Budgeting Under the Finance Bill 2023: Thriving on a Ksh 20K Salary

In response to President William Ruto’s efforts to calm the nation, the Finance Bill 2023 elicited a range of responses from stakeholders, who either supported or opposed the tax proposals.

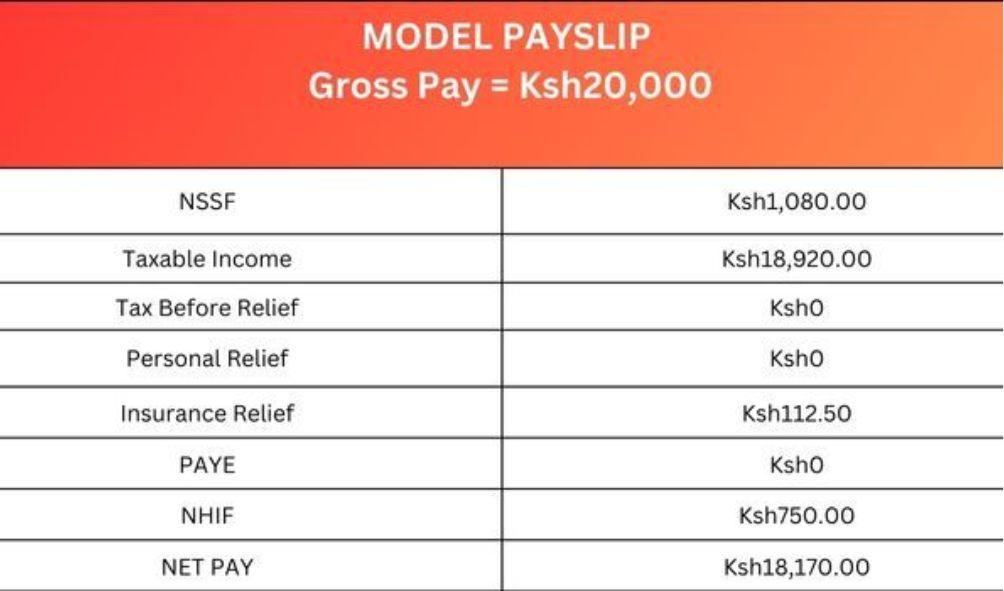

From a 15% digital tax, a 3% housing levy, and the requirement to remit rental tax within 24 hours to the introduction of intellectual property income, the tax increase will significantly impact an employee’s pay stub.

In addition, the bill proposes an increase in the Pay As You Earn (PAYE) tax rate from 30% to 35% for those earning more than Ksh500,000.

As of December 2022, the latest statistics from the Kenya National Bureau of Statistics (KNBS) indicate that the average monthly income for Kenyans is Ksh20,123.

Critics of the bill believed that, if enacted, it would be detrimental to the economy by overburdening the working class.

On the other hand, supporters of the bill argued that the economy would benefit in the long run.

Ruto intends to create millions of jobs through the housing fund and reduce the nation’s reliance on foreign debt.

How does the bill affect a worker’s paycheck after deductions, and how can you adjust your budget accordingly?

Professor Iraki, Associate Professor at the Faculty of Business and Management Sciences at the University of Nairobi, spoke with GossipA2Z about prudent ways to live on a monthly salary of Ksh20,000.

ALSO READ: MPs Convene Retreat to Tackle 7 Hotly Debated Clauses in Finance Bill

Location

One of the most important steps to take is to reduce expenses, particularly rental costs.

The 30% rule immediately comes to mind. It stipulates that rent should not exceed 30% of one’s monthly income. This equates to Ksh6,000 per month for those who earn Ksh20,000 per month. This should include your water and electricity bills, as well as your garbage bill.

Depending on the location, the sum can secure a bedsitter, a studio, or a Servant Quarter. Professor Iraki asserts that the distance from the city is an essential consideration.

“Rent is a big problem. “Move to a cheaper location, but keep in mind that prices rise as you move farther from the city,” he advised.

Additionally, one can move in with a roommate to split the costs.

Living close to your workplace is also an excellent way to maximize your savings. This consideration does not, however, apply to employees in affluent suburbs such as Westlands, Kilimani, Gigiri, and Hurlingham.

However, you may continue along the route to work. For instance, those working in Westlands can reside in estates such as Uthiru, Kinoo, and Mountain View along Waiyaki Way, while those working in Ngara and its environs can reside in Kahawa West, Kahawa Wendani, and Roysambu.

ALSO READ: Azimio’s Ineffectiveness as Government Watchdog Jeopardizes Finance Bill’s Passage, Warns MP Sylvanus Osoro

Save

Warren Buffet, an American business magnate, once advised, “Do not save what is left after spending; rather, spend what is left after saving.”

Experts recommend that employees save at least ten percent of their income, which in this case is Ksh2,000 per month and Ksh24,000 per year. Investing the funds in chamas and other cooperative societies is an alternative.

Professor Iraki advocated reducing non-essentials such as eating out and preparing more meals at home.

You can only save what you possess! “Check to see if your savings are earning you something,” he advised.

Adhere to a Budget

To avoid living beyond one’s means, it is prudent to adhere to a budget. Avoid engaging in expensive behaviors such as takeout, impulsive purchases, and excessive partying.

When one fails to plan, they run out of money and must rely on loans from friends or online lending platforms to survive.

Winston Churchill, the former prime minister of the United Kingdom, once said that the most important thing is to consider how to make more money. “Never waste a good crisis,” opined Iraki, advocating that employees focus on passive income to supplement their income.

ALSO READ: Karua’s Explosive Allegations: Kenya Kwanza Accused of Launching Economic Warfare on Citizens via Controversial Finance Bill

Track and Document Your Expenditures

Always keep your receipts, tickets, and bank statements for calculation purposes. This information is useful when comparing costs within your budget.

Consider cost-effective solutions to a specific problem. For instance, make a phone call instead of traveling to a distant location, purchase items on sale, and shop at food markets rather than supermarkets for groceries.

Such food markets include, among others, the Marikiti market, the Kangemi market, and the Wangige market. On the other hand, Kamukunji markets in Eastleigh are excellent locations for acquiring inexpensive household goods.

Interest Rate

According to the most recent KNBS data, Kenya’s inflation rate increased to 8% in May of 2023.

Specifically, housing, water, and electricity prices increased as a result of the rising cost of petroleum products. Between May and June 2023, retail prices for gasoline, diesel, and kerosene were Ksh183.29, Ksh169.10, and Ksh161.83 per liter, respectively.

KNBS also reported that the average price of a 2-kilogram packet of sugar doubled from Ksh200 to Ksh420.

Budgeting Under the Finance Bill 2023: Thriving on a Ksh 20K Salary

HEY READER. PLEASE SUPPORT THIS SITE BY CLICKING ADS. DON’T FORGET TO HIT THE NOTIFICATION BELL FOR MORE UPDATES AROUND THE GLOBE.