KRA Reintroduces Tax Amnesty Program

The Kenya Revenue Authority (KRA) has reintroduced the tax amnesty program and is encouraging Kenyans who have not yet taken advantage of it to do so.

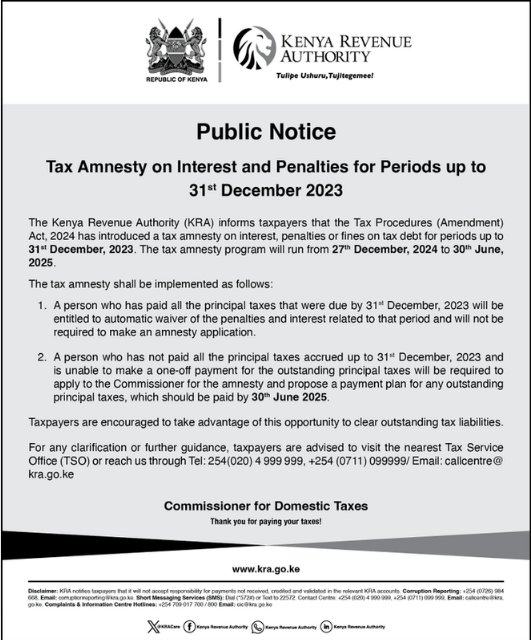

The program, which runs from December 27, 2024, to June 30, 2025, applies to interest and penalties for tax periods up to December 31, 2023.

KRA announced on Friday, December 27, 2024, that taxpayers who have paid their principal taxes will automatically have their penalties and interest waived.

“The Tax Procedures (Amendment) Act, 2024, introduces a tax amnesty on interest, penalties, or fines for tax debts up to December 31, 2023. The program will run from December 27, 2024, to June 30, 2025.

“Taxpayers who have paid all principal taxes by December 31, 2023, will receive an automatic waiver of penalties and interest for that period, with no need to apply for amnesty,” KRA said.

ALSO READ:

- Inside Job Exposed: Kenyan Prison Wardens Convicted for Orchestrating Daring Terrorist Escape

- Uganda Pulls the Plug: Nationwide Internet Blackout Ordered Days Before Crucial General Election

- African Elections Under the Spotlight as Zambia Turns to Kenya Ahead of 2026 Vote

- “Two Drug Barons in Cabinet?” Kenya Government Fires Back as Ex-Deputy President Sparks Explosive Drug Claims

- Kenyan Court Freezes Use of Private Lawyers by Government, Sparks Nationwide Legal Storm

Taxpayers who still owe the government and have penalties and interest on their outstanding amounts can apply for tax amnesty on the principal amount by June 30, 2025.

“If a taxpayer has not paid their principal taxes by December 31, 2023, and cannot pay in full, they will need to apply for amnesty and propose a payment plan to clear the outstanding principal taxes by June 30, 2025,” KRA added.

Taxpayers are encouraged to use this chance to settle any outstanding tax liabilities.

This is not the first time a tax amnesty has been offered. In June 2024, KRA announced that individuals with unpaid taxes up to December 31, 2022, could apply for amnesty on their principal amounts.

KRA Reintroduces Tax Amnesty Program