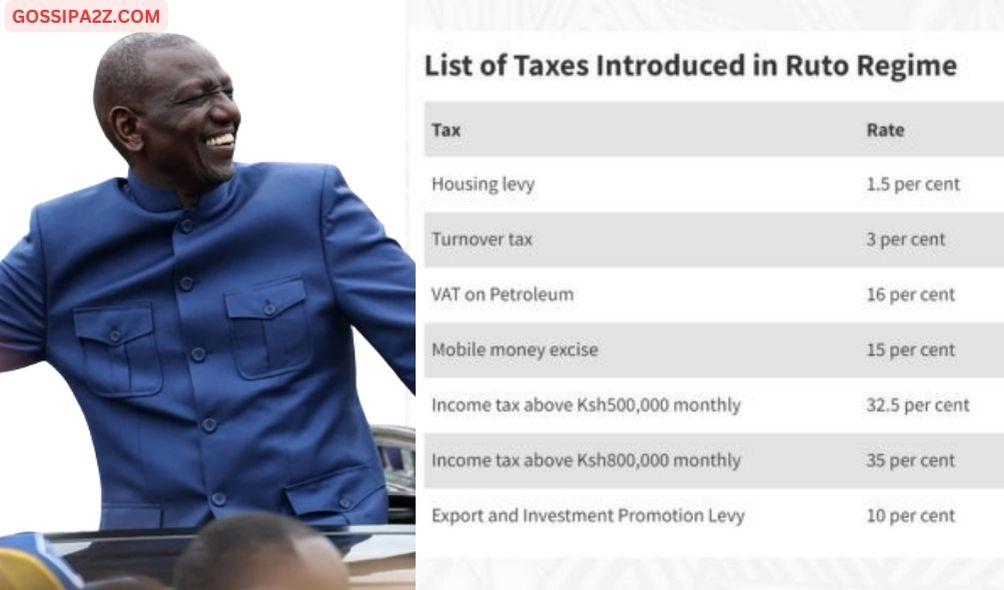

List of Taxes Introduced by Ruto Since 2022

Throughout President William Ruto’s tenure, a significant portion of Kenyan citizens from various political backgrounds have voiced objections regarding various tax proposals presented in Parliament.

From the Housing Levy, which impacts all Kenyan citizens, to taxes targeting specific sectors like the export and investment promotion levy, these measures extend beyond the typical Pay As You Earn (PAYE) and Value Added Tax (VAT).

ALSO READ:

- Why Money Collected From Tourists Was Banked in Swiss Accounts – Gov’t

- Hanna Cheptumo Says Her Family Is Worth Ksh.420 Million During Cabinet Vetting

- Ruto’s Gender CS Pick Blames Femicide on ‘Greedy Women Chasing Money’ — Claims Education and Independence Could Stop the Killings

- Kelvin Kiptum’s Father Demands Justice and Compensation from President Ruto

- Fuel Prices Drop in Kenya: EPRA Announces New Rates for April 2025

Due to a decrease in their earnings, workers have been compelled to reduce their spending on various items to manage their expenses. Additionally, some individuals have been laid off as businesses strive to reduce expenses and remain operational.

Gossipa2z.com takes a look at taxes introduced since Ruto took over office:

Finance Act 2023

In July 2023, President Ruto put into effect the Finance Act 2023, introducing various tax measures aimed at generating an extra Ksh211 billion in revenue.

Housing Levy

The government led by Ruto implemented a 1.5 percent levy on employees, with an equivalent contribution required from employers.

Background

One of the president’s enduring initiatives, the Housing Levy, faced challenges in implementation, notably a High Court decision in July 2023 deeming it unlawful due to insufficient public engagement. Following an arduous nine-month period, the Affordable Housing Bill was formulated and presented to Parliament.

The proposal was approved by both chambers and became active on March 19, 2024, following the Head of State’s approval of the legislation.

It has however been challenged in court again.

Impact

Following several amendments to the bill, all Kenyans will be required to pay 1.5 percent of their gross monthly pay.

This also includes Kenyans working in the informal sector and also those not earning salaries.

Doubling of VAT Tax

The Value Added Tax (VAT) rate on petroleum products was doubled to 16 percent.

Background

The provision was introduced in the Finance Act 2023, as the government sought to raise an additional Ksh50 billion from fuel taxes.

This was criticized by the opposition members who questioned the impact the amendment had on the cost of living.

On the other hand, Kenya Kwanza MPs argued that the amount would be channeled toward the rehabilitation of road networks across the country.

Impact

The provision saw a hike in fuel prices at the time, with a liter of Super petrol rising by an additional Ksh10 in a month. Lower-income households were among the most affected by the amendment due to the rise in the inflation rate.

Turnover Tax

Background

A levy was introduced for all businesses at a standard rate of 3 percent whether a business made a profit or not.

Impact

The levy was initially charged at one percent and affected only businesses whose turnover amounted to Ksh1 million or more. With the new provision, all businesses would be affected by the provision.

Expanded PAYE

Background

One of the provisions within the Finance Act, PAYE was expanded by introducing two forms in addition to the current rate of 30 percent.

Impact

Those earning between Ksh500,000 and Ksh800,000 would have to pay Ksh32.5 percent while those earning above Ksh800,000 would be required to pay 35 percent.

This impacted high-earning income households which had to part with more.

Export and Investment Promotion Levy

Background

President Ruto proposed an increase in the export and investment promotion levy on all imported goods to promote local manufacturing.

Impact

According to Ruto, the levy would be set at a ten percent rate on the customs value of the imported goods. This was expected to raise Ksh10 billion in revenue.

A caveat is that goods sourced from countries within the East African Community would be exempted from the levy.

List of Taxes Introduced by Ruto Since 2022