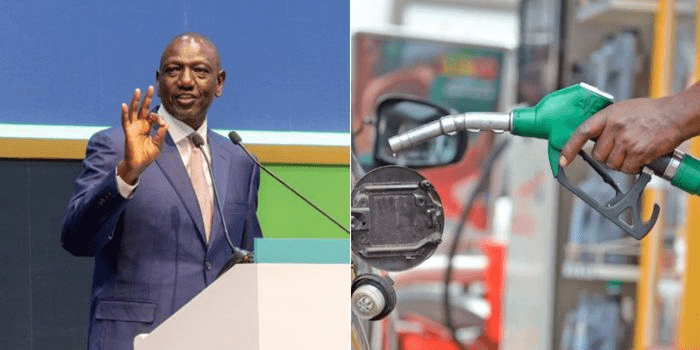

Ruto’s G-to-G Oil Deal Finally Tames Depreciating Shilling

In April, the administration led by President William Ruto initiated a government-to-government (G-to-G) agreement with specific Gulf nations to secure the purchase of fuel on credit. This move aimed to counteract the devaluation of the Dollar.

During that period, the nation faced a shortage of US dollars because oil companies required $500 million monthly for fuel imports, leading to a depletion of Kenya’s foreign currency reserves.

According to Reuters, the Kenya Kwanza government evaluated that having a credit line of 180 days would reduce the strain on the Dollar, leading to a potential bolstering of the Shilling.

Despite the agreement, the Kenyan Shilling persisted in experiencing a rapid decline against the dollar, and by December, it had depreciated by 19 percent.

Although it required half a year for the G-to-G to meet expectations, on Thursday, the Shilling was anticipated to experience its first increase against the Dollar in 2023.

The Treasury has linked the anticipated increase in the value of the Shilling to a decrease in the demand for the dollar coming from the fuel and manufacturing industries.

ALSO READ:

- Former Deputy President Rigathi Gachagua Reveals the Truth Behind His Impeachment

- Guatemalan and Salvadoran Troops Land for Haiti Mission

- Puzzle as Woman Is Found Dead in Mysterious Circumstances Close to Her Home

- Cross-Border Attack: Nigerian Gunmen Kill 5 Cameroonian Soldiers in Retaliation

- The Late KNCHR Chairperson Roseline Odede’s Illustrious Career, Awards & Legacy

This achievement was made feasible through the government-to-government collaboration facilitated by Kenya’s Ministry of Energy, involving Saudi Aramco, Abu Dhabi National Oil Corporation Global Trading (ADNOC), and the Emirate’s National Oil Company (NOC).

Moreover, Kenya’s domestic currency has experienced an increase due to the influx of funds from loans arranged by President Ruto’s government.

Over the past half-year, Kenya has obtained a combined loan totaling Ksh300 billion from the World Bank and the International Monetary Fund.

The country is also expecting to receive a Ksh150 billion loan from China in early 2024.

With the tourism sector, which is a major foreign exchange earner picking pace, Ruto’s administration is hopeful of strengthening the Shilling, which is currently trading at Ksh153 against the dollar.

Continentally, only the Nigerian Naira and the Angolan Kwanza have performed worse than the Kenyan Shilling in 2023.

Ruto’s G-to-G Oil Deal Finally Tames Depreciating Shilling