Govt Moves to Eliminate Double Taxation Between Kenya and Bangladesh

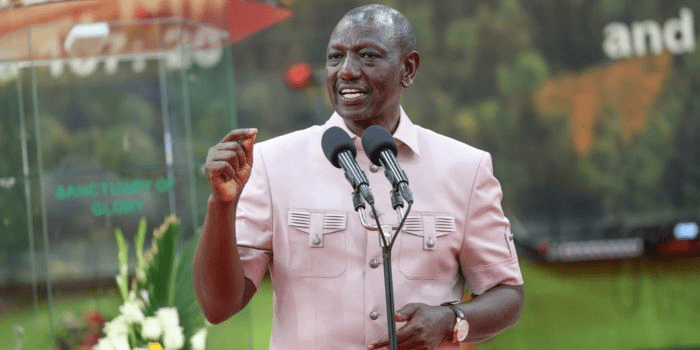

President William Ruto’s government has commenced efforts with the Bangladesh National Government to eradicate the issue of double taxation between their respective countries.

The initiative, led by the National Treasury Ministry, involves exempting taxes for Bangladeshi businesses in Kenya, reciprocated by a similar tax exemption for Kenyan businesses operating in Bangladesh.

According to the Treasury papers reviewed by Kenyans.co.ke, the earnings generated by Bangladeshi citizens in business will solely be subject to taxation within their own nation.

Kenya will only earn income from the business profits if the business is permanently located within Kenya rather than in Bangladesh.

As per the National Treasury, the prevention of double taxation guarantees that there are no chances for avoiding or evading taxes, thereby preventing instances of non-taxation.

If the company maintains a fixed location in Kenya, it will be subject to taxation, limited to the portion of income related to that specific permanent establishment.

According to the two countries, permanent establishment means, “Fixed place of business through which the business of an enterprise is wholly or partly carried on.”

This includes but is not limited to; a place of management, branch, office, factory, workshop, or any place of extraction of natural resources.

ALSO READ:

- Raila Ally Breaks Silence After Ruto-Uhuru Meeting

- Gachagua Close Ally Karungo Wa Thang’wa Accepts Ruto’s CBS Award

- Gov’t to Release Ksh.32 Billion to Counties Next Week – DP Kindiki

- High Court Strikes Down Ruto-Raila 2023 IEBC Amendment Bill

- Kenya Water Towers Agency Dissolved: Government Moves to Streamline State Corporations

Furthermore, companies based in Bangladesh will not be subjected to taxes on profits earned through shipping and air transportation.

“Profits of an enterprise of a contracting state (Kenya or Bangladesh) from the operation of ships in international traffic may be taxed by the other contracting state, provided that such profits are derived from operations in that other contracting state,” the agreement reads in part.

The taxation, however, will be limited to ensure it doesn’t surpass a certain percentage of the tax levied by the other country.

As per the National Treasury’s guidelines, earnings generated from running ships or aircraft engaged in global travel will encompass revenues obtained through leasing ships or aircraft on a bareboat arrangement for international travel purposes.

Income generated from real estate will not be eligible for the tax exemption.

“Income derived by a resident of a contracting state from immovable property (including income from agriculture, forestry or fishing) situated in the other contracting state may be taxed in that other state,” the agreement outlines.

Other forms of revenue that will be subject to double taxation include dividends, interest, royalties, capital gains, and fees for technical services.

Govt Moves to Eliminate Double Taxation Between Kenya and Bangladesh