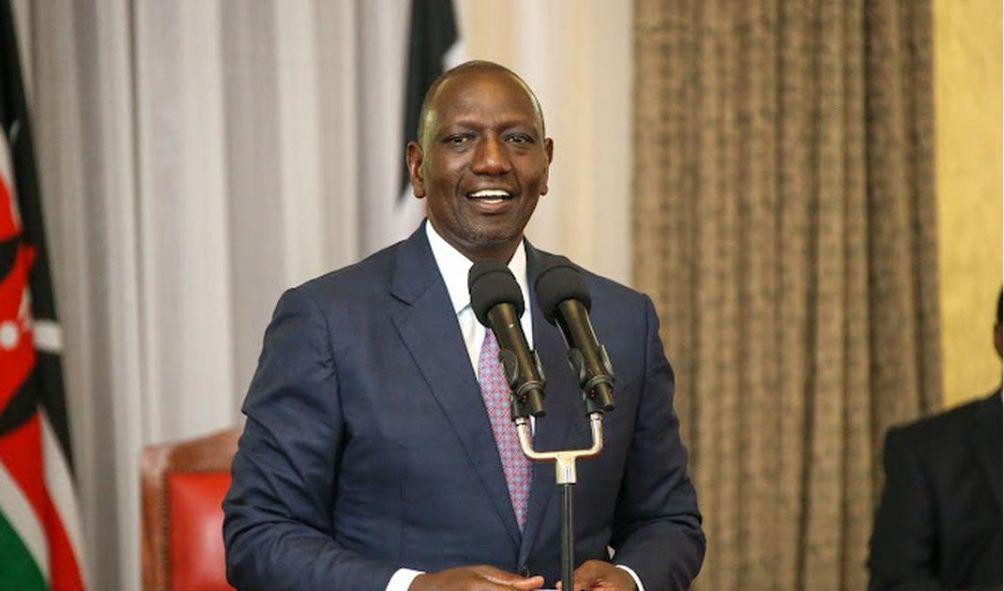

Ruto’s Strategy for Hustler Fund Defaulters Unveiled

The government of Kenya Kwanza has revealed its strategy for controlling Huslter Fund defaulters.

President William Ruto stated on Sunday that defaulters who have an outstanding payment on the platform would not conduct a second transaction.

“Those who have defaulted on individual loans and apply for group funding, the second product of the Hustler Fund, will be denied,” he stated.

The Head of State disclosed that thirty percent of Hustler Fund defaulters reside in Kwale County.

“You have already borrowed 400 million Shillings… The positive news is that the majority of you are making payments as you borrow more. Currently, 68% are paying, but there is another 30% who are aware of the situation,” Ruto said in Ukunda.

The President explained that the government has increased the amount of money available for borrowing. And that there is an option to borrow in groups, for which Sh20,000 to Sh1,000,000 can be granted.

Ruto stated, “Before we give you the Sh20,000, you must first repay the Sh500 you borrowed the first time.”

However, the President stated that his administration will not permit a few individuals to experience an unfair advantage when it comes to borrowing, even though others have followed the rules and made timely payments.

“If you wish to borrow, you must first repay the quantity you have borrowed. You have no one to blame; you will squander the opportunity yourself,” Ruto added.

The government had disbursed Sh33,067,395,968 in personal loans as of July 16, 2023.

According to information released by Co-operatives and MSME Development Cabinet Secretary Simon Chelugui, Sh22,514,523,325 had been repaid and Sh1,654,102,355 had been saved.

ALSO READ: Legal Battle: Azimio Challenges Ruto’s Pardon of 37 Prisoners

In his update, Chelugui stated that at least 20,699,178 individuals have joined the fund.

Since its inception, he said, 45,822,172 transactions have been completed, with 7,241,482 of those consumers being repeats.

On the second Hustler Fund product, Hustler Group Loan, CS Chelugui reported that various groups had received a total of Sh110,423,924. Sh2,260,660 has been repaid, while Sh5,521,196 has been saved.

The CS reported that a total of 344,978 groups have been created, with at least 408,371 members awaiting approval. Additionally, there are 817,884 approved members.

According to Chelugui, there are 33,919 total entities in the fund, but only 28,144 can borrow from it.

The borrowing limits for 12,086 complete groups have yet to be assigned.

There are 2,269 loan requests awaiting member approval. There are a minimum of 16,352 distinct borrowing categories.

As of the 1st of June, 20,000 groups had registered for Hustler Group loans.

The money is offered at an annual interest rate of 7% on a decreasing balance with a default rate of 1.5%.

The repayment period is six months from the date of disbursement, and creditors have the option of making installment or lump-sum payments.

Individuals seeking to expand their enterprises will also be eligible for loans ranging from Sh10,000 to Sh200,000 under the same terms.\

Ruto’s Strategy for Hustler Fund Defaulters Unveiled