Kenyan Shilling Surges: Biggest Daily Gain in Over a Decade

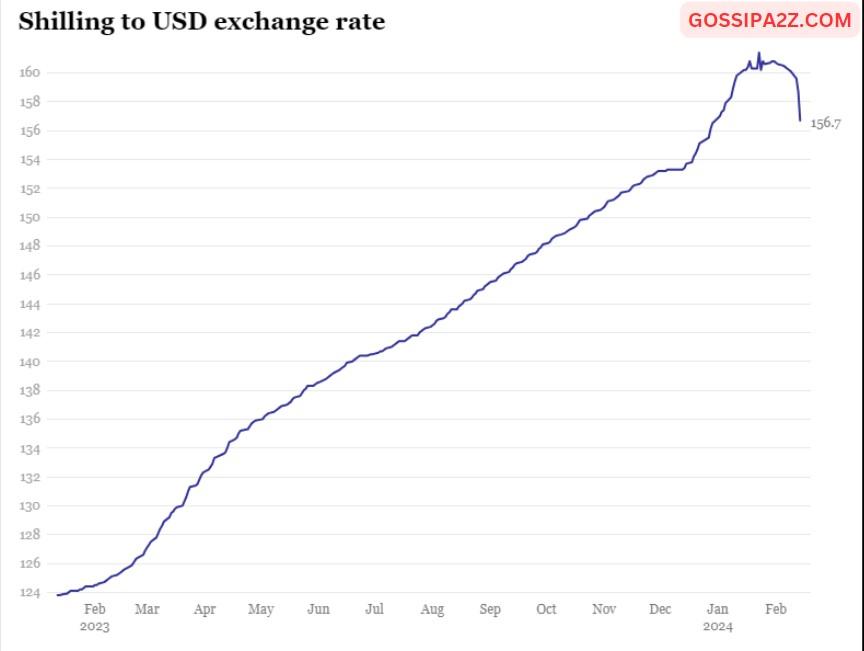

On Wednesday, the Kenyan shilling experienced its most robust intra-day appreciation against the US dollar in the past 12 years. This positive trend was driven by heightened investor confidence, fueled by substantial inflows to the government following the repayment of the $2 billion Eurobond.

On Wednesday, there was a significant increase that propelled the local currency to its highest point since November of the previous year, erasing all the losses incurred so far this year. Consequently, the shilling has experienced continuous appreciation for 11 consecutive days, trading below Ksh153.75 at certain commercial banks.

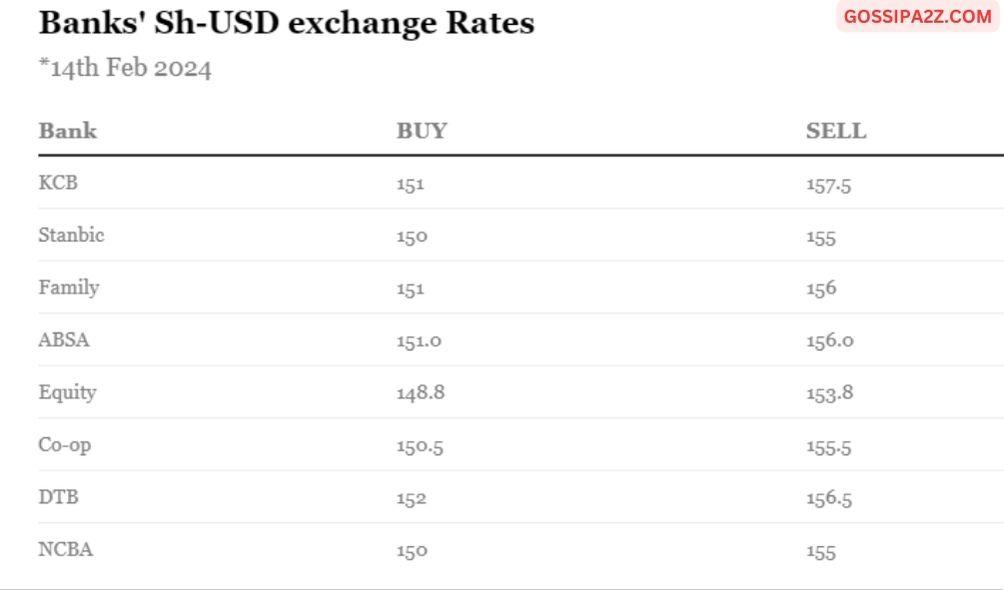

As an example, on Wednesday, Equity Bank set the exchange rate for the dollar at Ksh153.75, whereas KCB provided a quote of Ksh157.5, which was the highest among the eight banks monitored by Gossipa2z. Meanwhile, forex bureaus were selling the dollar within the range of Ksh152 to Ksh157.

On Tuesday, the Central Bank of Kenya (CBK) valued the domestic currency at Ksh156.7 about the US dollar. The significant strengthening of the shilling is expected to reduce the expenses of importing goods in terms of the local currency, as importers will need to spend less for the same quantity of ordered goods.

A more robust shilling is advantageous for the government as it leads to a reduction in debt service expenses. The Treasury estimates that a one-unit change in the currency’s value can affect debt service costs by Ksh40 billion.

The Kenyan shilling has strengthened by 3.62 units against the dollar in the week leading up to Tuesday. This has resulted in a reduction of Kenya’s debt service costs by Ksh144.8 billion ($965.3 million) within just seven days. However, individuals and entities earning in dollars have experienced paper losses, with an example of $10,000 decreasing from Ksh1.6 million to Ksh1.5 million during the same period, reflecting a paper loss of Ksh100,000.

Kenya’s decision to repurchase a portion of its Ksh313 billion ($2 billion) Eurobond notes, which are due to mature in June, has calmed investor concerns. This action has supported the ongoing strengthening of the shilling over multiple days by bolstering the influx of foreign currency.

ALSO READ:

- Raila Claims South Sudan Denied Him Access to Arrested VP Riek Machar, Told to Visit Museveni

- Gachagua Takes General Kahariri Head-on After Warning Kenyans on ‘Ruto Must Go’ Chants

- Compensation and Benefits for Families of Fallen Police Officers and Servicemen

- Cursed Money! Gachagua Warns Mt Kenya as Ruto Plans Cash Blitz—”Eat It, Don’t Take It Home”

- A new level of conscious gambling: 1xBet launches a special project dedicated to responsible betting

Kenya fulfilled its commitment last week by repurchasing a portion of the Eurobond notes worth Ksh313 billion, set to mature in June 2024. This action is part of a liability management operation aimed at mitigating the substantial redemption associated with the country’s initial Eurobond issuance.

The nation, with the assistance of lead managers Citi and Standard Bank, simultaneously released a fresh Eurobond, generating Ksh235.05 billion ($1.05 billion). The funds from this issuance are anticipated to cover payments related to the early Eurobond buyback.

Analysts state that the anticipated buyback, the results of which will be disclosed this Friday, has alleviated concerns among investors. The June maturity was previously viewed as a vulnerability for the Kenyan economy and a hindrance to potential portfolio investments from international investors.

Overseas investors have, in turn, reacted by reallocating capital to the local market, and significant inflows have been observed in the bids for the February infrastructure bond auction, which concluded on Wednesday, generating Ksh240.9 billion for the national treasury.

“There is a general increase in the supply of dollars which I view as a sentiment-driven phenomenon. This follows the partial Eurobond buyback which ratings agency S&P Global noted as an action in distress,” Standard Investment Bank Senior Research Associate Stellar Swakei told Gossipa2z on Wednesday.

The early buyback has provided clarity, significantly reducing the likelihood of distress occurring before June. This development is considered a protective factor, paving the way for renewed interest from major institutional investors in the Kenyan market.

“What’s happening is there are a lot of institutional investors coming back. This is going to increase the supply of dollars which will beat the demand for the same,” noted an analyst on condition of anonymity.

The previous week, the CBK reaffirmed its position that the domestic currency had exceeded a reasonable depreciation, suggesting a potential intervention to support the shilling, as it observed that the currency had reached a balanced level.

“It’s my view now that the exchange rate has overshot the equilibrium rate and that there could be scope to support the exchange rate going forward,” CBK Governor Kamau Thugge noted.

Nevertheless, there is a lack of agreement in the market regarding the exchange rate equilibrium, despite analysts leaning towards anticipating additional gains for the shilling in the days ahead.

“The current market conditions are noisy. It is difficult to tell where the shilling is likely to stabilize, especially if the CBK opts to intervene,” added Ms. Swakei.

Kenyan Shilling Surges: Biggest Daily Gain in Over a Decade