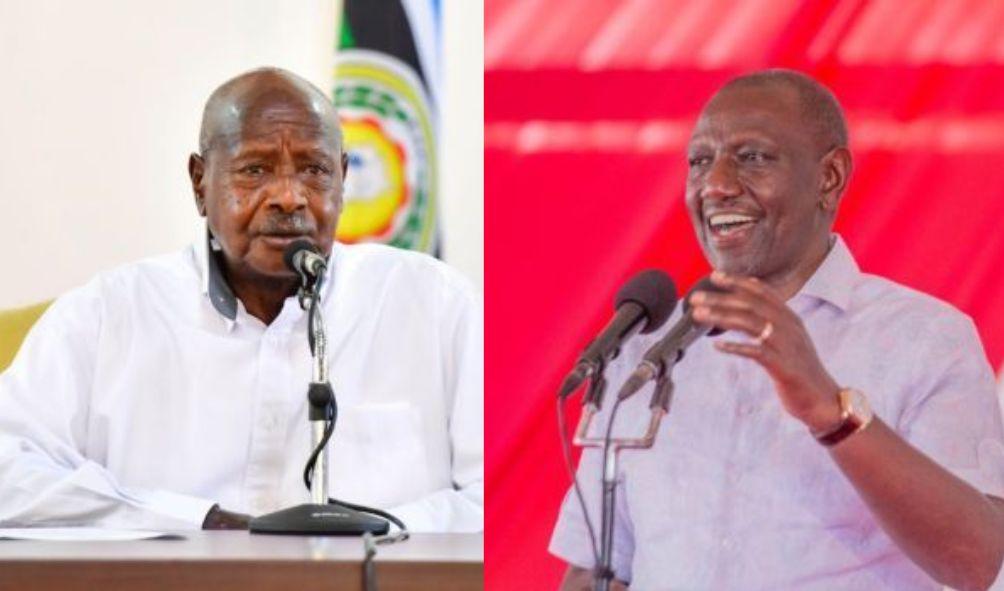

Renowned Economist David Ndii Forecasts Kenya’s Gains Following Uganda and Four Nations Exiting Oil Agreement

David Ndii, the economic counsel to President William Ruto, asserts that Kenya may still be able to gain from the repercussions of the East African nations’ opposition to its government-to-government (G2G) agreement.

Ndii clarified, in response to inquiries from Kenyans regarding Uganda’s recent decision to procure oil directly from foreign companies as opposed to Kenyan companies, that the Kenyan pipeline will continue to be utilized to transit the majority of the oil.

Ndii further stated that cargo transits will incur a tariff charge, as is customary in the international community.

Conversely, the transportation of petroleum products will also be documented as a service export for the nation.

“If Uganda and/or any other countries opt to import directly, the products will become transit goods. A transit tariff for the use of the pipeline will apply- this is standard international practice which will now be recorded in our Balance of payments as a service export.

“That figure is likely to be considerably higher than the financing cost savings,” he expounded.

Ndii’s response was met with apprehension by economists, who observed that the action taken by Uganda and other EAC nations would have an economic impact on the nation.

Economists, led by the economic expert Mohamed Wehliye, advised President William Ruto not to withdraw from the Kenyan oil agreement to devise a win-win solution for both nations.

“Alternatively, we can negotiate with the foreign Oil Marketing Companies (OMCs) to give us two prices. One for domestic OMCs & the other for Airlines & foreign OMCs who buy oil in cash.

ALSO READ:

- Raila Ally Breaks Silence After Ruto-Uhuru Meeting

- Gachagua Close Ally Karungo Wa Thang’wa Accepts Ruto’s CBS Award

- Gov’t to Release Ksh.32 Billion to Counties Next Week – DP Kindiki

- High Court Strikes Down Ruto-Raila 2023 IEBC Amendment Bill

- Kenya Water Towers Agency Dissolved: Government Moves to Streamline State Corporations

“We can’t pass through our credit line costs to folks who pay in cash! We must sit & come up with a win-win regional G2G,” he opined.

The Kenya oil agreement was supported by the majority of nations, including Uganda, due to the involvement of local companies that acted as intermediaries and sold fuel to Ugandan petrol stations for a profit.

As a direct result of the Kenyan companies’ exorbitant pricing, petroleum costs in Uganda would continue to rise.

As a result of the Ugandan Parliament’s approval of the Petroleum Supply (Amendment) Bill 2023, Uganda will procure its oil directly from foreign OMCs, bypassing the intermediary role of Kenyan corporations.

Tanzania was considered a potential substitute for Kenya by Uganda, a course of action that the Kenya Pipeline Company (KPC) cautioned would have adverse economic consequences for the nation.

“The current supply logistics have made the cost of landing petroleum products in Kampala through the Northern Corridor Transit Route (NCTR) higher than the Central Corridor Transit Route (CCTR) road option by two percent due to a reduction on freights and premium in the port of Dar-es-Salaam,” KPC warned that Kenya could lose up to Ksh2-3 billion per year.

Renowned Economist David Ndii Forecasts Kenya’s Gains Following Uganda and Four Nations Exiting Oil Agreement