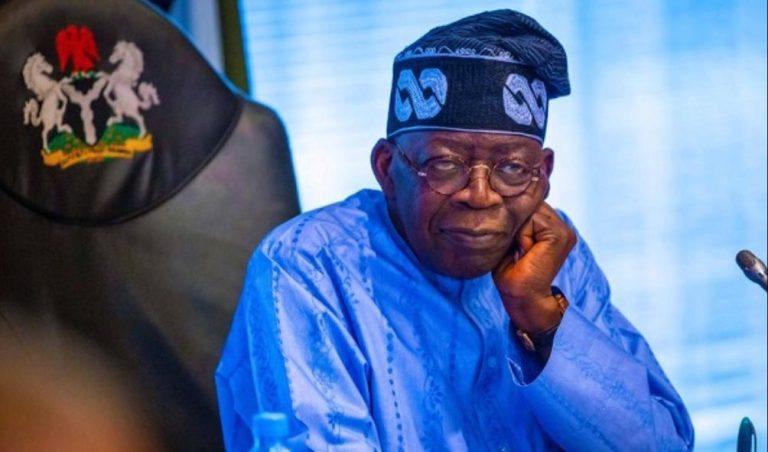

Tinubu Tax: Tempers Flare as Over 200 Memoranda Flood National Assembly

The Federal Government’s plan to change the country’s tax laws is making progress as over 200 written suggestions have been submitted to the Senate and House of Representatives by various groups and individuals.

Public hearings organized by the National Assembly were a significant step in this process. These hearings brought together different stakeholders to discuss the proposed tax reforms. Many individuals and organizations participated, including government agencies, private businesses, civil society groups, and tax experts. Each of them shared their views on how to improve the nation’s tax system.

One of the main topics discussed was how to create a fair tax structure that supports economic growth, generates more revenue, and considers the concerns of both businesses and citizens.

Different Opinions from Stakeholders

The hearings showed a variety of perspectives on the tax reform proposals. Many stakeholders provided useful feedback to improve the bills. In the House of Representatives alone, 54 memoranda were submitted, showing the high level of interest and differing opinions on the matter.

The proposed tax changes have received both support and criticism. Government officials and economists argue that the reforms will help reduce the budget deficit, improve tax compliance, and simplify the collection process. However, some critics worry that these changes could negatively affect small businesses and middle-class workers.

The suggested modifications to Value Added Tax (VAT) and income tax brackets were particularly debated. Some people believe these changes could put too much financial pressure on certain sectors of the economy.

Finding a Balance Between Growth and Fairness

One key concern raised was how to increase the number of taxpayers without raising tax rates or making it harder for individuals and businesses to pay. Groups like the National Association of Chambers of Commerce, Industry, Mines, and Agriculture (NACCIMA) suggested simplifying the tax system to make it easier for small and medium-sized businesses to comply. They also pushed for lower corporate taxes to encourage investment and job creation.

The Manufacturers Association of Nigeria (MAN) emphasized the importance of supporting local production. They warned that higher taxes on raw materials and other essential inputs could lead to increased production costs, making it harder for local industries to compete.

Workers, represented by the Nigerian Labour Congress (NLC), expressed concern over how the reforms might affect low-income earners. They called for a progressive tax system where those with higher incomes and large corporations contribute more, protecting lower-income workers from financial hardship.

Civil Society and Industry-Specific Concerns

Several civil society organizations (CSOs), including Tax Justice Network Africa, stressed the need for better transparency and accountability in tax collection. They urged the government to take stronger action against tax evasion, particularly by multinational companies, and ensure that tax revenues are used for social development.

The oil and gas sector raised concerns about how the proposed reforms might affect their operations. They argued that stable and predictable tax policies are necessary for them to remain competitive globally. Meanwhile, the Nigerian Bar Association (NBA) highlighted the need for a clear legal framework to prevent confusion and legal disputes regarding the new tax laws.

Other organizations also contributed their perspectives. The Alumni Association of the Legislative Mentorship Initiative praised the reforms as an important step toward economic development but urged lawmakers to consider their effects on vulnerable groups. The Centre for African Policy Research Advisory stressed the importance of allowing Nigerians to have a voice in how the reforms are implemented. Project Sprint raised concerns about how changes to VAT could impact economic activity and labor markets.

What’s Next?

As lawmakers review the feedback from stakeholders, the tax reform process continues. The goal is to pass a new law that modernizes the tax system, boosts economic growth, reduces inequality, and increases government revenue.

While most people agree that tax reform is necessary, the details of how it should be carried out remain a topic of debate. Legislators must consider different viewpoints and find a solution that is fair, effective, and beneficial to the country’s economy.

In the months ahead, all eyes will be on the National Assembly as it works to finalize these tax policies. The success of these reforms will depend on how well policymakers balance the interests of businesses, individuals, and the government. Stakeholders hope that the final decisions will support economic stability and long-term growth while ensuring fairness for all Nigerians.

Tinubu Tax: Tempers Flare as Over 200 Memoranda Flood National Assembly