Govt Sets 90-Day Period For Refunding Kenyans Money In Ruto Housing Project

Individuals in Kenya who choose to save voluntarily for the 10% down payment on President William Ruto’s affordable homes will have the option to receive a refund if they are unable to successfully acquire one.

As outlined in the Affordable Housing Bill of 2023, it was disclosed that individuals have the opportunity to accumulate savings to meet the 10 percent deposit prerequisite for the allocation of a house.

Nevertheless, due to the expected surge in housing demand, individuals might find it challenging to secure a unit and may opt to receive a refund instead.

“An agency shall open a separate bank account where voluntary savings shall be kept and any interest arising from the investment of voluntary savings shall be credited to this account. An agency shall issue an account number to each person making a voluntary saving.”

“A person who has made a voluntary saving and has not been allocated an affordable housing unit and desires to withdraw his or her savings shall give a 90 days notice to the agency for a refund with accrued interest, if any,” reads the proposed Bill in part.

The refunds will also take less than 90 days to be processed.

Monthly Payments

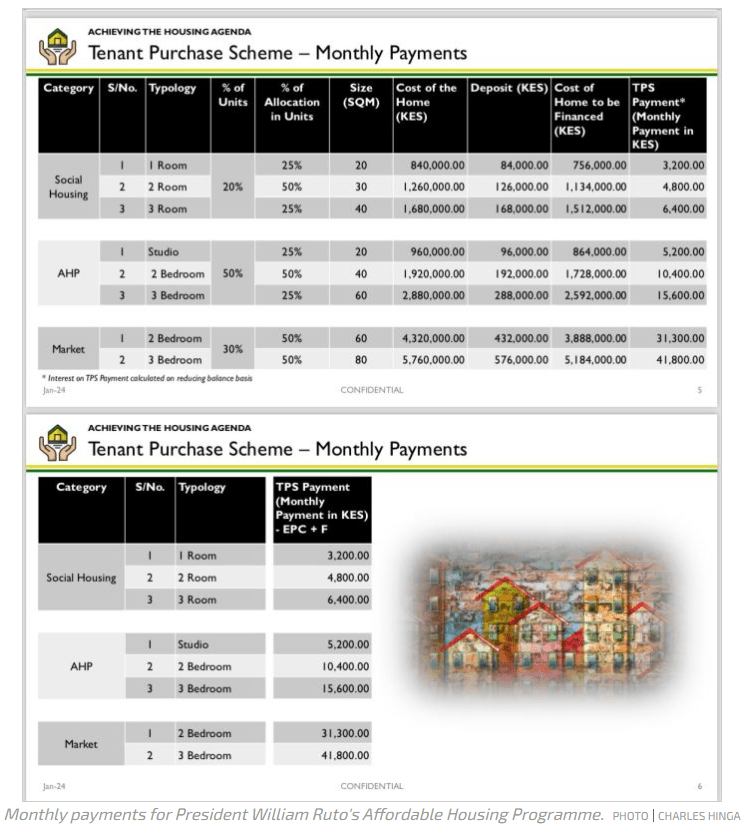

According to Charles Hinga, the Principal Secretary for Housing, affordable housing will be available in three classifications: Social, Affordable Housing Program (AHP), and Market.

Kenyans will have the opportunity to become homeowners using a rent-to-own approach. This involves making a 10% deposit and paying monthly installments over an extended period, allowing individuals to gradually fulfill the total value of the house.

Social

The affordable housing options will be provided for individuals with low incomes, featuring a variety of units that range from one-bedroom to three-bedroom homes.

A single-bedroom residence is priced at Ksh840,000. The initial payment for these accommodations is set at 10%, amounting to Ksh84,000. Subsequently, a monthly installment of Ksh3,200 is to be paid until the full payment for the house is completed.

ALSO READ:

- Under and Over 7 — when the rules are simple, but the emotions are intense

- CAF Trophy Hunt: Win iPhone, MacBook, PlayStation, and other prizes in 1xBet promo!

- Rigathi Gachagua Responds to Raila Odinga’s Claim That He Can’t Fix Kenya’s Problems

- Miguna Miguna Criticizes New IEBC Chair Erastus Ethekon, Calls Him a Ruto Ally- ‘Not Independent’

- Matiang’i: No Scores to Settle, I Just Want to Fix My Country

The cost of two-bedroom apartments is Ksh1.2 million, with a required deposit of Ksh126,000. Monthly payments for these residences will amount to Ksh4,800.

Alternatively, three-bedroom residences are priced at Ksh1,680,000. Prospective purchasers must make an initial payment of Ksh168,000 before occupancy, followed by monthly installments of Ksh6,400.

AHP

Units classified under this category were priced at Ksh960,000. Residents will need to make a monthly payment of Ksh5,200 after submitting a deposit of Ksh96,000.

Two-bedroom residences are set to be valued at Ksh1.9 million, while three-bedroom accommodations will be offered for Ksh2.8 million.

After submitting a 10 percent deposit, individuals interested in 2-bedroom houses will be required to make monthly payments of Ksh10,400. Meanwhile, occupants of three-bedroom houses will need to pay Ksh15,600 per month following their deposit payments.

Market

The market dwellings will be more spacious in comparison to those in the social and AHP classifications. This particular category will exclusively consist of residences with one and two bedrooms.

Single-bedroom residences with an area of 60 square meters are set to be sold at Ksh4.3 million. The payment plan involves an initial deposit of Ksh432,000 and a monthly installment of Ksh31,000.

Meanwhile, three-bedroom residences will have an area of 80 square meters and come with a price tag of Ksh5.7 million for Kenyan buyers. Following a 10 percent initial deposit, monthly installments will amount to Ksh41,000.

Govt Sets 90-Day Period For Refunding Kenyans Money In Ruto Housing Project