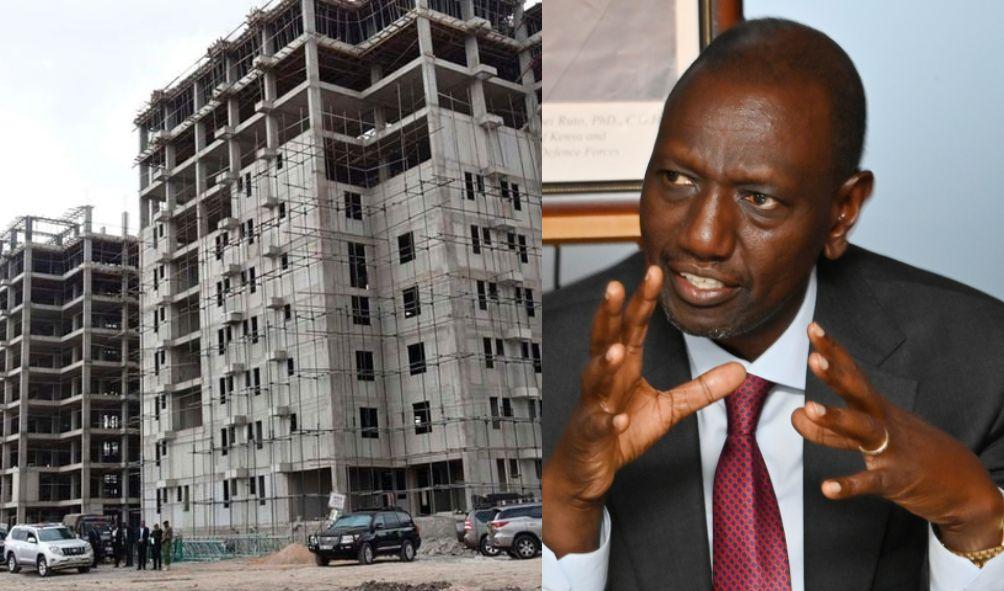

President Ruto’s affordable housing plan’s pros, and cons.

William Ruto’s first-term legacy may be the Housing Fund.

President Ruto has pitched the program as a life-or-death solution to the housing crisis and a million jobs a year.

The program’s proposal to forcibly deduct three percent of workers’ salaries and a similar amount from employers (capped at Sh5,000 per month) has drawn criticism from workers, employers, and economists who question its priority and practicality.

GossipA2Z has analyzed government documents, speeches by officials, and economists’ housing agenda arguments to determine who benefits, who loses, and what risks the government’s plan entails.

Real estate developers will get free land to build houses on, tax incentives on construction inputs, and a guaranteed market for their homes. Banks that lend them money and are guaranteed repayment, with interest, in government-developer contracts will be the biggest winners.

The program will benefit SMEs that supply construction inputs like doors and windows and beneficiaries who become homeowners at low-interest rates.

However, workers’ take-home pay will decrease by three percent (up to Sh2,500) monthly, while employers’ costs will rise as they match employees’ fund contributions.

Homeowners who default on payments are also losers.

After seven years, employees can withdraw their contributions but not their employers’.

ALSO READ: Ruto’s U-Turn on Sugar Prices Sparks Controversy

Sh36bn wages

The program will cost taxpayers Sh36 billion in additional wage costs.

In the proposed Affordable Housing Programme (AHP), the government will buy all houses built by developers and give them free serviced land and tax breaks to reduce construction costs.

The AHP will also allow developers to sell units at a fixed price after construction. The offtake agreement will reduce sales uncertainty, making affordable housing projects more attractive to investors. “Developers will build more units on a larger scale with the assurance that units will be purchased,” the government said in a document.

A developer can get a loan from a bank by showing the fund’s offtake agreement.

It also proposes a framework for developers to sign commercial agreements to buy cement and steel in bulk at discounted prices and get approvals centrally.

ALSO READ: China Hits Back: Denies Hacking Kenyan Government amid Debt Controversy

The government expects Sh9 billion.

“With Sh9 billion a month, I can start projects in every corner of this country without worrying about what the investor says,” Housing Principal Secretary (PS) Charles Hinga said.

After buying houses in bulk from developers, the government proposes to issue cheap mortgages to citizens at an average interest rate of five percent, with a repayment period of up to 30 years and monthly installments between Sh2,500 and Sh15,000, according to government sources.

Tenant Buyout

The Boma Yangu portal will register aspiring and qualified homeowners in informal settlements and low-income earners for a national Tenant Purchase Scheme.

The AHP’s financing framework will align with the Kenya Mortgage Refinance Company’s, working with financial institutions to extend the tenure of traditional mortgages and allow Kenyans earning above the affordable housing bracket to access cheaper mortgages.

The government’s documents don’t define affordable housing income.

Economists disagree with President Ruto’s claim that the program creates massive jobs and that mandatory contributions are not a tax.

ALSO READ: Ultimatum Issued by Azimio: Talks at Risk of Collapse Without Key Concerns Addressed

In a recent media interview, he asked, “Which plan will allow us to employ our youth and remove the shame of them staying on the streets and falling into drugs?”

The President has also appeared to blame Kenyans in the formal workforce for not wanting to contribute to the economic upliftment of slum dwellers and other poor citizens, but he has not explained what will happen if the houses the government buys in bulk from developers do not sell or if the poor citizens who buy them default.

Civil society organizations oppose the deduction of workers due to the government’s poor fund management, which puts workers’ money at risk with little guarantee of a refund.

“Saying contributors will get their money after seven years is problematic. What makes this fund’s retirees different from those who struggle for their pensions? Pamoja Trust’s Sam Orlando asked.

The government has also not explained why it has given free serviced land and tax exemptions. To developers to build houses before they are sold. Rather than building the capacity of the National Housing Corporation (NHC) and the Ministry of Housing. Where the funds would be properly audited by the Auditor-General.

ALSO READ: Registrar of Political Parties Ann Nderitu Addresses Jubilee Party Leadership Crisis

5.9 million of 9.18 million households owned their homes in 2013, while 3.28 million rented.

5.3 percent (486,578) of 9.18 million households lived in shanties, according to the 2012/2013 Housing Survey Report. The survey found that over six million households—two-thirds—lived in bungalows, maisonettes, or flats.

Kenya had 12.2 million households in 2019, up 32% from 2013. Slums (642,282) have grown at the same rate as other housing types.

President Ruto says six million Kenyans live in slums.

Unsustainable

Institute of Economic Affairs CEO Kwame Owino said the program won’t create the number of jobs claimed and that the fund won’t be sustainable because the government will build houses if people don’t want them.

Who says building 1,000 units in Siaya County will create jobs if we haven’t created jobs from 14 million houses and big tower blocks in Nairobi? “We deceive ourselves,” he said.

Mr. Owino also opposes the AHP’s proposal to issue mortgages cheaper than the cost of funds in the economy, warning that the fund won’t be sustainable and the government will have to pump taxpayers’ money into it to cover shortfalls.

The state plans to build one million homes in five years, 200,000 per year.

The lowest-level social housing program and AHP will receive some of the houses.

ALSO READ: All Saints Cathedral Provost Raises Concerns: “Politicians Suspected in Shakahola Massacre”

Both categories require low-income status.

The President recently told media outlets that homeowners under the scheme will pay between Sh2,500 and Sh12,000. However, government documents have put it between Sh3,000 and Sh15,000.

The government claims that the AHP will boost local businesses by encouraging the use of locally sourced and available materials and services, as mass housing production requires a stable supply chain.

The local jua kali sector’s main challenge is finding a market.

Given the risks of lending to the informal sector and the low-interest rates it has announced, the government has stated that one of its goals is to catalyze private finance into the program.

It is unclear what framework it will use to deliver the houses to the targeted Kenyans and how flexible it will be in involving private lenders.

President Ruto launched a program late last year to remove millions of Kenyans from Credit Reference Bureaus for loan defaults.

The government cut loan repayments in half for low-income Kenyans.

If lenders insist on due diligence to avoid exposing themselves to huge risks. By extending cheap mortgages to a population they have traditionally considered risky. Or if Kenyans fail to take up the houses, leaving hundreds of thousands of houses without a market. The government remains silent.

President Ruto’s affordable housing plan’s pros, and cons.

HEY READER. PLEASE SUPPORT THIS SITE BY CLICKING ADS. DON’T FORGET TO HIT THE NOTIFICATION BELL FOR MORE UPDATES AROUND THE GLOBE.