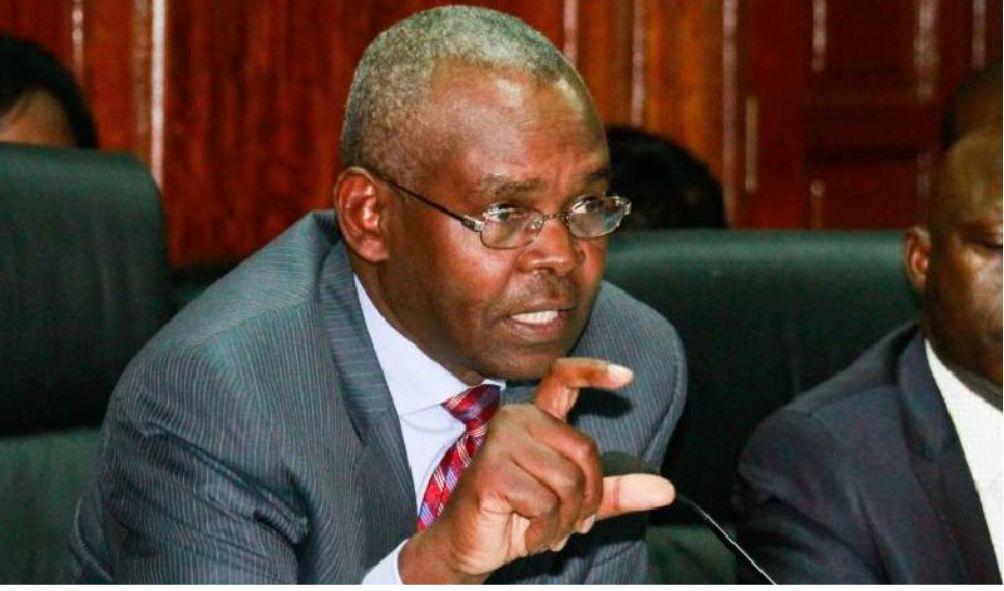

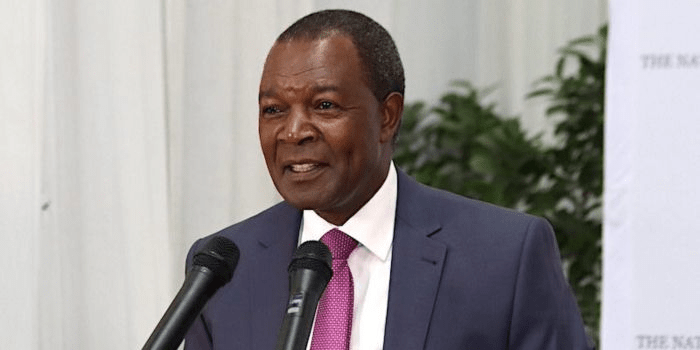

CS Treasury Njuguna Ndung’u Hints at Using CBK Reserves to Pay Eurobond Debt

Treasury Cabinet Secretary Njuguna Ndung’u has hinted at the possible use of Central Bank Reserves (CBK) to pay off the Eurobond Debt.

Speaking in an interview, the CS said the debt crisis was not unique to Kenya, claiming that most low-income countries are experiencing the same thing.

The CS was responding to a note by JP Morgan stating that Kenya was “walking a tightrope” in terms of debt.

“All low and middle-income countries are walking a tightrope given the current economic constraints globally. The Kenyan case is being featured because of the Eurobond 2024,” Ndung’u remarked.

“The upcoming Eurobond maturity should not be a big deal since Kenya can use its reserves at the central bank to pay off the debt.”

The issue of the Ksh295.8 billion ($2 billion) Eurobond debt, which will mature in June 2024, has been a bone of contention for a while now, with critics who share the same sentiments as JP questioning the government’s ability to pay it off.

According to JP, Kenya’s weak credit ratings have locked it out of capital markets, meaning the country cannot borrow from anyone to pay off the debt.

ALSO READ:

- KEMSA CEO On The Spot Over Withheld Millions Owed To Contractors And Suppliers

- How East Africa’s AFCON 2027 Joint Bid Victory Was Achieved

- Governor Arati Stops Salaries Of 740 Workers

Additionally, the huge payment gap expected in 2023 and 2024 will see national reserves take a huge hit with projections estimating that the reserves will have been drained to Ksh4.9 billion by 2024 if no additional source of revenue is presented.

This amount, JP analysts say, cannot even cover three months of basic imports, a major sign of financial distress for Kenya.

This is even as the International Monetary Fund (IMF) signed off Ksh147.8 billion ($1 billion) to Kenya in a bid to dig the country out of the mud.

Despite this cash injection, fiscal and current account deficits are projected to remain between 5 to 6 percent over the next 12 months.

This dangerous situation has prompted the government to introduce and raise several taxes much to the dismay of already struggling Kenyans.

As the situation stands, It remains to be seen whether the Treasury CS will actualize his statements come June 2024 and if so, what effects that may have on the economy.

CS Treasury Njuguna Ndung’u Hints at Using CBK Reserves to Pay Eurobond Debt