Uganda Struggles to Raise Money for Budget

The Ugandan government is facing challenges in securing funds for its budget due to elevated loan rejection rates from commercial banks, coupled with offshore investors hesitating to participate in the bond market.

In June 2023, the government aimed to facilitate the influx of foreign currency by including its securities on the FTSE Frontier Emerging Markets Index.

Officials had also anticipated that the designation would reduce the substantial government bond investments held by commercial banks that favored lending to the government.

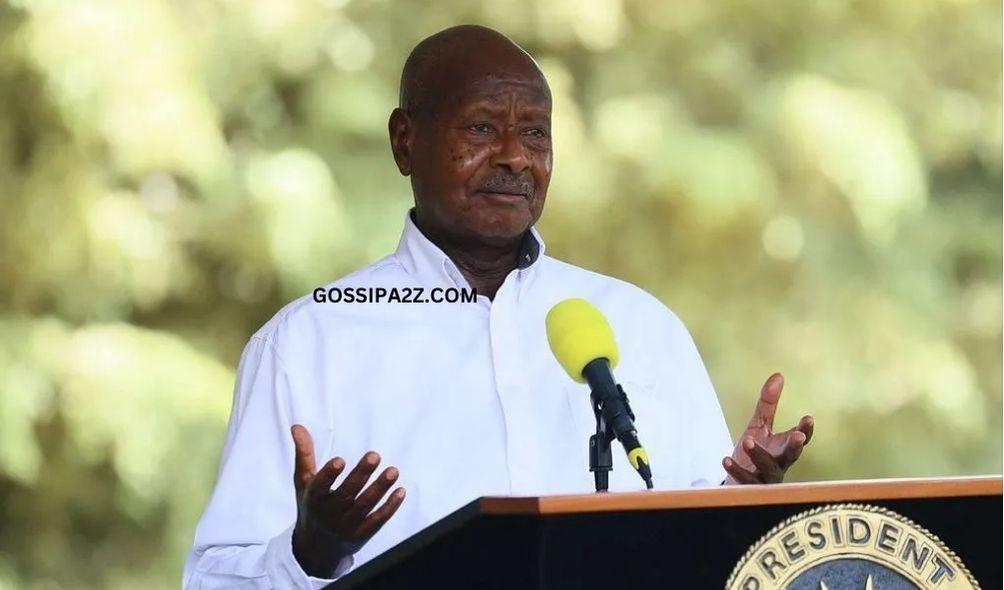

Even though the government securities have been listed on the index for the past eight months, making them more visible, Dickson Ssembuya, the Director for Research and Market Development at Uganda’s Capital Markets Authority (CMA), informed Gossipa2z.com that Uganda has not yet experienced the advantages.

Offshore investors’ deliberate strategy has led to a heightened accumulation of government bonds by both banks and the National Social Security Fund (NSSF).

ALSO READ:

- Raila Ally Breaks Silence After Ruto-Uhuru Meeting

- Gachagua Close Ally Karungo Wa Thang’wa Accepts Ruto’s CBS Award

- Gov’t to Release Ksh.32 Billion to Counties Next Week – DP Kindiki

- High Court Strikes Down Ruto-Raila 2023 IEBC Amendment Bill

- Kenya Water Towers Agency Dissolved: Government Moves to Streamline State Corporations

The Ministry of Finance data emphasizes the significant presence of government securities in the portfolios of banks and the National Social Security Fund (NSSF). According to the latest figures, the collective holdings of government securities by banks and NSSF amounted to 80% of the USh59 trillion ($15 billion) last month.

The limited bargaining space for the government in negotiating borrowing costs arises from the heavy concentration of securities held by two institutional investors.

There are also worries that the focus may be overcrowding private sector credit, as indicated by Ministry of Finance data, revealing a rejection rate of 41.4 percent for loan applications last month.

According to financial market specialists, the prevailing high-interest rates borne by the government can be attributed to the concentration within the bond markets. This underscores the disadvantaged position of the entity issuing the bonds.

Consistently operating with a budget deficit and facing a decline in donor funding, the government is currently servicing a 20-year bond with an interest rate just above 15 percent.

“When you have many investors in the market, chances are that you will be able to raise capital at a relatively low cost,” said Ssembuya.

Uganda Struggles to Raise Money for Budget