Kenya’s Fuel Mystery: High Costs Persist Despite Global Price Dip

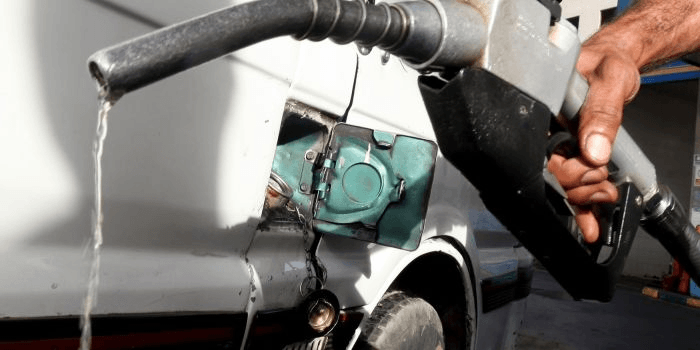

Tuesday’s petroleum price report from the Energy and Petroleum Regulatory Authority (EPRA) revealed that the price of super-petrol remained virtually unchanged, while kerosene and diesel experienced a slight decrease.

EPRA attributes this to the increasing landed cost of diesel and super-petrol, while petroleum experiences a slight decline.

Since the previous six weeks, the Central Bank of Kenya has documented a decline in worldwide petroleum prices. As of September 28th, these prices had decreased by approximately 16 USD (Ksh.2,432) per barrel, the lowest level since September 28th.

International prices decreased during the week ending Thursday of last week, according to the CBK’s weekly bulletin. This decline can be attributed to ongoing concerns regarding demand and the diminishing effects of the conflict between Israel and the Hamas group.

According to CBK, the price per barrel of Murban oil decreased from 87.24 USD (approximately Ksh.13,260) a week before November 9 to 81.59 USD (approximately Ksh.12,402).

Monthly petroleum price reports from EPRA indicate that global prices have fluctuated significantly over the past half-year, culminating in a precipitous decline in October. The price per metric tonne fell to 804 USD in October, the lowest level since May of this year.

Nonetheless, Kenya has yet to experience this decline.

The most recently reported landed cost of super petrol by EPRA was 827 USD per metric tonne. This represents a consistent increase in the landed cost of super petrol, as reported by EPRA. This is manifested in the actuator.

Since June, the cost of fuel has increased by over 47 Kenyan shillings due to various factors, including landed costs, fluctuating exchange rates against the dollar, and increased taxes.

ALSO READ:

- Murkomen Forms 11-Member Committee to Probe JKIA Mess

- Breaking: Energy CS Chirchir Accuses ‘Ann Njeri’ of Forging Documents in Ksh.17B Oil Controversy!

Notwithstanding the decrease in worldwide oil costs, the retail price of a liter of petrol was estimated to be Ksh.229 before the implementation of a price stabilization measure that reduced it to Ksh.217, thereby preserving the rate from the previous month.

For the first time this year, EPRA has indicated that “In this review, the cargoes that have been factored were priced [based on] the average September 2023 Platts price which was much higher than October 2023.”

EPRA said, “These are cargoes that were discharged at the Port of Mombasa between 10th October and 9th November 2023.” This suggests that Kenya’s current stock was bought before the international price decline that started in September.

Prior announcements indicated that each increase in landed cost corresponded to a corresponding increase in pump price. A local outlet price decline has occurred in response to an international price decline, at least for the following month.

The shilling’s depreciation against the dollar has not benefited Kenya. From April to October of this year, the shilling depreciated by more than 16 points against the dollar, settling at an average of Ksh.155.64, as reported by EPRA.

Mid-December may be the earliest that Kenyans can benefit from the global price fluctuations that commenced in September, assuming EPRA’s calculation is predicated on oil orders placed after September.

According to EPRA, “The National Treasury has identified resources within the current resource envelope to compensate Oil Marketing Companies and to cushion consumers against increased landed costs” to reduce pump prices relative to actual calculations.

Kenya’s Fuel Mystery: High Costs Persist Despite Global Price Dip