Inside Treasury CS Mbadi’s Plans to Reduce VAT, Corporate Tax, PAYE

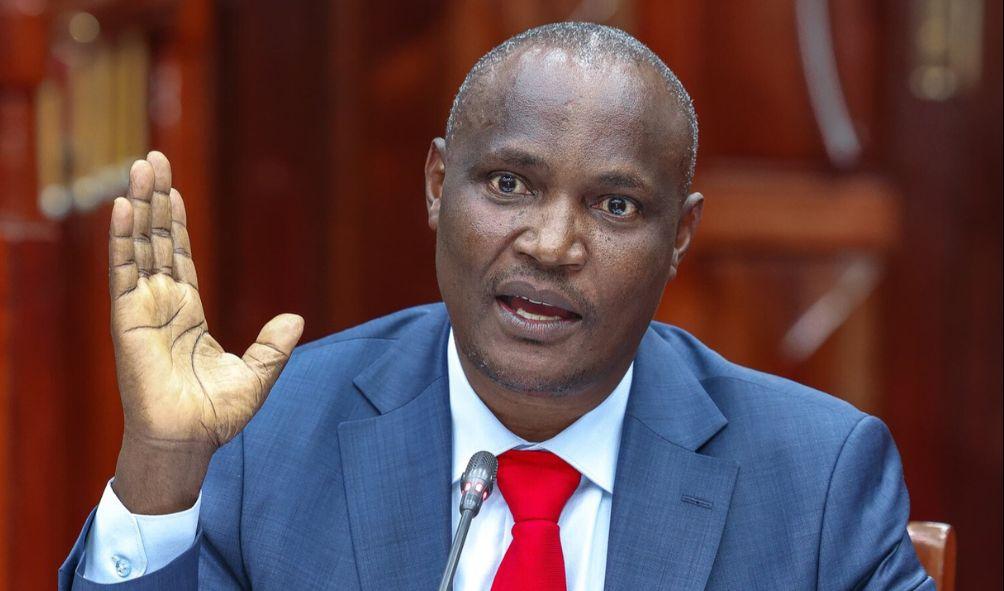

During the 2024/25 budget-making process launch at KICC in Nairobi, Treasury Cabinet Secretary John Mbadi outlined the government’s fiscal reform plans.

The National Treasury has rolled out a medium-term revenue strategy aimed at bolstering domestic revenue mobilization while also aiming to cut key tax rates.

In a surprising move, Mbadi emphasized that the Treasury’s priority is to lower, not increase, taxes, aiming to improve compliance and widen the tax base.

Mbadi announced, “We plan to reduce VAT from 16% to about 14% in the medium term. Additionally, corporate tax will be lowered from 30% to 25%, and PAYE rates will also see reductions.”

This strategy is designed to fortify the fiscal consolidation framework.

The overarching goal is to meet the East African Community convergence criteria by reducing the fiscal deficit to 3% of GDP.

Public Finance Management Reforms to Boost Accountability

Mbadi highlighted the urgent need for reforms in Public Finance Management (PFM), urging government accounting officers to prioritize efficiency, accountability, and the responsible use of public funds.

A key reform includes the introduction of a fully digital e-government procurement system to enhance transparency and deliver better value for money in government spending.

“The system requires Sh560 million, and I’ve directed the Treasury Principal Secretary to ensure the funds are secured. The savings from disciplined procurement will surpass the initial investment,” Mbadi reassured.

The procurement system is set to be fully operational by January 2025, with pilot tests already underway.

Transitioning to Accrual Accounting and Overhauling Asset Management

The Treasury will also shift from cash-based to accrual-based accounting, which is expected to improve cash flow management and provide more accurate financial reporting.

According to Mbadi, this transition will allow the government to accurately account for all assets and liabilities, a crucial step for better financial oversight.

“Currently, we cannot definitively state the value of government assets, including land and buildings. The accrual accounting system will address this by accounting for all assets and liabilities,” Mbadi noted.

Pending bills will now be integrated into Kenya’s financial reports, no longer being treated as separate entries.

To ensure the smooth execution of these reforms, a multi-agency task force, led by Treasury Principal Secretary Chris Kiptoo, has been established.

This team will oversee the transition to accrual accounting and the automation of asset and inventory management across Ministries, Departments, Agencies (MDAs), and County Governments.

Accountability and Efficiency as Key Priorities

Mbadi emphasized that accountability and efficiency must be at the forefront, especially in public procurement.

He acknowledged that previous attempts to streamline procurement were hindered by delays, but affirmed that this would no longer be acceptable under the new system.

“The current dysfunctional procurement process will come to an end. We’re moving to a comprehensive, end-to-end system where every procurement, from ministries to county governments, will be fully tracked for transparency and accountability,” Mbadi firmly stated.

Inside Treasury CS Mbadi’s Plans to Reduce VAT, Corporate Tax, PAYE