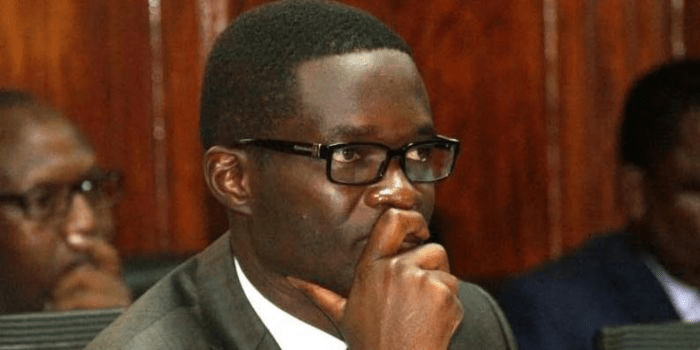

Why Ezra Chiloba’s Self-Paid Ksh.25M Mortgage Led to Suspension

PoliticalPulseChat has determined that the mismanagement of a Ksh.662 million staff mortgage scheme is at the heart of Communications Authority of Kenya (CA) Director General Ezra Chiloba’s suspension on Monday night.

The administration of the CA Staff Mortgage Scheme has resulted in losses of millions of shillings in recent years, according to an audit.

Chiloba applied for and self-approved a Kshs.25 million mortgage loan to facilitate the purchase of a property between himself and Jacob Simiyu Wakhungu, according to a report of the Special Board Audit and Risk Committee meeting held on August 8. Chiloba did not submit the transaction details to interrogation or approval by a higher authority.

In addition, he is said to have purchased a home and seven acres of land, which exceeds the Civil Servants Housing Scheme requirement of one acre.

The committee notes that Chiloba’s loan application was approved by a junior staff member and there is no evidence to support the fact that the junior staff member carried out requisite due diligence and advice management including but not limited to the relationship between the seller and the buyer and the size of the property.

ALSO READ: CA Boss Ezra Chiloba Suspended

In addition, the bank account to which the Authority transferred the funds was discovered to be in the name of Chiloba’s company, Kitale Hilmost Ltd.

The report indicates that the staff mortgage was approved and granted without regard to the contract term or terms of service, resulting in a total loan default of Ksh.28,874,815.62.

According to the audit conducted by an internal auditor from the National Treasury, a real estate expert from the State Department of Housing and Urban Development, and 14 government valuers from the State Department of Lands, the government and privately contracted valuers differ in property valuation by more than 20%.

For example, there is a Ksh 10.7 million disparity in the value of one of the properties Chiloba himself acquired through the scheme.

There are also cases of employees who have left the Authority falling behind on their mortgage payments.

“Despite assurances from Management that there was no record of default or non-payment of the mortgage loans as shared in the Board meeting held on 3 May 2023, the audit exposed cases of default in mortgage repayment,” reads the report.

In one case, former CA Director General Mercy Wanjau, who is now secretary to President William Ruto’s Cabinet, has not repaid her Ksh19.9 million mortgage since November of last year. She is obligated to pay Ksh 108,267 per month.

UNAUTHORIZED LOAN BALANCES

The auditors also identified instances of understated loan balances for former Authority employees who resigned or retired.

In the case of Ms. Wanjau, who resigned, the CA documents indicated that her outstanding mortgage loan as of June 30 was Ksh.18,381,266; however, the audit determined that it was actually Ksh.18,585,571.

The loan balance of one of the Authority’s longest-serving administrators, Daniel Kiprop, who is now retired, was understated from Ksh.1,045,847 to Ksh.939,834.

Auditors also discovered that there were insufficient approvals of architectural plans or designs for the construction mortgage facility and that there were no site visits or inspections of houses mortgaged under the program.

The administration of the initiative was not handled with adequate records and documentation management, according to the audit. They also neglected to insure the property of former employees under the scheme.

Other irregularities highlighted by the audit report include the failure to obtain a timely mortgage insurance protection advance for the property, inadequate internal controls in the approvals and authorizations of mortgage applications, and the refinancing of loans to CA employees who lack evidence of upgrades or improvements to their purchased or under-construction homes.

ALSO READ: Pressure Mounts On President Ruto To Sack Some CSs, Advisors

“Refinancing amounted to Kes.364,815,120 representing 55.07% of the total outstanding balance and with no supporting evidence of upgrades done to the houses,” the report says.

There was also a failure to conduct due diligence on transactions between the vendor and the purchaser, with auditors noting a direct conflict of interest and process abuse in the mortgage loan process for Mr. Chiloba.

The total size of the Scheme’s loan book as of June 2023, according to payroll records viewed by the auditors, was Ksh.662,405,123.94. This was comprised of Ksh.72,243,324 in construction loans, Ksh.196,471,864 in house purchase loans, Ksh.364,815,120 in loan refinancing loans, and Ksh.28,874,815 in outstanding loan balances for ex-staff.

DISCIPLINARY MEASURE

As a result, the committee recommended that Chiloba be subjected to explicit disciplinary measures for grossly abusing the scheme administration.

The committee also suggests applying sanctions to the Director of Human Resources, Director of Legal Services, Director of Finance, and Internal Auditor of the Authority.

Mary Mungai, chairwoman of the CA, proclaimed Christopher Wambua’s appointment as Director General in Acting Capacity beginning on Monday until further notice.

Previously, Chiloba served as the chief executive officer of the Independent Electoral and Boundaries Commission. In September 2021, he was slated to assume the position of CA Director General for a 4-year renewable term.

Unveiling Crucial Special Board Meeting Where Ezra Chiloba’s Fate Was Sealed