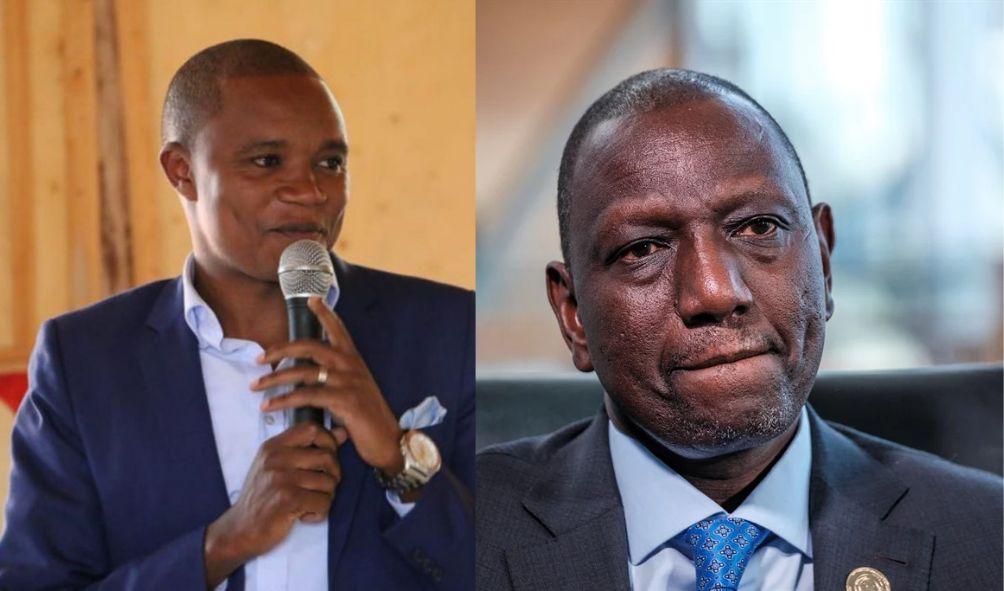

UDA MP Exposes Ruto’s Fuel Tax Hike

Kenyans have questioned the motivations behind the government’s persistent push to pass the Finance Bill 2023. Which imposes significant tax increases on employers & employees. And business establishments across numerous economic sectors.

The National Assembly (NA) voted in favor of a substantial increase in the Value-Added Tax (VAT) on fuel from 8% to 16% on June 21. This development sparked outrage across the nation.

The Chairman of the Finance and National Planning Committee, Molo MP Kimani Kuria. Has shed light on the political intrigues that compelled President William Ruto to rally his allies to forcibly pass unpopular legislation.

This action could jeopardize the political careers of several members of parliament in the upcoming general election.

Kimani Kuria disclosed in an interview with Citizen TV. That President William Ruto’s tenacity stems from an international commitment he made.

The lawmaker claimed that the President’s international commitment to reduce fossil fuel consumption necessitated the tax increase.

“There is a global discussion about climate change and becoming environmentally conscious. “Many nations across the globe are transitioning away from the consumption of fossil fuels and toward the consumption of clean energy,” he explained as justification for the fuel VAT increase.

Instead of this commitment, he added, the Finance Committee decided to investigate alternatives to fossil fuel.

Kimani emphasized that the Finance Bill exempts bio ethanol fuel and Liquefied Petroleum Gas (LPG) from taxation. Allowing many Kenyans to transition to renewable energy.

Kimani highlighted the benefits of bioethanol fuel and emphasized that the policies outlined in the Finance Bill make clean energy initiatives possible, resulting in substantial benefits for Kenyans.

ALSO READ: MPs Approve Fuel Levy: Brace for Soaring Fuel Costs

Notably, he mentioned that these policies make it possible for Kenyans to prepare a meal for four people using only Ksh10 worth of fuel.

“In terms of fuel efficiency, the majority of consumers purchase hybrid vehicles. We did offer tax incentives for the production of electric vehicles, he clarified.

John Mbadi, a member of the panel and a nominated MP, strongly disagreed with Kimani’s explanation, arguing that the fuel tax increase was detrimental to Kenyans.

He acknowledged that international commitments and a rapid transition away from fossil fuels were impractical.

“This has even defeated the most developed nations. In addition, you cannot make life difficult and expensive for Kenyans to fulfill obligations or treaties you signed somewhere, he raged.

Mbadi added that it was unfair to burden Kenyans, as they were not privy to the signing of these agreements.

In the meantime, Kenyans are concerned that the price of a liter of petrol will surpass the dreaded Ksh200 mark in July, making household items and daily life more expensive.

UDA MP Exposes Ruto’s Fuel Tax Hike

HEY READER. PLEASE SUPPORT THIS SITE BY CLICKING ADS. DON’T FORGET TO HIT THE NOTIFICATION BELL FOR MORE UPDATES AROUND THE GLOBE.