July 2023: Introducing 5 Fresh Taxes Impacting Your Wallet

Since its inception, the Finance Bill 2023 has elicited conflicting reactions across the nation, prompting President William Ruto to return to the drawing board to quell dissenting voices.

Ruto attempted to pass his first Finance Bill by threatening lawmakers with dire consequences, summoning them to the State House to dissect its content, and gaining the support of opposition leaders.

The differing views on the Bill were necessitated by the tax increases that were introduced or later amended to expand the country’s budget portfolio.

The tax proposals included the Housing Levy, the digital service tax, and a value-added tax (VAT) of 16 percent on petroleum products.

- The Housing Tax

In the Finance Bill 2023, the Housing Levy is a proposed tax that would require all Kenyan employees to contribute 1.5% of their monthly salary to a National Housing Development Fund (NHDF).

The Finance Bill 2023 specified that the fund would be used to construct affordable housing units for Kenyans with low incomes, particularly in urban areas. Employers would also contribute an equal amount to President William Ruto’s legacy preservation fund.

ALSO READ: Edible Oils Scam Unveiled: Azimio Coalition Demands Trade Secretary’s Resignation

Before the Second Reading, members of parliament eliminated the Ksh2,500 cap on the housing levy, allowing the government to deduct 3% from the salaries of all Kenyans.

- Export and Investment Promotion Levy

The Export and Investment Promotion Levy (EIPL) would be imposed on imports except for East African Community (EAC) imports.

EIPL aims to encourage local manufacturing and investment, generate revenue for the government, and provide the country with an opportunity to reduce its import reliance.

Others consist of materials utilized in the production of exportable goods and the construction of affordable housing units.

The EIPL would be 10 percent of the imports’ customs value.

The EIPL is anticipated to generate 10 billion Kenyan shillings in revenue, which would be used to finance the National Housing Development Fund (NHDF) and the Kenya Industrial Transformation Plan (KITP).

Nevertheless, the Kenya Association of Manufacturers (KMA) opposed the proposed amendment and the implementation of the Export and Investment Promotion Levy.

“According to our analysis, the imposition of the levy will make Kenyan goods the most expensive in the East African region, reversing the trade flow from EAC partners to Kenya.

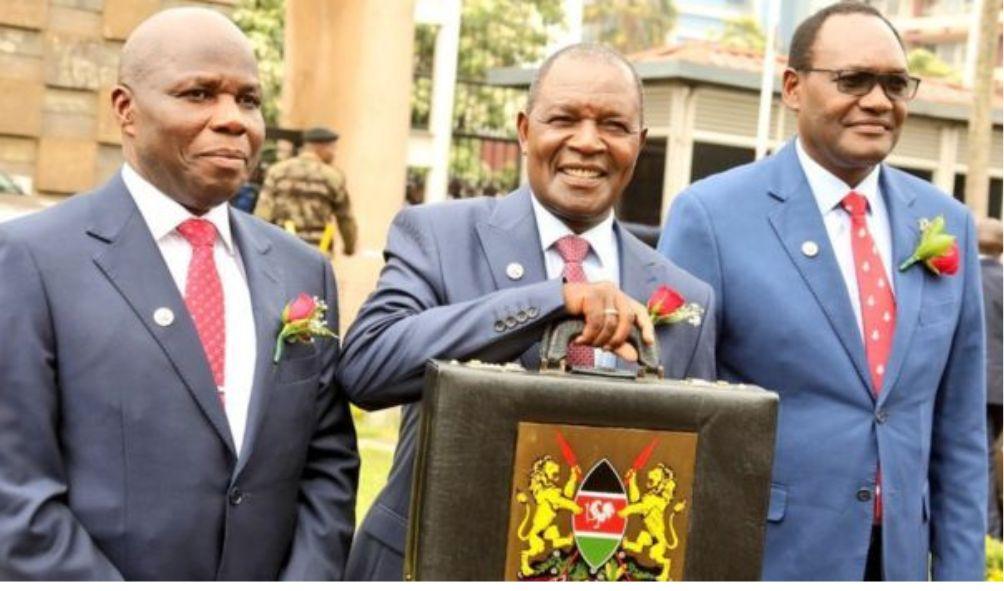

ALSO READ: President Ruto’s Debut Budget Unveils Key Highlights

“Locally, the increase in commodity prices will be passed on to consumers who are already facing an ever-rising cost of living,” warned KAM.

- 3.16 Per Cent VAT on Petroleum Products

The proposed Finance Bill 2023 would increase the Value-Added Tax (VAT) on petroleum products from 8% to 16%.

Thus, Kenyans would pay more for fuel, which would affect the prices of transportation, food, and other goods and services.

The government argued that the increase in the value-added tax would contribute to an increase in revenue that will fund development projects as the nation moves away from an excessive reliance on foreign loans.

- Expanded PAYE for those earning Ksh800,000 and above

The Finance Bill of 2023 proposed to increase the Pay As You Earn (PAYE) tax rate to 35% for those earning Ksh800,000 or more.

This means that Kenyans earning Ksh800,000 or more will be required to pay PAYE on their entire income, up from the previous 30%.

The initial expansion was based on monthly incomes beginning at Ksh500,000, but Members of Parliament increased it to Ksh800,000, thereby technically excluding themselves from the increased PAYE bracket.

- Increase in Turnover Tax

Kenyan businesses are subject to the Turnover Tax (TOT) based on their annual revenue. The current TOT rate is 1%, but the Finance Bill 2023 proposed increasing it to 3%. This would require businesses with a turnover of Ksh1 million or more to pay a higher tax rate.

However, the government proposed lowering the digital service tax from 15% to 3% in response to opposition from content creators.

July 2023: Introducing 5 Fresh Taxes Impacting Your Wallet

HEY READER. PLEASE SUPPORT THIS SITE BY CLICKING ADS. DON’T FORGET TO HIT THE NOTIFICATION BELL FOR MORE UPDATES AROUND THE GLOBE.