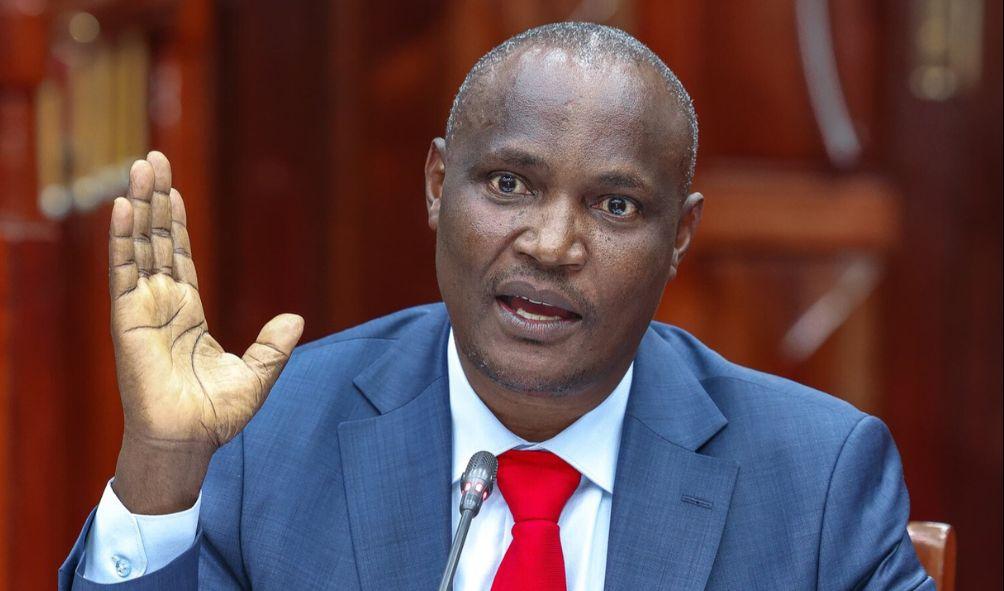

Mbadi: This is What We Discussed with IMF Boss

National Treasury and Planning Cabinet Secretary John Mbadi has disclosed that his recent discussions with International Monetary Fund (IMF) representative Selim Cakir focused on an upcoming board meeting between Kenya and the financial institution scheduled for September this year.

Mr. Mbadi refuted claims that the IMF imposed conditions during the meeting, emphasizing that no loan terms or conditions were discussed.

“We only had a general conversation about the upcoming board meeting in September. You may recall that the meeting was initially set for July but was postponed due to reasons we all know,” he said.

The IMF executive board was slated to convene in July to approve a funding drawdown. However, the session was delayed following anti-government protests and the withdrawal of the Finance Bill, 2024, which created a financing gap of Sh346 billion.

The government is seeking to draw down approximately $600 million (Sh78.16 billion) from the IMF, pending the approval of Kenya’s medium-term funding program during the institution’s seventh review.

The talks, as explained by Mr. Mbadi, also touched on the court’s ruling declaring the 2023 Finance Act illegal.

“The IMF representative voiced concern over the potential revenue shortfall following the ruling on the 2023 Finance Act,” Mr. Mbadi stated.

Mr. Mbadi described Mr. Cakir as a mediator between the IMF and Kenya, noting that the meeting was routine given his assumption of a new office.

“These meetings are standard when someone assumes a new office,” he added.

ALSO READ:

- Inside Job Exposed: Kenyan Prison Wardens Convicted for Orchestrating Daring Terrorist Escape

- Uganda Pulls the Plug: Nationwide Internet Blackout Ordered Days Before Crucial General Election

- African Elections Under the Spotlight as Zambia Turns to Kenya Ahead of 2026 Vote

- “Two Drug Barons in Cabinet?” Kenya Government Fires Back as Ex-Deputy President Sparks Explosive Drug Claims

- Kenyan Court Freezes Use of Private Lawyers by Government, Sparks Nationwide Legal Storm

Mr. Mbadi assumed office amidst the rejection of the Finance Bill, 2024, after continuous protests—an outcome the IMF had foreseen in its January report.

The report urged the government not to backtrack on new revenue-raising measures outlined in the bill.

The IMF has consistently defended its loan programs for Kenya, maintaining that their primary goal is to enhance the country’s economic stability.

Following the Monday meeting, the Treasury highlighted the IMF’s significant role in supporting Kenya’s economic stability on its social media platform.

“IMF representative in Kenya, Mr. Selim Cakir, paid a courtesy call to Treasury CS @_HonMbadi and @Kiptoock this morning. The IMF continues to play a critical role in supporting Kenya’s economic stability and development,” the Treasury posted on its X account.

However, many Kenyans, led by Central Organization of Trade Unions (Cotu) Secretary General Francis Atwoli, cautioned Mbadi against blindly adhering to any IMF conditions.

The Cotu leader emphasized that the union remains committed to policies promoting economic stability while safeguarding workers’ rights and the welfare of all Kenyans.

The IMF has often been blamed for the rising cost of living in Kenya. President William Ruto opted to partner with the IMF to stabilize the economy after assuming office in 2022.

ALSO READ: This is a Turning Point: We Will Never Be Outside Govt Again- Opiyo Wandayi

The fund has also been criticized for endorsing stringent taxes, such as the 16 percent value-added tax (VAT) on fuel and other austerity measures, which the Kenya Kwanza administration has recently implemented—criticisms the IMF continues to reject.

The IMF and the World Bank have been key players in Kenya’s economic landscape since independence, with their influence ranging from the structural adjustment programs of the 1990s to the recent amendments in the Finance Bill, 2024.

Despite Mr. Atwoli’s caution, Kenya is not alone in expressing concerns over painful IMF-backed tax proposals. Countries like Argentina, Spain, Greece, Indonesia, Ecuador, Egypt, and Suriname have also voiced objections.

In Kenya’s case, several controversial measures in the Finance Bill, 2024, for the fiscal year beginning July are part of a lending program initiated under retired President Uhuru Kenyatta’s administration in 2021.

The program introduced various austerity measures, including significant tax hikes that sparked nationwide protests.

During his vetting, Mbadi was questioned about how he plans to navigate Kenya’s relationship with the IMF and address the country’s dependence on unfavorable lending terms.

“There was a time when Kenya operated without the IMF, and we can do so again. The IMF doesn’t invite itself; it’s invited, and terms are agreed upon. We can, however, negotiate modified rates that don’t burden taxpayers,” Mr. Mbadi told the vetting panel.

ALSO READ: ‘Relax and wait for your fate,’ Malala claps back at new UDA SG Hassan Omar

He reiterated his stance yesterday, stressing that the IMF has not imposed any conditions on Kenya.

“The IMF doesn’t impose conditions before lending. You negotiate the terms, and it’s only if you fail to meet them that they raise concerns,” Mr. Mbadi clarified.

He added, “You agree on the actions you’ll take once funding is provided.”

Mr. Mbadi has committed to reintroducing non-controversial elements of the rejected Finance Bill to stabilize the nation’s finances.

The government has also unveiled a series of cost-cutting measures to address the fiscal challenges posed by the rejection of the Finance Bill.

The meeting between Mbadi and the IMF sparked concerns among Kenyans that the country might be preparing for another loan from the fund.

Kenya had successfully avoided IMF loans until 2021 when it was grappling with the economic fallout from the COVID-19 pandemic.

During the peak of the pandemic in 2020, the country’s foreign exchange reserves dwindled as export markets like Europe and the US shut down due to lockdowns.

Upon taking office, the Kenya Kwanza government agreed with the IMF to increase VAT on petroleum products to 16 percent.

Additionally, excise duty on airtime and mobile money transfer fees was set to rise from 15 to 20 percent, and a motor vehicle tax was to be introduced in the Finance Act 2023, though these measures were delayed until this year.

The government also planned to slash tax exemptions by introducing VAT on previously zero-rated items like bread.

According to the IMF, these initiatives would have generated over Sh32 billion in revenue, but their implementation was delayed following the rejection of the Finance Bill.

Mbadi: This is What We Discussed with IMF Boss