KRA Reintroduces Tax Amnesty Program

The Kenya Revenue Authority (KRA) has reintroduced the tax amnesty program and is encouraging Kenyans who have not yet taken advantage of it to do so.

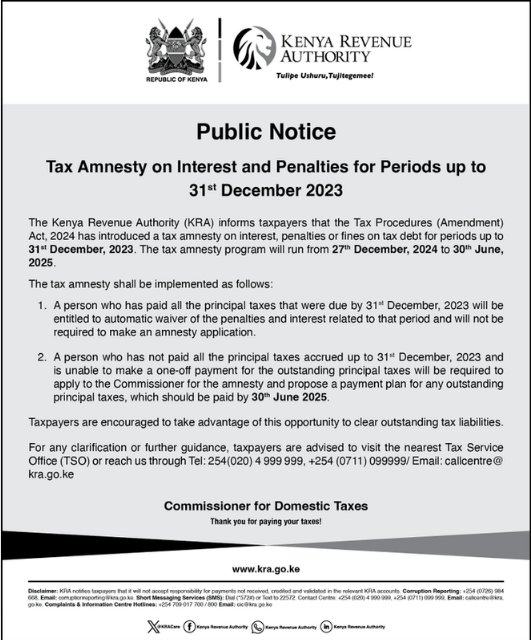

The program, which runs from December 27, 2024, to June 30, 2025, applies to interest and penalties for tax periods up to December 31, 2023.

KRA announced on Friday, December 27, 2024, that taxpayers who have paid their principal taxes will automatically have their penalties and interest waived.

“The Tax Procedures (Amendment) Act, 2024, introduces a tax amnesty on interest, penalties, or fines for tax debts up to December 31, 2023. The program will run from December 27, 2024, to June 30, 2025.

“Taxpayers who have paid all principal taxes by December 31, 2023, will receive an automatic waiver of penalties and interest for that period, with no need to apply for amnesty,” KRA said.

ALSO READ:

- “Two Groups, One Agenda”: Gachagua Accuses Raila of Secret Political Deals

- Exclusive: Ida Odinga’s 75th Birthday Party in Karen (Photos)

- FKF President Discloses Exact Amount Paid to Harambee Stars Players

- Gachagua’s Ally Senator John Methu Admits Ruto Might Win 2027 Elections

- Maraga Explains Why He Hasn’t Campaigned in Kisii Despite 2027 Bid

Taxpayers who still owe the government and have penalties and interest on their outstanding amounts can apply for tax amnesty on the principal amount by June 30, 2025.

“If a taxpayer has not paid their principal taxes by December 31, 2023, and cannot pay in full, they will need to apply for amnesty and propose a payment plan to clear the outstanding principal taxes by June 30, 2025,” KRA added.

Taxpayers are encouraged to use this chance to settle any outstanding tax liabilities.

This is not the first time a tax amnesty has been offered. In June 2024, KRA announced that individuals with unpaid taxes up to December 31, 2022, could apply for amnesty on their principal amounts.

KRA Reintroduces Tax Amnesty Program