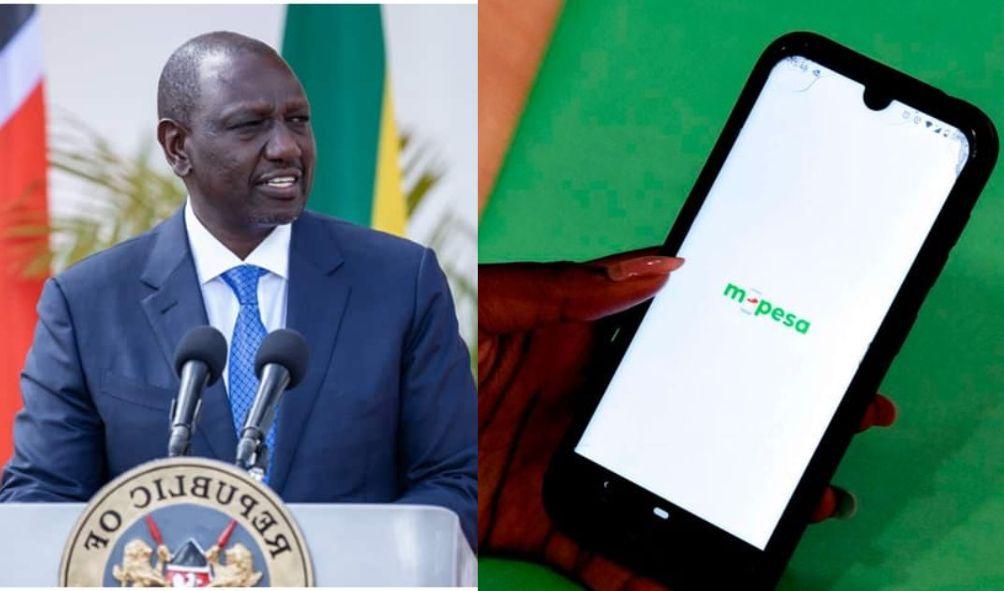

Safaricom Discredits Ruto’s Sh5,000 Smartphone as Tax Hike Puts it in Doubt

With the proposed increase of import duty, excise duty, and value-added tax (VAT), Safaricom has ruled out the possibility of assembling a Sh5,000 mobile phone locally, dampening President William Ruto’s ambition for Kenya to produce the cheapest smartphone in Africa.

The proposed taxes, according to Safaricom, will increase the price of locally assembled smartphones to Sh11,500.

In December, President Ruto announced that Kenya will produce the cheapest smartphone in Africa this year for less than Sh5,000.

Dr. Ruto pledged to deliver the affordable smartphone within eight to twelve months of this year to ensure that all Kenyans have access to digital business platforms and government services.

He told a forum of representatives from Micro, Small, and Medium Enterprises (MSMEs) that the cheapest smartphone costs between Sh10,000 and Sh15,000.

ALSO READ: Uhuru’s Tactical Move: Registrar of Parties Blunder Helps Oust Kega from Jubilee

Tuesday, the telecommunications company requested that the Finance and Planning Committee of the National Assembly revise the import duty, excise duty, and VAT rates on cell phones through the Finance Bill 2023 to reduce the price of locally assembled phones.

“For me to save Sh4,000 and reduce the price of the phone from Sh11,500 to Sh7,500, we must address the issue of import, excise, and output Vat.” During public hearings on the Finance Bill, Safaricom’s Head of Venture, Karanja Gichiri, told MPs.

“We can reduce the taxes to 3,000, bringing the final price of a locally assembled smartphone to between 6,500 and 7,000.”

A coalition of telecommunications operators and device manufacturers wants the Finance Committee to amend the Finance Bill of 2023 to exempt mobile phones assembled or manufactured locally from VAT.

The consortium urged the committee chaired by Molo MP Kuria Kimani to amend the law to exempt locally assembled or manufactured phones from excise duty.

In the fourth quarter of 2022, imports decreased by 13.5% due to scarcity and inflation. Job Kabochi, a partner at PwC, informed MPs on behalf of the consortium.

“We propose that the Vat Act and the Excise Duty Act be amended to introduce a new paragraph within Part A of the Second Schedule of the VAT Act to include the supply of locally assembled and manufactured mobile phones, and to introduce a new paragraph within Part A of the Second Schedule of the Excise Duty Act to include disassembled/unassembled kits for local assembly or manufacture of mobile phones.”

ALSO READ: Uhuru Kenyatta’s Political Stand Jeopardizes Millions: The High Stakes of Refusing Retirement

In its presentation to the committee. Safaricom stated that the reduction of taxes would allow it to produce the most affordable phone in Africa.

Safaricom stated it will soon launch a factory to produce between 1.2 million and 1.4 million smartphones annually.

“As of today, one local assembly line has just begun operation. It is estimated that we import 4 million phones annually. Which is a constraint on our foreign currency needs, as stated by Mr. Gachiri.

Most expensive

“The most expensive component of the phone is the microchip that controls the 4G network. The appropriate starting point for a good phone, as determined by the chip and components, is $40.”

He stated that bringing the phones to the port of Mombasa incurs taxes. Arguing that Safaricom spent an additional Sh2,300 on a Sh5,000 phone due primarily to import duty and excise tax.

ALSO READ: Jubilee Leadership in Disarray: Clash Between Political Parties Registrar and Tribunal

“Thereafter, phone assembly will cost Sh300, including factory profit margins.” We intend to pass on the savings to the consumer.”

“However, when considering last-mile connectivity, an additional Sh1,400 will be expended, and the device’s output Vat is Sh1,500.” This brings the total price to Sh11,500, with the manufacturer receiving only Sh300,” said Mr. Gachiri.

When Dr. Ruto announced the production of the Sh5,000 locally assembled smartphones. The exchange rate was approximately Sh118 per dollar, whereas it is currently Sh135.

Mr. Gachiri stated, “We estimate that 120 million new subscribers in Africa will require mobile phones, and by leveraging the Africa Continental Free Trade Agreement (Acfta), we will be leaders in Africa and the world in mobile telephony.”

Safaricom Discredits Ruto’s Sh5,000 Smartphone as Tax Hike Puts it in Doubt

HEY READER. PLEASE SUPPORT THIS SITE BY CLICKING ADS. DON’T FORGET TO HIT THE NOTIFICATION BELL FOR MORE UPDATES AROUND THE GLOBE.