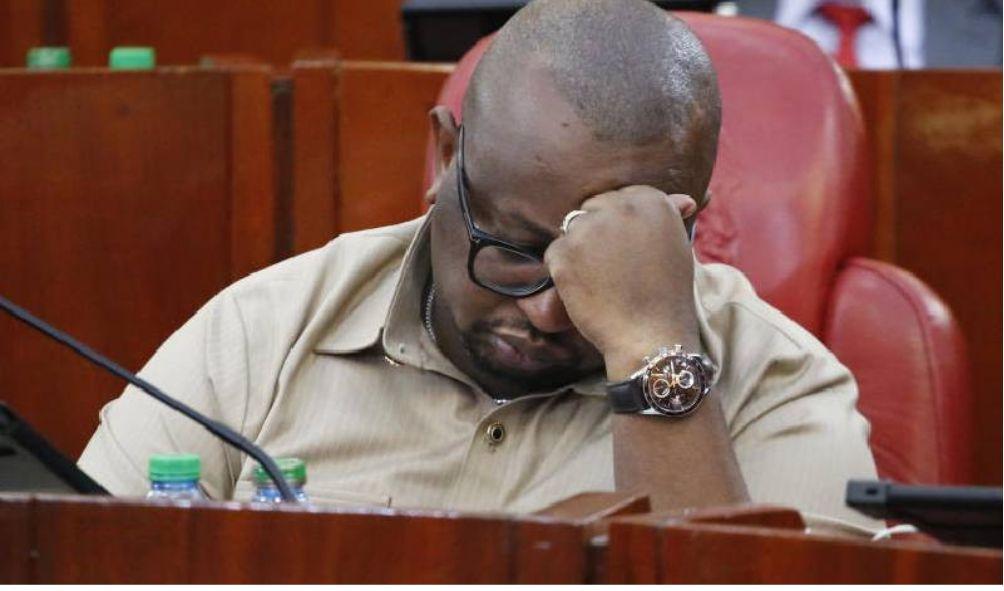

Kenyans Voice Frustration Over Finance Bill as Officials Struggle to Justify Proposals

Sessions for public participation in the Finance Bill of 2023 were marked by vehement opposition to a number of its proposals, even though government officials defended them.

The bill contains 84 amendments to various tax laws and related statutes.

The three percent housing development levy that the bill proposes to impose on salaried workers and employers is the most contentious proposal. Under this proposal, President William Ruto intends to construct 250,000 units of affordable housing.

Eric Theuri, president of the Law Society of Kenya (LSK), opposed the proposal when he testified before the Departmental Committee on Finance and National Planning earlier this week. He argued that the purpose of a tax increase should not be solely revenue generation.

Theuri criticized the imposition of a mandatory contribution that reduces the earnings of Kenyans, noting that the action also violated Article 201 of the Kenyan Constitution. He argued that contributions should be discretionary.

LSK, along with Westminister Consulting and Anjarwalla and Khanna Advocates, opposed the proposal to tax the expanding content creation and creative sector in Kenya via withholding tax mechanisms at a resident rate of 15% payable to KRA.

They proposed a reduction of the withholding tax to five percent so that the sector could expand.

ALSO READ: CS Duale Strongly Condemns Raila’s Reckless Secession Advocacy: “An Irresponsible Move!”

Charles Hinga, however, has defended the housing levy, stating that it is not a tax but rather a saving.

Hinga explained that the fund confers a direct right to either receive an affordable unit or, after seven years, to receive their money plus returns if they do not want the unit.

“The housing levy should be mandated by law and not be voluntary,” said Hinga, “because if it is mandated by law, there is an assurance of collecting money even after three years, so long as the law is in place.”

The Kenya Association of Manufacturers (KAM) has also criticized the government’s proposal to impose an excise tax of Sh5 per kilogram on sugar, stating that the move will increase the price of sugar and increase the cost of living.

Sugar currently retails for Sh200 per kilogram, and KAM argued that imposing an excise duty on sugar would make products manufactured with sugar uncompetitive because other EAC states do not impose excise duty on sugar.

KAM argues that a proposal for a mandatory deposit of 20% of disputed tax with the KRA when appealing a Tax Appeals Tribunal (TAT) decision will negatively impact working capital and cash flow, given that tax disputes can take years to resolve.

Kenyans Voice Frustration Over Finance Bill as Officials Struggle to Justify Proposals

HEY READER. PLEASE SUPPORT THIS SITE BY CLICKING ADS. DON’T FORGET TO HIT THE NOTIFICATION BELL FOR MORE UPDATES AROUND THE GLOBE.