Government to Introduce Tax on Education Services

The National Treasury has proposed taxing certain services offered by schools that are not explicitly related to education, as determined by the government.

The Treasury noted in its Medium-Term Revenue Strategy (MRTS) for the Financial Years 2024/25 to 2026/27 that tax exemptions on education services are not uniform across institutions due to differences in fees charged and services rendered.

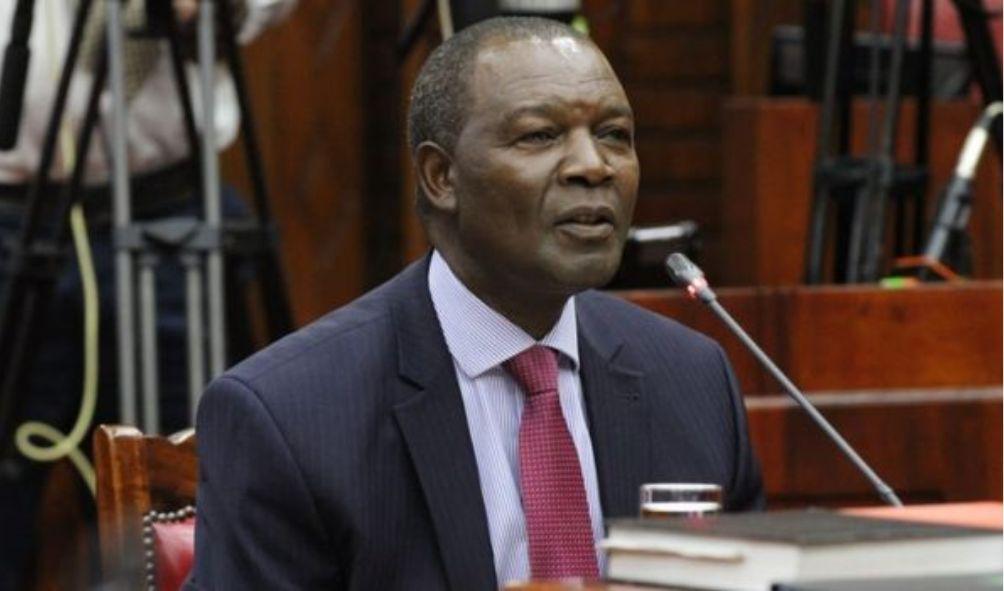

Treasury also noted that the exemption of education from VAT, which includes all school-provided services, is unjust. The ministry led by Njuguna Ndung’u explicitly mentioned swimming, noting that the service is valuable when offered outside of school.

“To remove this discrimination, there is a need to impose VAT on the additional benefits,” the Treasury stated.

The tax is one of the measures the government is implementing to close tax exemptions and increase taxpayer compliance.

ALSO READ: Education Ministry Seeks Ksh 60B Debt Waiver for Public Universities

Treasury Cabinet Secretary Njuguna Ndung’u elaborated that the education tax and other new levies introduced through the MRTS would assist the government in carrying out its development agenda.

“Education services in Kenya are exempt from Value Added Tax to make education accessible to all learners. However, the benefit of the exemption is not uniform across all learners due to differences in fees charged and services provided,” the CS explained the need for the tax on education services.

“In this respect, the Government will explore the introduction of VAT on services provided by schools but are not directly related to education,” the MRTS read in part.”

In addition, the Treasury will investigate the appropriate threshold for the services.

The MRTS has also proposed the general taxation of insurance services.

The Treasury has also proposed, via the MRTS, the elimination of the threshold for employing the VAT input tax allocation formula.

Government to Introduce Tax on Education Services