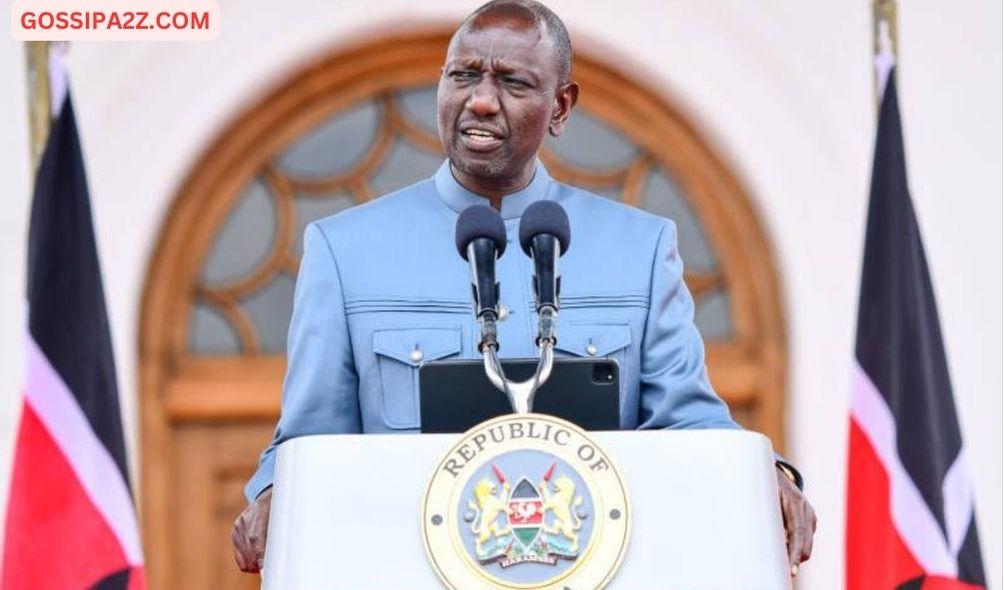

Ruto Secures Ksh 12.3B Loan Weeks After IMF and WorlBank Boosts

President William Ruto’s legacy blueprint received a boost on Wednesday when the African Development Bank approved a Ksh12.3 billion (€73 million) loan to Kenya.

As per the continental organization, the funds will be allocated to facilitate the nation’s economic recuperation, enhance industrial progress and competitiveness, and bolster Kenya’s intermediate and long-term objectives.

The financing will be available for the 2023–2024 fiscal year.

“The program will continue to support Kenya’s medium- and long-term development through three components: fiscal consolidation to secure the viability of the public finances, strengthening industrial development and competitiveness, and improving economic and social inclusion,” read a statement issued by the bank.

The Bank Group’s Director General for East Africa, Nnenna Nwabufo, emphasized in a statement that the funds will enable Kenya to withstand the effects of external shocks such as international conflicts.

“Kenya is pursuing the vigorous recovery of its economy after the pandemic and is currently faced with significant shocks. The country is facing its worst drought in 40 years and the consequences of the Russian invasion of Ukraine,” she stated.

Moreover, Kenya will be safeguarded against the repercussions of the pandemic and economic recovery will be ensured by the funds.

Bank representatives reaffirmed that the institution will further assist with Kenya’s initiatives across three distinct strategic phases.

Fiscal consolidation to ensure the sustainability of public finances was identified as one of the components by the AFDB, alongside enhancing economic and social inclusion and bolstering industrial development and competitiveness.

Phases I and II of the program, the bank reports, enabled Kenya to close funding gaps during fiscal years 2021/22 and 2022/23. This facilitated the nation’s economic recuperation after the pandemic.

ALSO READ:

- Raila Ally Breaks Silence After Ruto-Uhuru Meeting

- Gachagua Close Ally Karungo Wa Thang’wa Accepts Ruto’s CBS Award

- Gov’t to Release Ksh.32 Billion to Counties Next Week – DP Kindiki

- High Court Strikes Down Ruto-Raila 2023 IEBC Amendment Bill

- Kenya Water Towers Agency Dissolved: Government Moves to Streamline State Corporations

In phase III, the funds will additionally facilitate the implementation of the Public Finance Management Amendment Bill 2023, which aims to enhance the debt management framework, through the support of an electronic procurement system.

Furthermore, it will provide backing for the social protection policy, the privatization law, and the ownership policy that aims to tackle the obstacles encountered by state-owned enterprises, as well as the implementation of the enhanced single registry for Social Protection in 29 counties.

“These measures will help consolidate the progress made during the first two phases of the program. The program comes in support of the Kenyan government’s strategy to extend the average duration of the public debt portfolio to reduce its servicing cost over the long term,”

“It will also support government efforts to promote competitiveness and employment and to support the livelihood of the most vulnerable,” read part of the statement.

This occurred after the World Bank and the International Monetary Fund (IMF) increased their financial assistance to Kenya to stimulate the economy.

Ruto Secures Ksh 12.3B Loan Weeks After IMF and WorlBank Boosts