PRESIDENTIAL FUND MISMANAGEMENT: Taxpayer Billions Squandered in Prudent Use-Free Era

A month after his inauguration as president last year, William Ruto announced plans to launch the Hustler Fund, which he marketed as the key to unlocking financing for small businesses after years of neglect by the formal financial system.

The government injected close to Sh9 billion into the fund within two months of its launch in December, with approximately 18 million Kenyans expected to borrow.

“We have saved close to Sh1.3 billion and seven million Kenyans use this platform daily to borrow money.” Dr. Ruto stated last month, “We have a product that has allowed us to lend Sh26 billion in a record five months.”

In the supplementary budget for 2022/23, the administration of President Ruto allocated Sh20 billion to the Hustler Fund, also known as the Financial Inclusion Fund.

ALSO READ: Raila Holds Crucial Meeting with MPs As Kenya Kwanza Takes Bold Steps to Safeguard Ongoing Talks

Also See: Kenyans flood the House with petitions opposing Ruto’s 2023 Finance Bill Now, the President proposes to establish a Housing Fund via the Finance Bill 2023, which will, among other things, deduct 3% of workers’ basic salaries to fund the construction of affordable housing.

President Ruto continues the practice of previous administrations by establishing funds to address various socioeconomic issues.

However, experts assert that the funds have not always lived up to their billing, as evidenced by accountability reports, and that they are not a panacea for all socioeconomic issues nor a government committed to prudent public finance management.

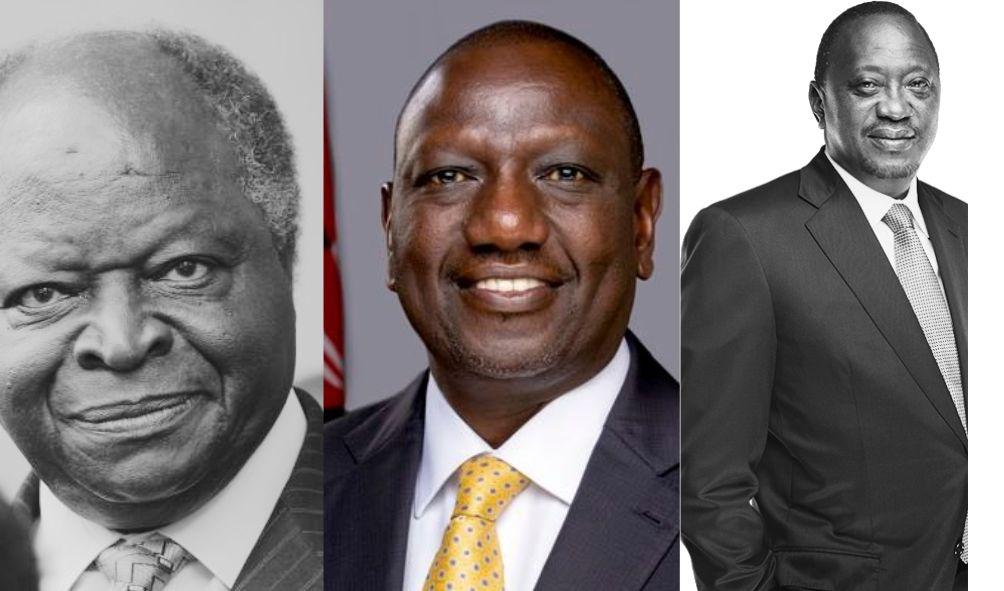

A survey of the three administrations that have led Kenya over the past two decades reveals the establishment of at least seven important national government funds.

However, the majority of the funds have served redundant purposes, targeting the same populations, and have had fundamental management flaws, resulting in losses and waste.

Former President Mwai Kibaki, for instance, established the Women Enterprise Fund and the Youth Enterprise Development Fund in 2007 to address the financial needs of women-owned businesses and young people, respectively.

In 2014, his successor Uhuru Kenyatta also established the Uwezo Fund to provide loans to youth, women, and people with disabilities.

President Ruto has established the Hustler Fund, which aims to increase access to affordable credit for small businesses owned by youth, women, and individuals with disabilities.

ALSO READ: From Grilling to Support: Hussein Mohamed’s Timeless Interview with Uhuru on the Housing Levy

In addition, he proposes the Housing Fund. It’s becoming a trend in Kenya for governments to establish funds, which is a lazily populist approach to addressing problems. Mr. John Mutua, a program coordinator at the Institute of Economic Affairs, asserts that the reason we face obstacles along the way is that these endeavors are always hurried.

Mr. Mutua argues that establishing funds is a lazily populist method for governments to avoid accusations of inaction and appear to be addressing issues affecting groups of citizens.

This, however, has led to the establishment of funds without proper planning and research, resulting in management, structure, and design flaws of enormous proportions.

“They face implementation difficulties because, in most cases, the framework and structures for implementation are developed after the establishment of these funds. “These gaps are a conduit for corruption when they exist,” says Mr. Mutua.

Past audit reports have raised questions about the use of billions of shillings in the funds, and in 2018/19, nine of the thirteen government entities issued a “disclaimer of opinion” by the auditor-general, the lowest opinion indicating the poorest management of public funds, were national funds.

Nine of the fourteen funds that received an ‘adverse opinion’ — the second-worst performance — were also national funds.

The majority of the funds have proven ineffective, as they have been caught between prioritizing the positive action obligation placed upon them and ensuring proper public financial management.

ALSO READ: Panyako: Unveiling My Grievances with Ruto

In nearly all instances, prudent use has suffered. In June 2021, more than Sh4.6 billion reportedly lent by the Uwezo Fund remained unpaid despite the expiration of the repayment period, with the auditor-general exposing gaping holes in the fund’s management, such as the issuance of irregular loans.

“The Sh4.64 billion represents outstanding loans made to a variety of groups since the fund’s inception.” “However, a review of the records maintained at the sampled constituency offices of the Uwezo Fund revealed that no measures have been implemented for effective follow-up of loan beneficiaries, resulting in a high rate of loan defaults,” the auditor-general stated in her report on the fund for the fiscal year 2020/21.

In addition, the auditor-general has raised concerns about the management of the National Government Affirmative Action Fund, an initiative launched in 2015 to support the socioeconomic lives of Kenyans who are economically vulnerable.

“The recipient institutions did not acknowledge receipt of the $3,304,286 in bursaries. Therefore, it was impossible to determine whether the funds were used for the benefit of the intended institutions and individuals,” the auditor-general reported in 2018/2019 regarding the fund’s Tharaka-Nithi County office.

The scholarships are intended to provide school fees for 600 deserving students.

ALSO READ: Ruto requests Sh2 billion allocation in the upcoming budget for international engagements

In 2019/2020, the auditor-general reported that the Women Enterprise Fund was owed Sh3.37 billion, of which Sh80 million was uncertain. Mr. Ken Gichinga, the chief economist at Mentoria Economics, argues that while the funds present the government with an opportunity to inject money into the real economy, prudent management of the funds should take precedence.

“The cornerstone of public finance is prudence. Without it, says Mr. Gichinga, a nation faces an existential threat. It is a problem that has plagued the management of funds at both the national and county levels, where prudent resource management is frequently of secondary importance.

Other funds established in the past continue to face financial management challenges, and the auditor-general has criticized the delay in closing some funds whose legal mandates have expired.

Additionally, the Land Settlement Fund, the Rural Enterprise Fund, and the National Humanitarian Fund continue to face obstacles.

In the past, there have been calls to merge funds that perform redundant functions to save taxpayers money, as the government administers numerous funds that perform similar functions, thereby diluting their impact on society.

“This is because each administration desires recognition for something it has established, even if it knows it is establishing something that already exists. According to Mr. Mutua, the cost-effectiveness is compromised because the government is essentially spreading itself too thin, which diminishes the impact.

PRESIDENTIAL FUND MISMANAGEMENT: Taxpayer Billions Squandered in Prudent Use-Free Era

HEY READER. PLEASE SUPPORT THIS SITE BY CLICKING ADS. DON’T FORGET TO HIT THE NOTIFICATION BELL FOR MORE UPDATES AROUND THE GLOBE.