Accountants Want All Kenyans Over 18 Years Tracked in New Tax Proposals

The Institute of Certified Public Accountants of Kenya (ICPAK) has proposed tracking all Kenya Revenue Authority (KRA) pinholders aged above 18 years to enhance tax compliance and expand the tax base in Kenya.

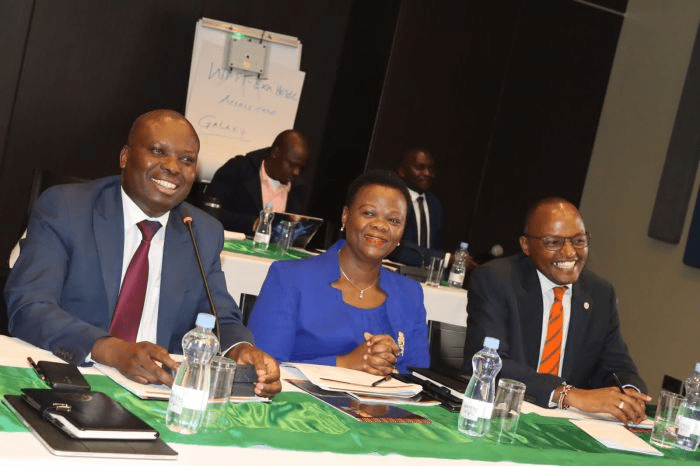

Speaking while appearing before the National Assembly Finance and National Planning committee, chaired by Molo MP Kuria Kimani, the accountants emphasized the importance of proper bookkeeping to help the country emerge from its current revenue squeeze.

According to ICPAK Chairperson Philip Kakai, this approach will enable the Kenya Revenue Authority (KRA) to meet its revenue targets and ease the pressure on existing taxpayers.

“Among the challenges in the current tax system that ICPAK has cited as requiring reforms, is the lack of precision in the identification of taxpayers due to the lack of an integrated mechanism that identifies all taxpayers

“They also identified the limited access to taxpayer transactional information given that Kenya currently operates a self-assessment system for income tax purposes,” the report by the NA committee read in part.

ALSO READ:

- ‘If We Can’t Fix Sondu Then Haiti Will Be A Hellhole,’ Siaya Governor James Orengo Says

- Panic As Cash Strapped Standard Group Asks Employees to Take Early Retirement

- DCI Arrests Lavington Resident Over NTSA Fraud

On the other hand, the group also proposed that the taxman leverages the power of technology in tax collection.

According to the accountants, technology will help the Kenya Revenue Authority (KRA) pinpoint loopholes and inconsistencies and enhance efficiency in tax collection.

ICPAK was making their presentation before the committee which is collecting views on the proposed national tax policy.

The policy aims to establish predictable tax regulations and provide clear guidelines for implementing new taxes.

“The policy is also geared towards articulating broad guidelines for governing tax administration and the tax system in Kenya.

“The implementation of the interventions caused by the policy is also expected to increase the tax-to-GDP ratio to the desired East African Community (EAC) target of 25 % thereby raising sufficient resources to support the government’s development agenda,” read the statement in part.

Accountants Want All Kenyans Over 18 Years Tracked in New Tax Proposals