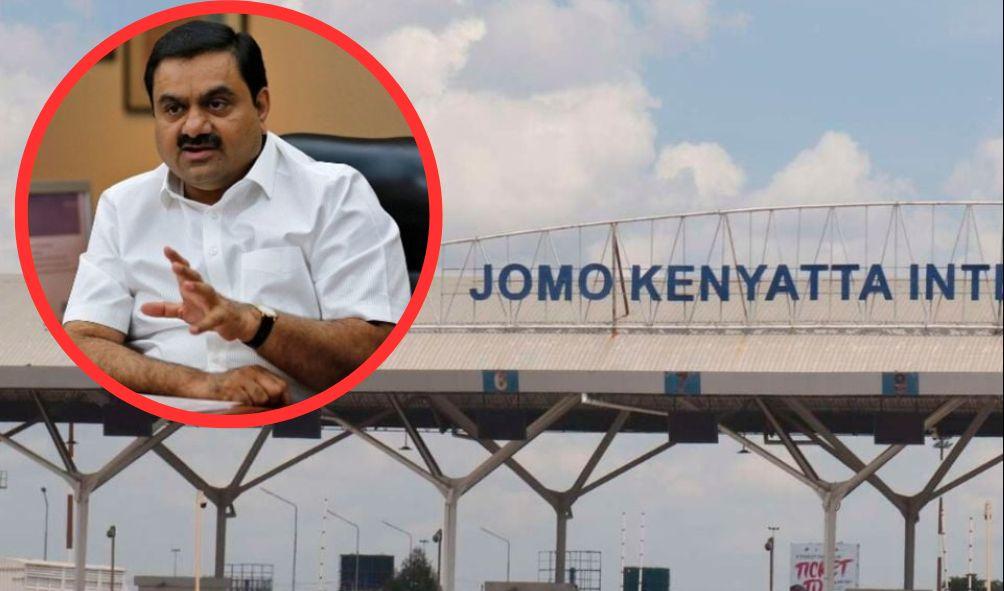

Adani Confirms Ksh 6.5M Payment for JKIA Takeover Bid

Adani Airport Holdings Limited confirmed that it paid $50,000 (equivalent to Ksh.6.47 million) as a review fee to the Kenyan government for its $1.85 billion (Ksh.242 billion) bid to take over and revamp Jomo Kenyatta International Airport (JKIA) in Nairobi.

In recent court documents viewed by Citizen Digital, the Indian conglomerate, owned by Adani Group, stated that the payment was made to the Public Private Partnerships Facilitation Fund. This was part of the submission process for its highly debated privately initiated proposal (PIP) to the Kenyan government.

According to the filing, “Upon submitting the PIP, Adani Airport Holdings Limited paid the required USD 50,000 review fee to the Public Private Partnership Facilitation Fund,” the company noted through its legal team.

Additionally, Adani submitted essential pre-approval documents, including incorporation certificates, tax compliance records, and financial statements, to enable the Public Private Partnership (PPP) Directorate, in collaboration with the Kenya Airports Authority (KAA), to conduct due diligence on the proposal.

This statement was made in a September 17 affidavit, responding to a case filed by the Kenya Human Rights Commission (KHRC) and the Law Society of Kenya (LSK) on September 9, which seeks to block the deal.

Adani noted that on March 18, the Kenya Airports Authority acknowledged receiving the proposal and confirmed the project could advance to the feasibility study phase.

The company later submitted a feasibility study report, detailing the project’s environmental and social impact, the financial framework, and how it would offer value for Kenyan citizens.

ALSO READ:

- “Two Groups, One Agenda”: Gachagua Accuses Raila of Secret Political Deals

- Exclusive: Ida Odinga’s 75th Birthday Party in Karen (Photos)

- FKF President Discloses Exact Amount Paid to Harambee Stars Players

- Gachagua’s Ally Senator John Methu Admits Ruto Might Win 2027 Elections

- Maraga Explains Why He Hasn’t Campaigned in Kisii Despite 2027 Bid

According to court filings, Adani also provided an initial operational plan, noting that the project aligns with national infrastructure goals and aims to address ongoing infrastructure issues at JKIA.

The Indian firm maintains that the project is still in the review and due diligence phase, rejecting claims by KHRC and LSK that JKIA has already been leased for 30 years as inaccurate.

KHRC and LSK assert that Kenya’s largest airport was leased to a foreign entity without adequate public consultation or transparency.

The Public Private Partnerships Act outlines that a contracting authority may review a privately initiated proposal if the project aligns with national infrastructure goals, fulfills societal needs, offers value for money, and provides sufficient information for fiscal assessment and risk analysis.

The proposal must ensure delivery at a fair market rate, be accompanied by all necessary documentation, and transfer risks efficiently from the public to the private sector.

After submission, the contracting authority refers the proposal to the Directorate of Public Private Partnerships for review and approval.

Additionally, the Cabinet Secretary may announce submission periods in the Gazette. A private entity must pay a non-refundable review fee into the Public Private Partnership Facilitation Fund upon proposal submission, calculated at 0.5% of the estimated project cost or $50,000, whichever is lower.

The law clarifies that payment of the review fee does not obligate the contracting authority or the Directorate to approve the proposal.

ALSO READ: Ruto Appoints New SHA Chairperson in Latest Changes

In its court filings, Adani revealed it became aware of JKIA’s deteriorating condition through Kenyan media and decided to invest in its renovation, submitting the proposal on March 1, 2024, to the KAA.

Former Transport Cabinet Secretary Kipchumba Murkomen hinted at JKIA’s improvement plans in November last year but did not disclose the project’s cost.

Murkomen stated the government’s intent to modernize JKIA—Kenya’s primary airport and East Africa’s busiest—to match international standards.

However, KAA acting CEO Henry Ogoye said the Adani deal would require substantial investment, which the Kenyan government could not currently finance due to financial constraints.

On September 9, the court halted any further steps regarding JKIA’s lease to Adani until the case is resolved, with the next mention scheduled for October 8.

($1 = Ksh.129.30)

Adani Confirms Ksh 6.5M Payment for JKIA Takeover Bid