Voting Under Duress? Questions As MPs Who Voted For Tax Law Now Oppose It

The Finance Act 2023 is now facing objections from two Members of Parliament (MPs), sparking numerous questions about why they initially supported it with such enthusiasm.

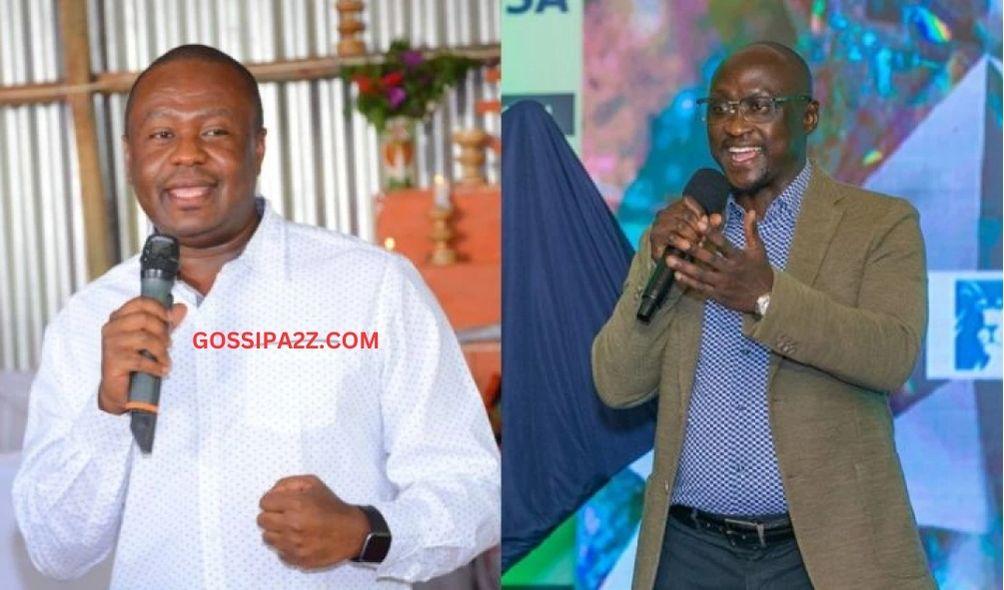

On February 26, 2024, Kandara MP Chege Njuguna and Gatanga MP Edward Muriiu, both supporters of the Act, joined forces with local farmers to obstruct an awareness campaign conducted by Kenya Revenue Authority (KRA) officials. The officials had arrived to educate farmers about the obligation for businesses to electronically create and send their invoices to KRA through the eTIMS system.

On Monday, the Kenya Revenue Authority (KRA) additionally declared that every type of business, including those in the Informal Sector and Small Businesses, is required to electronically create and send their invoices using the electronic Tax Invoice Management System (eTIMS).

The eTIMS Lite platform allows taxpayers who are not registered for VAT to electronically create and send their invoices to the Kenya Revenue Authority (KRA) using a user-friendly interface.

MP Njuguna addressed the gathering saying: “We are telling the government, we are not going to pay those avocado taxes. What the government needs to do is subsidize the avocado, which means helping the farmers not killing them. We refuse our farmers to be killed. Hiyo maneno tumekataa kabisa.”

However, Section 23A of the Finance Act, 2023 outlines that “The Commissioner may establish an electronic system through which electronic tax invoices may be issued and records of stocks kept for this Act.”

It further reads…” a person who carries on business shall issue an electronic tax invoice through the system established under subsection (1).”

ALSO READ:

- Raila Ally Breaks Silence After Ruto-Uhuru Meeting

- Gachagua Close Ally Karungo Wa Thang’wa Accepts Ruto’s CBS Award

- Gov’t to Release Ksh.32 Billion to Counties Next Week – DP Kindiki

- High Court Strikes Down Ruto-Raila 2023 IEBC Amendment Bill

- Kenya Water Towers Agency Dissolved: Government Moves to Streamline State Corporations

The disputed action taken by KRA has prompted inquiries about whether Members of Parliament thoroughly examined the Act before collectively supporting it, and whether they would subsequently challenge it.

Deputy President Rigathi Gachagua engaged in double-speak when, in a previous public statement, he mentioned that the sections of the act impacting farmers are currently being reassessed.

“Even on this taxation, there is a bill in parliament we have seen it has some defects as it seeks macadamia farmers to start being deducted. I have sat down with the President and the Treasury CS we are looking for a better solution,” said Gachagua.

“We will talk to our MPs because we cannot help a farmer with one hand and hurt them with another.”

This originated from statements made by President William Ruto at a Thanksgiving prayer event in Narok County on June 4, 2023.

During the assembly, President Ruto cautioned Members of Parliament in the Kenya Kwanza administration against resisting the bill when it is presented in the House.

He told the MPs to ensure that the Bill sails through.

“We need to pass this bill so Kenya can develop. There are some suggestions that MPs should disclose how they voted when the bill is tabled in parliament, but I am waiting to see any MP who will shut down that bill,” said the president.

ALSO READ: Mount Kenya Unease: Leaders Frown at Ruto-Raila AU Pact

One week later, Ruto’s proposal saw fulfillment when around 184 Members of Parliament, predominantly from Kenya Kwanza, endorsed the bill, whereas 88 MPs, primarily from Azimio, opposed the proposed changes.

Gathoni Wamuchomba, the Member of Parliament for Githunguri, is among the Kenya Kwanza legislators who did not support the bill during the voting process.

Challenges emerged when Members of Parliament aligned with the governing United Democratic Alliance (UDA) and opposed Ruto’s instructions, as they faced the potential of facing disciplinary measures.

Nandi Senator Samson Cherargei cautioned that individuals who opposed the stance of the ruling political group would face appropriate consequences.

“If the party has directed you make a certain decision, if you don’t follow party position…if you were elected by UDA party supporters, you are in UDA party and do not want to vote according to UDA, you will have to be dealt with by the law,” he stated.

On June 26, President Ruto approved the Bill, and since then, Kenyans have been facing increased financial burdens to support the government’s initial unfavorable budget.

Voting Under Duress? Questions As MPs Who Voted For Tax Law Now Oppose It