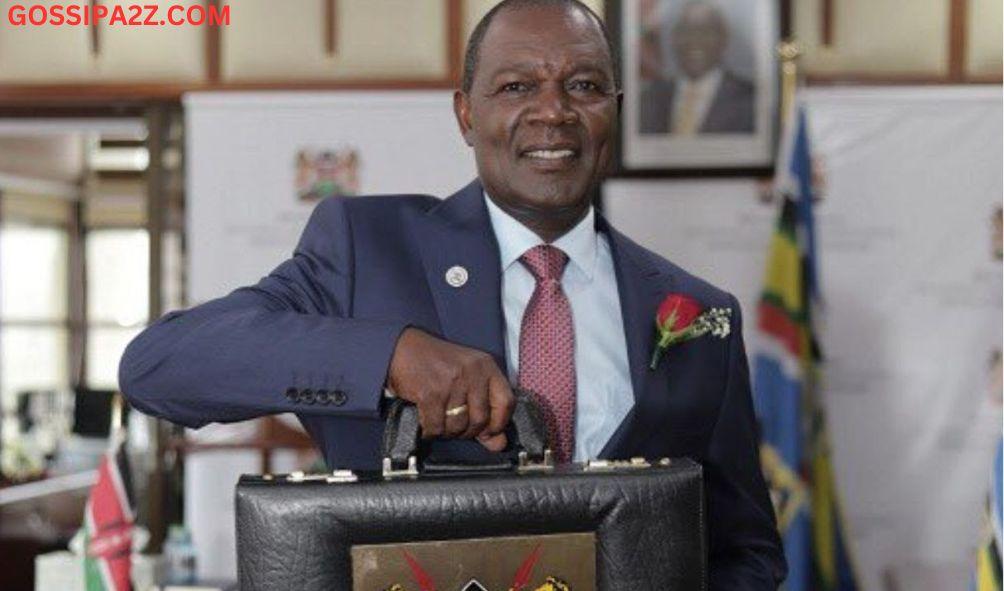

Treasury’s New Proposal: VAT Hiked to 18%

The National Treasury is proposing the imposition of additional taxes as the administration of President William Ruto seeks additional revenue to finance its ambitious programs.

In the Kenya Kwanza government’s Draft Medium-term Debt Strategy for the years 2024-25 and 2026-27, the National Treasury proposes a number of significant tax adjustments.

The harmonisation of the country’s VAT with East African Community member states will be one of the highlights of the proposed tax revisions.

Kenya levies a VAT of 16 percent, while the majority of EAC states charge 18 percent.

In addition, the National Treasury proposes to place alcoholic beverages and cigarettes back on the excise duty radar after a brief reprieve.

Under the Finance Act of 1923, the government imposed no additional taxes on the products.

The excise rate on filtered cigarettes, non-filtered cigarettes, and other tobacco products will be harmonised, whereas alcohol excise duty will be based on alcohol content.

ALSO READ: Ruto Revives Controversial Uhuru-Era Tax

Kenyans have until October 6, 2023 to provide feedback on Treasury’s proposals.

Currently, the taxation of alcoholic products is based on a variety of factors, including consumer behavior, product value, consumption volume, and alcohol content.

”In order to streamline the taxation of alcoholic products, over the strategy period, the government will review the basis of taxation to the alcoholic content of the product taking into consideration the harmonisation with EAC region,” the proposals read in part.

In the draft strategy document, the National Treasury states that the government will increase excise duty on spirits and products with a higher alcohol content to discourage their consumption because they pose greater health risks.

”This will be informed by quantitative analysis to determine the optimal tax rate that will be applicable to each alcoholic product,” reads the draft medium-term debt strategy.

Regarding exercise duty on cigarettes and other tobacco products, the National Treasury proposes to harmonise exercise duty rate across filtered cigarettes, non-filtered cigarettes and other tobacco products.

The National Treasury asserts that it will consider international best practices and promote equity.

”Given the negative health externalities of these products, the rates will be based on the extent of the externalities of these products as well as recommendations of the ongoing EAC partners states study,” the treasury says.

Treasury’s New Proposal: VAT Hiked to 18%