Kenya’s Central Bank Cuts Lending Rate to 12.75%: What It Means for You

The Central Bank of Kenya (CBK) has announced a reduction in the lending rate by 0.25 percentage points, lowering it to 12.75 percent to alleviate financial strain on borrowers.

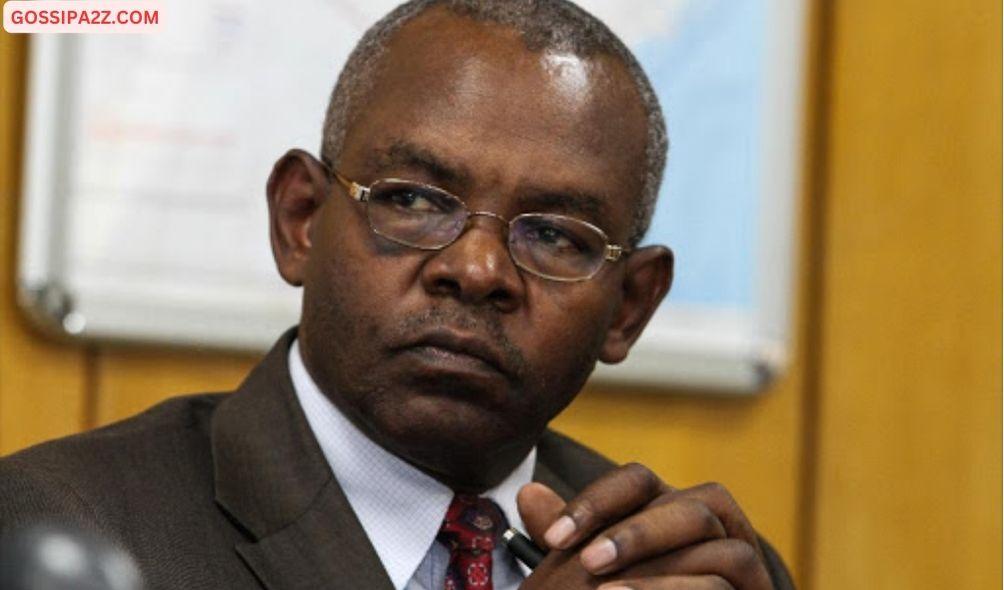

This adjustment is the first since March 2020, representing a notable shift in Kenya’s monetary policy. CBK Governor Kamau Thugge revealed this decision on Tuesday, August 6, reflecting a cautious but hopeful view of the country’s economic outlook.

Despite appeals from the banking sector to keep the rate at 13 percent, the Monetary Policy Committee (MPC) decided to make this cut.

The rate reduction follows seven consecutive hikes since May 2022, a period marked by high inflation and a fluctuating shilling.

Governor Thugge explained that the MPC saw an opportunity for a gradual easing of the monetary policy while maintaining exchange rate stability, leading to the rate cut to 12.75 percent.

The aim is to stimulate economic growth by making borrowing less expensive while keeping the exchange rate steady.

This rate cut comes as Kenya’s inflation rate falls to its lowest point in over three years. The Kenya National Bureau of Statistics (KNBS) reported a drop in overall inflation to 4.3 percent in July from 4.6 percent in June.

The decline is attributed to the strengthening of the Kenyan shilling, which has lowered transportation costs and contributed to price stability.

Economic analysts observe that Kenya’s easing inflation aligns with global trends, with several major economies also reducing interest rates, indicating a shift toward more supportive monetary policies. The MPC noted that other central banks might soon follow this trend.

ALSO READ:

- Raila Ally Breaks Silence After Ruto-Uhuru Meeting

- Gachagua Close Ally Karungo Wa Thang’wa Accepts Ruto’s CBS Award

- Gov’t to Release Ksh.32 Billion to Counties Next Week – DP Kindiki

- High Court Strikes Down Ruto-Raila 2023 IEBC Amendment Bill

- Kenya Water Towers Agency Dissolved: Government Moves to Streamline State Corporations

The CBK’s rate reduction is expected to positively impact the economy by making credit more accessible, which could boost investment and consumption. It is also likely to support financial stability by aiding the shilling and controlling inflation expectations.

Nonetheless, the decision has sparked debate. The Kenya Bankers Association (KBA) had advised the CBK to keep the rate at 13 percent, suggesting that the effects of previous hikes had not yet fully materialized.

The KBA’s research note argued for maintaining the current rate, citing ongoing risks and the need to observe the impacts of prior rate changes.

The Central Bank Rate (CBR) influences the lending rates commercial banks offer, impacting borrowing costs for customers.

This latest reduction is aimed at easing loan costs for domestic borrowers who have faced challenges due to rate hikes since June 2022 amid global economic instability and high inflation.

High CBR levels, combined with inflation and increased taxes, have led to a rise in loan defaults, with commercial bank lending rates reaching as high as 18 percent.

Despite these concerns, the MPC believes the current economic conditions warrant a more lenient approach. The committee will closely monitor the effects of these policy changes and be prepared to make further adjustments if needed, with the next MPC meeting scheduled for October 2024.

As Kenyans assess the impact of the new lending rate, attention will turn to how this policy change will affect different economic sectors.

The agricultural sector, which depends heavily on credit for inputs and infrastructure, could see significant benefits. Small and medium-sized enterprises (SMEs), crucial to the Kenyan economy, are also expected to gain from the rate cut.

Kenya’s Central Bank Cuts Lending Rate to 12.75%: What It Means for You