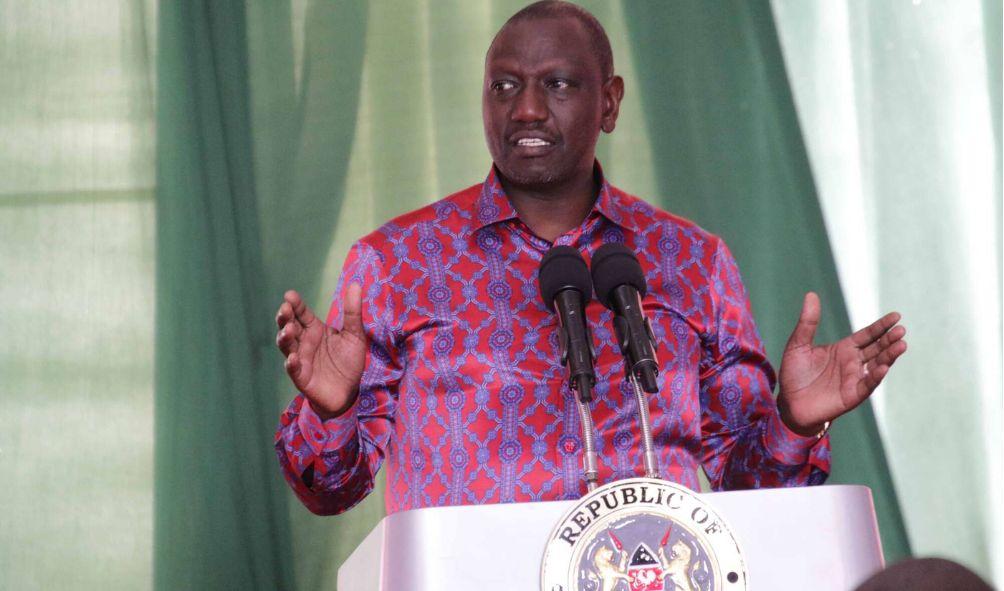

Ruto Aims to Bridge IMF Demands and Unrest of Citizens

President William Ruto’s advisors are racking their brains to save the Kenyan economy, which is currently characterized by deteriorating fundamentals and rising debt, despite escalating pressure to quell a political crisis brought on by new taxes and a high cost of living.

The opposition Azimio la Umoja One Kenya Alliance has recently sponsored civil disobedience in opposition to the unpopular Finance Act 2023, which doubled the value-added tax on petroleum products, effectively increasing the price of commodities, in addition to imposing new taxes on salaried employees.

According to local manufacturers, Azimio chiefs commanded by former prime minister Raila Odinga called for a three-day protest beginning on Wednesday, which shut down many businesses and caused losses in the millions of dollars.

In a press briefing on Friday, the Kenya Association of Manufacturers (KAM) stated that the Northern Corridor was the most detrimental due to the disruption of product movement.

According to the Economic Survey 2023, our manufacturing sector’s contribution to the Kenyan economy is approximately Ksh1 trillion. This translates to daily value addition of Ksh2,86 billion ($20,2 million). Therefore, the country could lose up to Ksh2.86 billion per day if the demonstrations continue to disrupt business as they have for the past two weeks.”

Since the beginning of the demonstrations, the manufacturers claim they have lost approximately $42 million.

“These disruptions have hindered the ability to transport raw materials and finished goods, thereby impacting the entire manufacturing process and causing delays and higher costs,” said Shah.

However, economists assert that the numbers are exaggerated because there was no total closure of the manufacturing sector.

Thursday, rating agency Fitch revised Kenya’s credit status, citing a poor macroeconomic environment and uncertainties over the government’s debt repayment capacity as a result of a weakening revenue position. Even though the Ruto administration is cracking down heavily on the rioters, Kenya’s loans just became more expensive.

The outlook on Kenya’s long-term foreign currency issuer default rating (IDR) was revised from stable to negative, and the rating was affirmed at ‘B’.

This means that taxpayers will pay a higher interest rate on government-obtained loans from international financial markets.

Dr. Ruto ascended to power roughly ten months ago on the promise of alleviating the plight of the impoverished, also known as ‘hustlers.’

However, he is currently walking a tightrope as he attempts to reconcile the interests of the World Bank and International Monetary Fund (IMF), which have imposed stringent guidelines on economic reforms, with the demands of the populace for relief at the cash register.

Governance is also under pressure, with human rights watchdogs and global organizations such as the Commonwealth demanding a swift resolution to the crisis and respect for the right of the people to protest.

“According to Kenyan and international law, everyone has the right to peaceful assembly and protest,” said Michele Heisler, the medical director of the New York-based lobby Physician for Human Rights.

“We condemn the arbitrary and excessive use of force by law enforcement against protesters and bystanders.”

The use of live ammunition and indiscriminate crowd-control weapons, such as rubber bullets and tear gas, has had devastating health consequences, including severe injuries and fatalities.

Extreme force

The UN Office for human rights (OHCHR) expressed grave concern over reports of police using excessive force to suppress protests that have resulted in dozens of deaths and injuries.

“We call for prompt, thorough, independent, and transparent investigations into the deaths and injuries,” said Jeremy Laurance, a spokesperson for the OHCHR.

“Those accountable must be held accountable. To prevent additional fatalities and injuries, it is necessary to take effective precautions. We call on the authorities to uphold the constitutional right to peaceful assembly and international human rights law.”

In exchange for budgetary support, the Ruto administration has demonstrated its commitment to IMF guidelines by aggressively pursuing fiscal consolidation and debt sustainability measures.

Among the painful IMF-led policy measures is the tightening of monetary policy (increased interest rates), the imposition of a 16 percent value-added tax on fuel, the merger and reform of state-owned corporations, the elimination of the fuel subsidy, and the rationalization of the public service, all of which will result in employment losses.

The government is facing a backlash due to high food and energy prices, the high cost of doing business, skewed state appointments, and a new rise in state borrowing, which has made it difficult for businesses to obtain low-interest loans from banks for investment purposes.

Fitch believes that the government’s fiscal consolidation process (increasing revenues and decreasing expenditures) faces several risks, including the protests and legal challenges surrounding the VAT on petroleum products and the projected increase in government spending, particularly on debt servicing, pension, and gratuity costs.

The past two weeks have been characterized by a nation descending into anarchy, as demonstrations have turned violent and security agents have shot at and arrested scores of protesters.

The ambitious plan to triple the manufacturing sector’s contribution to the nation’s GDP to 20 percent by 2030 may not be achievable at the current rate, according to KAM leaders.

As foreign investors withdraw funds from the Nairobi Securities Exchange (NSE), foreign direct investment has declined. On Wednesday, only $400,000 was traded, and 25% of that was with foreigners.

According to Mwathi Kilonzo, director of equities at EFG Hermes Kenya, foreign investors have not driven market activity over the past 18 months, primarily due to currency fluctuations.

The government is attempting to fund a Ksh3.6 trillion ($25.53 billion) budget for the 2023/2024 fiscal year, despite a funding gap of Ksh718 billion ($5 billion).

In the eleven months culminating in May 2023, the National Treasury will spend approximately Ksh1.02 trillion ($7.23 billion) on debt repayments, representing approximately 50 percent of its revenue.

According to the National Treasury, Kenya’s current debt is Ksh9.63 trillion ($68.29 billion), comprised of Ksh4.54 trillion ($32.19 billion) and Ksh5.09 trillion ($36.09 billion) of domestic and external debt correspondingly, of which Ksh856.38 billion ($6.07 billion) is owed to China.

External debt

This month, the Treasury is expected to pay external debt service totaling Ksh63.5 billion ($450.35 million), the majority of which covers biannual repayments for standard gauge railway loans obtained from China, and in June 2024, a $2 billion Eurobond is scheduled to be repaid.

The courts have suspended the implementation of the controversial Finance Act, 2023, which aims to raise Ksh211 billion ($1.5 billion) through punitive tax measures such as a value-added tax (VAT) on petroleum and a 1.5 percent housing levy on employee salaries that must be matched by the employer. Nevertheless, the administration implemented the fuel tax.

Upon assuming office last year, President Ruto eliminated petroleum subsidies.

The Catholic Church has joined the chorus of voices calling for a review, and the bishops are requesting that the President repeal the unpopular law.

Archbishop Anthony Muheria stated that the Finance Act imposes an unmanageable burden on already distressed citizens, particularly those with low incomes.

“We are aware that severe economic distress contributes to the disillusionment and disillusionment that is leading to grave agitation and fury. “The high cost of living has made it difficult for individuals and families to meet their basic needs and maintain a decent standard of living,” said the cleric.

“We, therefore, request that the President repeal the Finance Act and institute a process that seeks to achieve the same objectives in light of the current economic climate.”

The Law Society of Kenya has also opposed the contentious tax law, claiming that some of its proposals are “extremely harmful.”

Dr. Alfred Mutua, Cabinet Secretary for Foreign Affairs, defended the government’s policy by stating that the high cost of living is a global phenomenon and not a Kenyan phenomenon.

Ruto Aims to Bridge IMF Demands and Unrest of Citizens