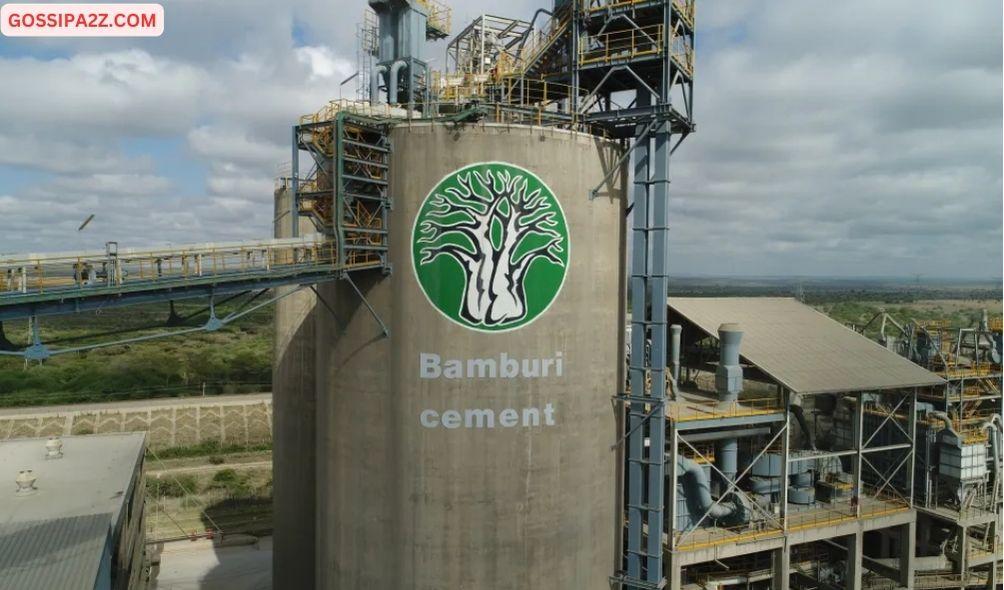

Gov’t Approves Bamburi Cement Buyout by Tanzanian Company Amsons Group

Tanzanian manufacturing and energy powerhouse Amsons Group has received approval from Kenya’s mining ministry to proceed with the unconditional acquisition of Bamburi Cement.

In July, Amsons, through its Kenyan subsidiary Amsons Industries Kenya, proposed a Ksh.23.9 billion bid to purchase a full 100% stake in the publicly traded cement company.

“Obtaining all the necessary regulatory approvals is a clear endorsement of our steadfast dedication to completing this transaction,” Amsons Group CEO Edha Nahdi stated in a media release on Wednesday, one day before the offer period ends on December 5.

ALSO READ:

- Inside Job Exposed: Kenyan Prison Wardens Convicted for Orchestrating Daring Terrorist Escape

- Uganda Pulls the Plug: Nationwide Internet Blackout Ordered Days Before Crucial General Election

- African Elections Under the Spotlight as Zambia Turns to Kenya Ahead of 2026 Vote

- “Two Drug Barons in Cabinet?” Kenya Government Fires Back as Ex-Deputy President Sparks Explosive Drug Claims

- Kenyan Court Freezes Use of Private Lawyers by Government, Sparks Nationwide Legal Storm

“As we near the conclusion of the offer period, we are confident in our ability to finalize the acquisition seamlessly and deliver value to Bamburi Cement shareholders. This achievement underscores the strength and credibility of our offer.”

Amsons also announced receiving unconditional approval for the acquisition from the COMESA (Common Market for Eastern and Southern Africa) Competition Commission.

“With support from KCB Investment Bank, Amsons is committed to ensuring a smooth closing process, including the prompt payment to shareholders who accept Amsons’ offer,” Nahdi added.

Bamburi Cement is primarily owned by Swiss cement manufacturer Holcim, which holds a 58.6% stake through its subsidiaries Fincem Holding and Kencem Holding.

Founded in 2006, Amsons Group is led by Tanzanian entrepreneur Edha Nahdi. With an annual revenue exceeding $1 billion (approximately Ksh.129 billion), the family-run conglomerate operates in bulk oil and petroleum imports, cement production, wheat flour milling, LPG, and transportation.

SAVANNAH OFFER

Following Amsons’ bid to acquire Bamburi, Kenyan firm Savannah Clinker placed a Ksh.25.4 billion offer for the company in August.

Savannah Clinker would offer an additional Ksh.1.8 billion to Bamburi shareholders if the deal proceeds, as confirmed by its chairman and CEO, Benson Ndeta.

According to filings with the Capital Markets Authority (CMA), the five-year-old company, fully owned by Ndeta, proposed purchasing nearly 363 million Bamburi shares at Ksh.70 each, which was Ksh.5 higher than Amsons’ offer.

Last week, Ndeta was arrested in connection with an alleged fraudulent Ksh.700 million deal to expand Savannah Clinker.

He was charged on Friday at Nairobi High Court, where he denied all eight charges, including conspiracy to commit a felony, obtaining execution of security under false pretenses, and presenting false documents.

Despite a High Court order halting Ndeta’s prosecution and detention on Friday, the businessman remained in custody over the weekend and was released unconditionally on Monday.

The case, which some politicians claim is aimed at derailing his Bamburi Cement bid, is scheduled for mention on January 21.

Amsons’ approval for the Bamburi acquisition comes shortly after Holcim announced its decision to divest from its Nigerian operations, selling its nearly 84% stake in Lafarge Africa for $1 billion (Ksh.129 billion). This exit is part of Holcim’s strategy to concentrate on high-growth regions like North America, according to Reuters.

Gov’t Approves Bamburi Cement Buyout by Tanzanian Company Amsons Group