We Pity You- IMF To Kenyans Complaining Of Ruto’s Hiked Taxes

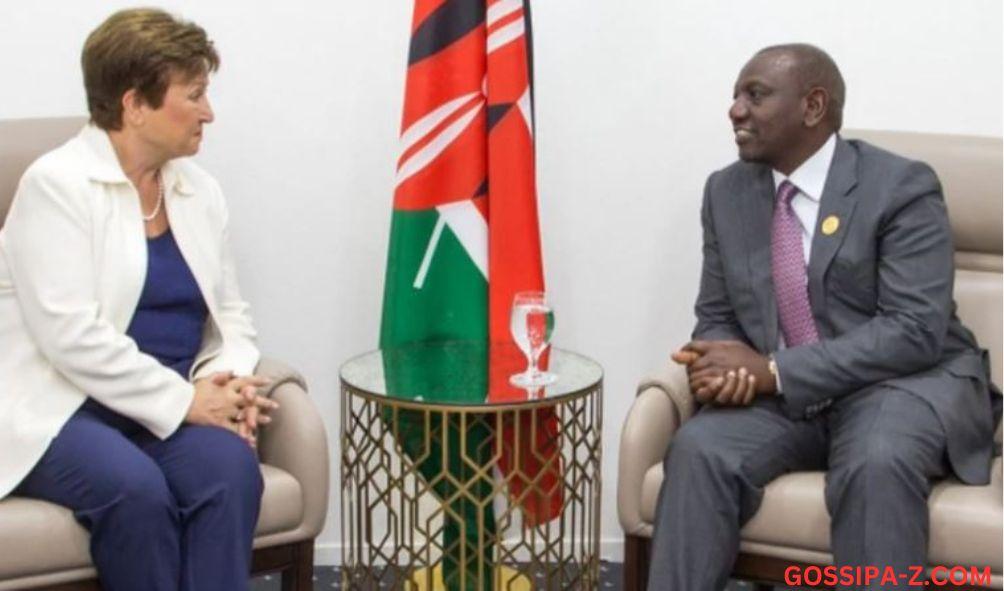

The International Monetary Fund (IMF) has stated its position regarding the consequences of the increased taxes implemented by President William Ruto as outlined in the Finance Act of 2023.

In a statement issued this January by the IMF, the organization expressed its understanding and sympathy for the financial challenges faced by Kenyan individuals impacted by the recently imposed taxes.

It also recognized that most of the residents in the area are unhappy with the tax policies, which have led to an increase in the cost of living as the local currency weakens.

“We empathize with the very difficult economic conditions facing the people of Kenya, and we were deeply saddened that some protests became violent,” IMF referred to the ripple effect created by Ruto’s fiscal policies including demonstrations led by opposition leader Raila Odinga.

“The discontent reflected existing concerns about the rising cost of living, alongside efforts to remove fuel subsidies and increase in the electricity tariff,” added the report in part.

Nevertheless, the IMF supported Ruto, asserting that the taxation measures were essential to tackle certain fiscal issues confronting the nation.

In particular, the IMF emphasized that the measures were designed to tackle the challenges posed by Kenya’s increasing domestic loan, which reached Ksh5 trillion for the first time in history. The total debt amounted to Ksh11 trillion as of December of the previous year.

Kenya recently settled a Ksh72 billion loan with China for the Standard Gauge Railway (SGR) and is currently facing the challenge of repaying the Ksh312.1 billion Eurobond, which is due to mature in June of this year.

However, it was observed that the government had implemented certain measures to assist the people of Kenya.

ALSO READ:

- “Two Groups, One Agenda”: Gachagua Accuses Raila of Secret Political Deals

- Exclusive: Ida Odinga’s 75th Birthday Party in Karen (Photos)

- FKF President Discloses Exact Amount Paid to Harambee Stars Players

- Gachagua’s Ally Senator John Methu Admits Ruto Might Win 2027 Elections

- Maraga Explains Why He Hasn’t Campaigned in Kisii Despite 2027 Bid

‘The FY2023/24 Budget and 2023 Finance Act go a long way to reduce Kenya’s debt vulnerabilities but there are tradeoffs. These are compounded by the challenging external environment, including tighter financing conditions and volatile international commodity prices.

“These tradeoffs can be mitigated by protecting and enhancing social and development expenditures. In this regard, the authorities’ social initiatives, including the Financial Inclusion Fund (Hustler Fund), affordable housing, and the expansion of water infrastructure respond to these social needs,” read the statement in part.

The Ruto administration implemented fresh tax measures in the Finance Act of 2023 to generate revenue to support various government projects and programs.

Some of the recently implemented measures involve the introduction of the 1.5 percent Housing Levy and a 16 percent Value Added Tax (VAT) on fuel products, among other changes.

Furthermore, there has been an increase in pension and health insurance premiums for employed individuals in Kenya. Additionally, fees for government services have witnessed an upward trend over the past year.

The alterations in various aspects have resulted in a decrease in income for Kenyans, even as the cost of living continues to rise. A notable finding from a study conducted by the research firm Infortrak indicates that more than 70 percent of the Kenyan population is facing challenges in meeting their basic needs.

We Pity You- IMF To Kenyans Complaining Of Ruto’s Hiked Taxes